In November 2024, Eurovent Market Intelligence (EMI) published its latest comprehensive report, HVACR 2030. This detailed analysis focuses on the performance of the HVACR sector in 2023 and provides a forward-looking perspective up to 2030. The report, spanning 154 pages, examines market dynamics, emerging technologies, and future opportunities across 16 product categories. It covers key segments such as cooling, refrigeration, thermodynamics, terminal units, and ventilation within the European market, including the EU27, Norway, Switzerland, Türkiye, UK and Ukraine. Designed to inform manufacturers, investors, and policymakers, this edition builds on EMI’s three decades of expertise in HVACR market intelligence.

2023 market size in billion euros

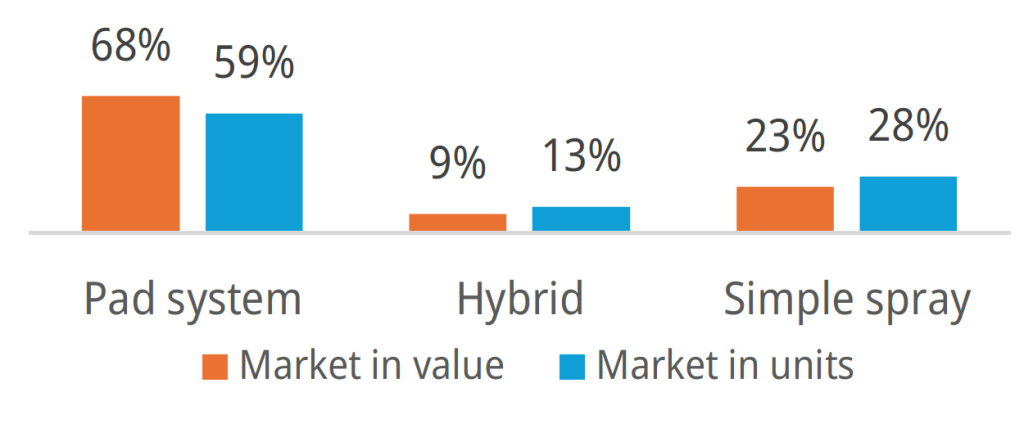

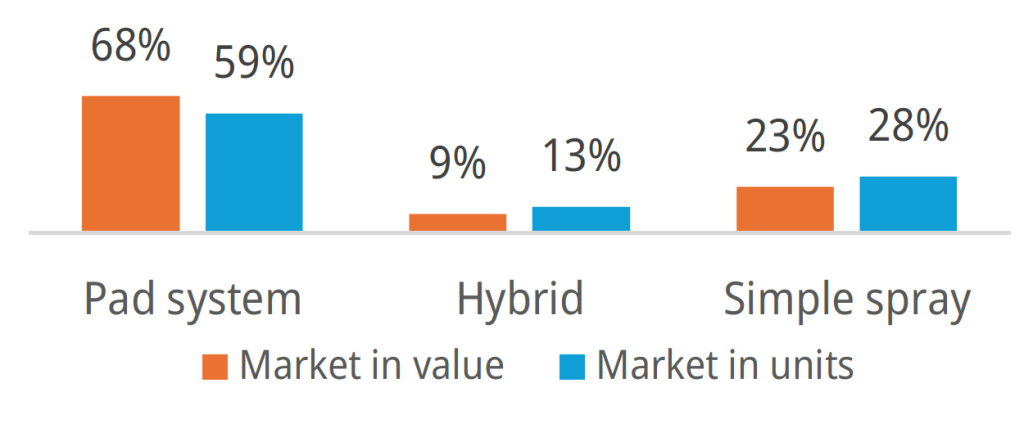

In the first section of the report dedicated to cooling, we can see a comparison of the cooling tower and dry cooler markets: the dry cooler market amounts to €372.7 million in 2023 in Europe compared to €210 million for cooling towers, the former being dominated by Germany and the latter by Türkiye. The evolution in value was much more favourable in 2023 for dry coolers, with +15% while that of cooling towers stagnated. This is part of an underlying trend in Europe which sees the dry cooler market progressing more quickly than that of cooling towers. Between the two, the adiabatic and hybrid dry coolers progress the fastest, but another confrontation is looming between the simple spray and pad systems. As can be seen in the graph opposite, pad systems dominate the market but this trend could be reversed.

