Integrated Thinking Drives Industrial Heat Pump Adoption

Industrial heat pumps are emerging as a critical technology for decarbonizing process heat and district heating networks. With manufacturers now pushing temperature limits beyond 120°C and growing recognition that heating and cooling systems should work as integrated solutions rather than isolated pieces of equipment, heat pumps are also transitioning from niche applications to mainstream options. Where is the technology heading, and what barriers remain?

Regional Adoption Patterns Reflect Policy and Economics

The pace of industrial heat pump adoption varies significantly across regions, shaped by a complex interplay of mindset, electricity pricing, existing infrastructure, and policy support. Nordic countries lead global deployment, benefiting from favorable electricity-to-gas price ratios and decades of proven operational experience.

Ivan Rangelov, Industrial Heat Pumps Manager at Danfoss A/S, identifies several key factors that have influenced the uptake. "The Nordic countries have the fastest implementation rates of industrial heat pumps. This can be explained by the very low electricity/gas price ratio in those countries (close to 1), as well as the fact that heat pumps have already been proven technology in Scandinavia for several decades."

The extensive district heating infrastructure in Scandinavia provides an additional advantage, enabling heat pumps to replace boilers entirely in many applications. Meanwhile, central and southern Europe face slower adoption rates where electricity-to-gas price ratios remain less favorable for heat pump economics. Lower heating demand in southern regions further reduces the economic incentive for investing in heat pumps.

Recent geopolitical events are reshaping the market landscape. Gas price fluctuations and supply insecurity following disruptions in natural gas imports have accelerated European interest in electrified heating solutions. Rangelov notes changing dynamics even in traditionally gas-dependent markets. "There is also a rise of interest in heat pumps in countries such as the United Kingdom, where the gas price used to be way too low, but recently, there has been growing interest."

North America presents a different picture. While the continent lags Europe in deployment, Rangelov sees momentum building. "We see more interest in heat pumps in the North American market, and we already have several ongoing projects. We believe that the Canadian market will be moving at a fast pace, among others, because of low power prices."

Technology Types and Application Focus

The industrial heat pump market is dominated by water-to-water systems for process applications, while air-to-water configurations are gaining traction in district heating networks. Each technology offers distinct thermodynamic advantages suited to specific use cases.

According to Dominique Silva, Regional Marketing Leader at Trane Technologies, "This really largely depends on the type of application, although we do see high demand for all air-air, air-water, and water-water type solutions.”

Rangelov notes that industrial processes and district energy applications are the primary demand drivers for industrial heat pumps, with the former showing the most potential in the longer term.

District heating has integrated heat pumps more rapidly due to simpler system integration requirements, while industrial process applications present greater complexity but offer larger long-term potential. Within industrial sectors, food and beverage operations represent the most accessible opportunity. "I would definitely pick Food & Beverage as the lowest hanging fruit to look into industrial decarbonization," Rangelov notes.

Applications requiring process heat up to 120°C are driving the strongest demand, particularly in manufacturing processes requiring simultaneous heating and cooling.

Thermal Management Systems Challenge Traditional Thinking

Understanding these application demands has driven a fundamental shift in how industrial facilities approach heating and cooling systems. Rather than viewing heat pumps as standalone equipment replacements, leading adopters are moving toward integrated thermal management systems. This systems-level thinking represents more than incremental improvement; it challenges decades of siloed design practices.

Silva emphasizes the paradigm shift. "Rather than treating heating and cooling as 'siloed' systems, industrial users should and are increasingly adopting integrated thermal management systems. This design, where chiller and boiler plants work alongside each other as standalone, separate systems, is no longer justifiable."

According to the European Environment Agency, industrial heating and cooling contribute approximately 20–25% of Europe's CO2 emissions. Traditional systems operating in silos frequently waste valuable energy, whether rejected heat from cooling condensation or waste heat from heating processes.