Distribution of the Adiabatic and hybrid market in Europe in 2023

The chapter on refrigeration covers the market for coolers and condensers (including CO2 units): the former totalling 271,000 units compared to 48,900 for the latter in 2023. The market is dominated by France, followed by Italy and then Germany, but the most interesting point is of course the evolution of CO2 units in Europe. Their proportion increased from 12% in 2019 to 20% in 2023: it is higher in Northern Europe (around 50%) but this is not necessarily where the largest markets or the strongest growth are. Concerning ammonia units (NH3), we find large markets in Spain, Poland and the Netherlands but once again the growth potential is elsewhere.

Refrigerant share in Chillers >50 kW in 2023

In the following thermodynamics chapter, the market evolution in 2023 showed a positive trend overall, except for the rooftop segment, which experienced stagnation in unit numbers. One of the standout segments of 2023 was chillers with a capacity above 50 kW, which experienced remarkable double-digit growth, reaching a market value of €1,997.7 million. Both air-cooled and water-cooled chillers fueled this expansion. While the long-term analysis by cooling and heating type reveals differing trends, the refrigerant analysis concludes that the phase-down of HFCs in 2023 is rather slow, despite a decline in the use of R-410A. The report also features an analysis of refrigerants based on capacity, heat source, type of cooling or heating, compressor, and application. Additionally, it includes a forecast of the chiller.

The CRAC/CRAH market also enjoyed double-digit growth in 2023, with unit sales increasing by 15% and market value rising by 33%, reaching €375.8 million. This growth was primarily driven by the rising demand for high-capacity CRAH units (over 100 kW), which are essential for hyperscale and large enterprise data centres. These units have consistently experienced growth since 2015, although there was a brief slowdown in 2021 due to uncertainties following the pandemic. However, the market rebounded in 2022, and in 2023, there was a 28% increase in sales of large units.

In the section dedicated to terminal units, the report highlights the positive growth of the fan coil market, which is valued at €570 million in 2023. The market is primarily driven by units without casing, which makes up about one-third of the market, slightly surpassing units with casing. This strong growth contrasts with the chilled-beam market, which remains particularly stable in both value and structure. Here, the sales have reached almost 64 million euros, with Sweden alone accounting for more than a third of this amount. A modest decline is expected for the chilled-beam sector through 2030, as fan coils— a more cost-effective solution—continue to gain market share.