Silva stresses the importance of holistic thinking. "Integrated thermal management systems challenge the traditional mindset, enabling industrial plants to recover, repurpose, and balance thermal energy across their processes. This system-level thinking is key to reducing emissions, cutting costs, and moving towards truly decarbonized operations."

High-Temperature Capabilities Expand Market Reach

While systems-level thinking addresses how heat pumps are deployed, parallel advances in temperature capabilities are expanding where they can be applied. Manufacturers have significantly increased the temperature capabilities of their products in recent years, opening up applications that were previously considered beyond the reach of heat pumps.

The pace of this evolution has been remarkable. According to Rangelov, five years ago, heat pumps could only reach temperatures of up to 80°C. Now, all of Danfoss’s equipment allows manufacturers to build heat pumps that can deliver water at 100°C. The company has already released compressors that can handle hot water up to 120°C, with 130°C options scheduled for release next year.

Silva confirms that technological advances in heat pumps are raising their appeal: "Advances in technology and design have enabled these systems to achieve higher leaving water temperatures at much higher efficiency levels compared to boilers, which is making heat pumps a very attractive and viable solution to decarbonize process heat while delivering high energy efficiency."

Patrick Crombez, General Manager Heating and Renewables EMEA at Daikin Europe and President of the European Heat Pump Association (EHPA), explains that although high-temperature systems attract attention, Daikin's focus remains on applications below 100°C where efficiency and cost-effectiveness are strongest. However, he recognizes that continued development in high-temperature capabilities will be essential for expanding industrial adoption.

Looking forward, Rangelov envisions refrigerants generating hot water and steam for processes up to 130°C, potentially reaching 150°C. Beyond that threshold, mechanical vapor recompression using steam as a refrigerant can achieve higher temperatures. "However, for temperatures above 200°C, according to literature, there will mainly be electric boilers or other heat generation technology," he explains.

Refrigerant Selection Navigates Regulation and Performance

These higher operating temperatures require careful refrigerant selection to balance performance, safety, and environmental impact. The revised EU F-Gas Regulation is influencing refrigerant selection for industrial heat pumps, though the transition toward low-Global Warming Potential (GWP) options proceeds at varying speeds across temperature ranges and applications.

According to Rangelov, natural refrigerants, including ammonia (R717), CO2 (R744), and hydrocarbons, are gaining ground in the lower-temperature segment. Low-GWP refrigerants (such as HFOs) are also in play, and some HFCs, but less so in Europe.

The picture simplifies for higher-temperature applications. "Above 100°C, the picture is much simpler: with minor exceptions which are not yet scaled, there are either only hydrocarbons or low-GWP refrigerants which can be used," Rangelov explains.

Water can also function as a refrigerant, though Rangelov notes economic requirements. "To be economic, it needs to be generated already above 100°C, and we still need to get there with a refrigerant."

Crombez confirms the regulatory influence on refrigerant choices, noting that popular options include ammonia, CO2, and various synthetic refrigerants capable of reaching higher temperatures, sometimes used in cascade systems.

Silva takes a performance-first approach to refrigerant selection. "At Trane, we select refrigerants that offer the optimal performance with a minimal global warming impact, without compromising on safety."

Economic Barriers and System Integration Challenges

Despite technological progress and favorable policy environments in many regions, several persistent barriers constrain industrial heat pump adoption. Understanding these obstacles is essential for stakeholders developing acceleration strategies.

Rangelov identifies the fundamental challenge. "The main one is an unfair electricity/gas price ratio. If this ratio is lower, then the implementation curve will grow much faster."

High capital expenditure for high-temperature systems presents another significant hurdle. Crombez lists the main barriers as high capital expenditure for high-temperature systems, lower efficiency at elevated temperatures, and competition from electric boilers, particularly at high temperatures.

System integration complexity adds another layer of difficulty, especially as heat pump deployment increases. "Another limitation with scaling up heat pumps is sector integration. When a heat pump is installed, it most often needs to be integrated into an already existing system. This challenge can be expected to increase with the higher implementation rate of heat pumps in industry," Rangelov explains.