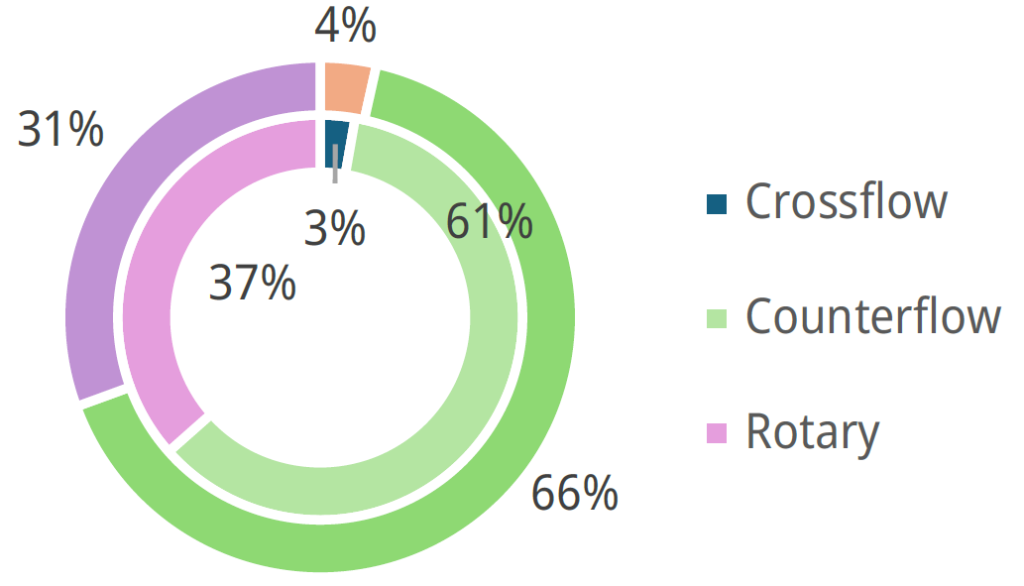

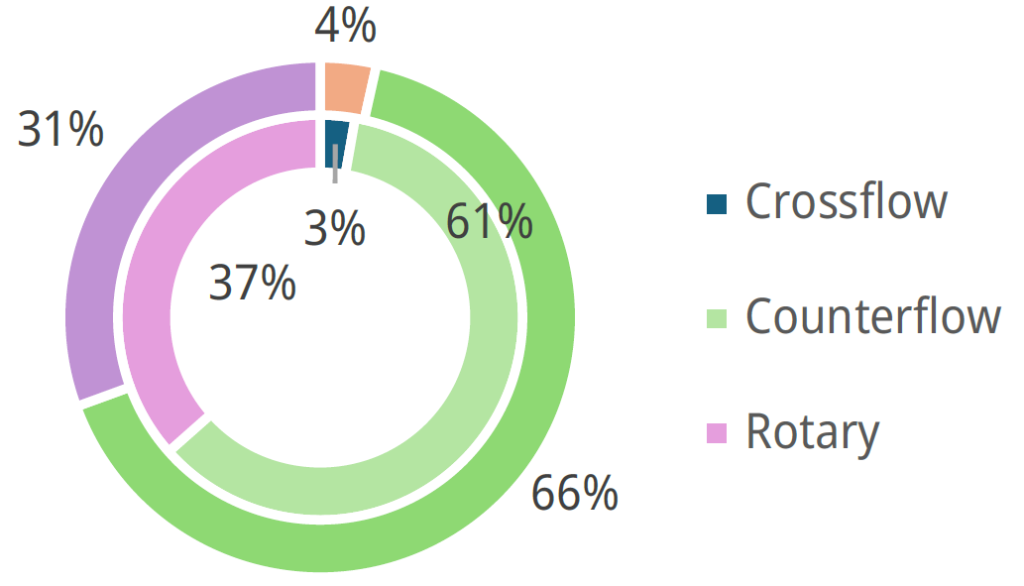

Finally, in the ventilation chapter, the report features three products: air handling units (AHU), central residential mechanical ventilation with heat recovery (MVHR) and air filters. Only the last one demonstrated stable growing dynamics. Largest in the ventilation sector in Total Europe, the AHU market (around 2,9 billion euro sales) in 2023, grew by +7,5% in euro but stagnated in units. The situation by country varies a lot with only Southern Europe and the UK having a positive evolution in units. 2023 for the AHU market was highlighted by turning the rotary into the dominant heat recovery technology in Europe (37% against 32% for the plate) with a high probability of keeping this prevalence in the future. Additionally, the report explores the correlation between the evolution dynamics of AHUs and integrated control and compact units, which both suffered a decrease in 2023 following the weak performance of retail and light commercial applications.

Market by type of heat recovery in Total Europe

The central residential MVHR market experienced the worst downturn in the Ventilation segment with a 10% decline, impacted by the crisis in new residential construction all over Europe. Among significant markets, only Spain and the UK enjoyed a positive evolution in 2023, while Northern and Eastern Europe dipped by around -20%. The EMI forecast predicts a gradual recovery, though rather slow and not immediate. Despite the overall decrease, the units with enthalpy slightly increased, but mainly in Eastern Europe. Unlike that for AHU, the share of rotary heat recovery in central residential MVHR in Total Europe diminished in 2023, which is likely related to the strong decline in Northern Europe, the region where this heat recovery type dominates. Additionally, the report analyses the defrosting strategies used in different European countries and the preferences by the unit’s mounting type.

Eurovent Market Intelligence has been a trusted data provider for the HVACR industry in Europe for over 30 years. As the largest organisation in its field, EMI has built a solid reputation for providing high-quality insights. EMI’s vast database, which includes contributions from over 500 participants, forms the foundation for the HVACR 2030 report, providing a deep understanding of the economic, technological, and regulatory factors shaping the HVACR sector.

Spanning 154 pages, the report is now available for purchase. For those interested in obtaining the full study or for further information, the "Publications" section of the Eurovent Market Intelligence website offers detailed pricing and additional resources. Alternatively, interested parties can contact Eurovent Market Intelligence directly at

statistics@eurovent-marketintelligence.eu.

With its in-depth analysis of key trends, emerging technologies, and future market projections, the HVACR 2030 report is a must-have for anyone looking to understand the current and future dynamics of the HVACR sector in Europe.