Process temperature requirements designed around boiler capabilities create additional constraints. Rangelov points to a fundamental challenge: processes are typically designed around boiler temperature outputs, and operators are often reluctant to alter these established parameters. Retrofitting these systems for heat pump operation requires careful planning and sometimes process redesign.

Silva acknowledges that there are mindset issues. "While traditional concern and skepticism around the industrial use of heat pumps persist, benefits far outweigh the obstacles. Common concerns about complexity, cost, or site limitations often reflect legacy thinking rooted in siloed systems."

The transition to integrated systems is more conceptual than physical. "Moving from separate to integrated systems doesn't mean reinventing the plant. It means rethinking how energy flows through it," Silva explains.

Return on investment (ROI) calculations vary significantly by region and application. Silva notes that business cases are typically attractive. "While incentives can help provide an additional boost, there is usually an attractive business case tied to shifting to a thermal management system approach, driven by higher energy efficiency and fewer equipment needed to maintain."

The payback period for all-in-one thermal management systems often falls within two to three years due to greater energy efficiency and operational savings, though this depends heavily on electricity and fuel price differentials.

Policy Frameworks Drive Adoption

Policy support is accelerating industrial heat pump deployment across multiple fronts, from direct financial incentives to regulatory mandates requiring waste heat recovery. European initiatives are particularly comprehensive, though implementation and support levels vary by country.

The EHPA has compiled an overview of national support mechanisms for industrial heat pumps across 24 European countries. These mechanisms vary by country but share common features, including grants covering a percentage of investment costs (often scaled by company size and heat pump capacity), waste heat recovery and grid integration incentives, and technical requirements.

Many national programs require heat pumps to achieve a Seasonal Performance Factor (SPF) of at least 3.8, use refrigerants with GWP below 2,000, and feature a nominal capacity of at least 100 kW for eligibility.

Several European initiatives – including the Clean Industrial Deal, Industrial Decarbonisation Accelerator Act, and EU Heat Pump Accelerator Platform – aim to position heat pumps as central to decarbonization by promoting simplified state aid, waste heat reuse, and fair electricity pricing.

Beyond regulatory frameworks, industry experts emphasize that successful adoption requires stakeholder engagement at all levels. Silva emphasizes the need for broad awareness campaigns. "Awareness and education on the value of heat pumps and thermal management systems is key to continuing to see an uptake in this kind of sustainable technology. We need this at all levels, from manufacturers to policymakers to engineering schools."

Crombez reinforces the key role of policy. "Grants and incentives play a critical role in adoption. Where available, they help reduce upfront costs and accelerate deployment. Daikin advocates for stable, long-term policy frameworks to support industrial decarbonization."

Market Growth Projections and Future Outlook

Industrial heat pumps are gaining market share across regions, with European markets expected to experience significant growth in the coming decade, despite recent slowdowns in the overall heat pump market.

Rangelov projects substantial expansion. "We forecast this trend growing in the coming years, and we can expect the European industrial heat pump market to grow by a factor of 10 in the coming 10 years."

Several factors could influence this growth trajectory, though the fundamental potential remains clear. The adoption curve will accelerate if electricity-to-gas price ratios become more favorable. Rangelov believes heat pump technology deserves prioritization for subsidies. "I believe there are other new technologies, or even fossil fuel technologies, which have been prioritized for subsidies instead of heat pumps. As a mature technology that already exists, I would like to see it supported differently."

While Europe leads in deployment, North America is beginning to close the gap, particularly in Canada. The regional differences reflect varying policy environments, energy prices, and industrial structures, but momentum is building across major markets.

The question of whether heat pumps will eventually dominate industrial heating applications entirely remains open. Crombez offers a nuanced assessment. "While heat pumps will remain central to industrial heating, it is unlikely they will be the sole technology used. High-temperature applications face efficiency and capital expenditure limitations, so hybrid systems and electric boilers will continue to complement heat pumps."

Temperature limitations define realistic deployment boundaries. In Food & Beverage, Pulp & Paper, Textile, and District Heating sectors, where most processes operate below 150°C, heat pumps are positioned to become the natural choice. However, industries like chemical and steel manufacturing require temperatures up to 500°C, going beyond current heat pump capabilities.

Silva frames the transition as both technological and strategic. "Redefining how heating and cooling systems are managed is vital for energy efficiency and sustainability. Thermal management is no longer just about choosing the right boiler or chiller. It's a strategic partnership for energy optimization, decarbonization, and operational resilience."

Rangelov expresses optimism about industrial heat pumps playing a central role in decarbonization efforts. "The potential is there, and we will make sure to support the industry in this journey. We have been focusing on developing new equipment targeting industrial heat pumps for the last 5 to 10 years already. Industrial heat pumps are one of the strategic goals Danfoss has in our LEAP 2030 strategy."

The most significant barrier to accelerated adoption may have nothing to do with technology. "The biggest step is changing the mindset: Reimagining heating and cooling as part of a single thermal system is not just a technological shift, it's a leadership one," Silva emphasizes. "The good news is that this mindset change is already underway. Now, it's time to scale it.”

The shift toward integrated thermal management represents both the greatest opportunity and the biggest challenge for industrial heat pump adoption. As manufacturers continue pushing temperature capabilities upward and policy frameworks strengthen, the technology itself is increasingly capable. Yet success will ultimately depend less on equipment specifications than on the industry's willingness to abandon siloed thinking. For industrial heat pumps to capture substantial market share, the shift in thinking must keep pace with technological advancement.

Real-World Case Studies

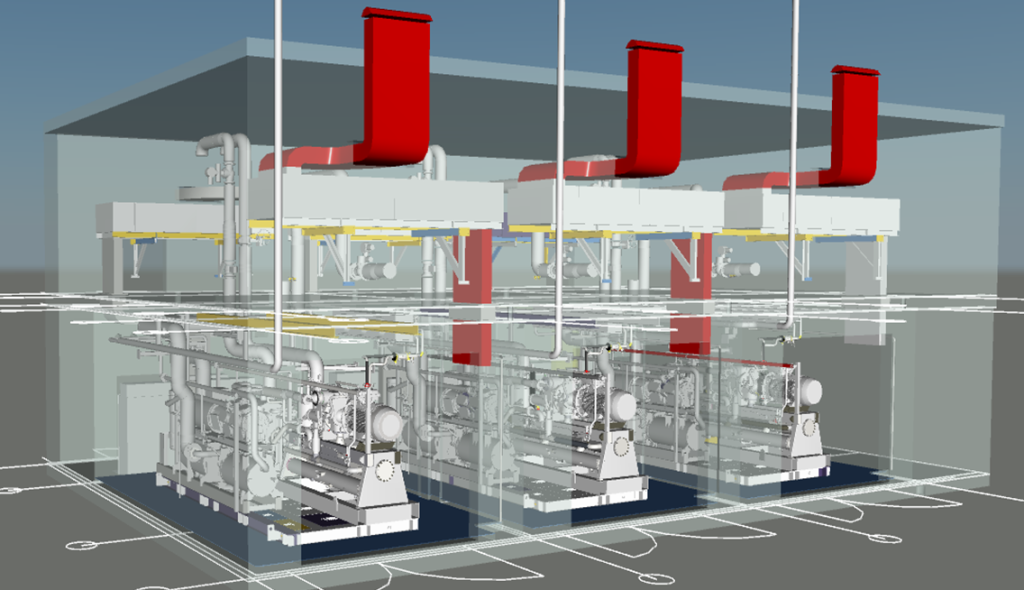

Johnson Controls – Rosenheim District Heating, Germany

To decarbonize municipal heating, Stadtwerke Rosenheim installed three Sabroe DualPAC ammonia heat pumps supplied by Johnson Controls. Drawing thermal energy from the nearby Mühlbach River, the system delivers water up to 88 °C, providing 4.7 MW of renewable energy and reducing CO₂ emissions by approximately 2,640 tonnes per year.

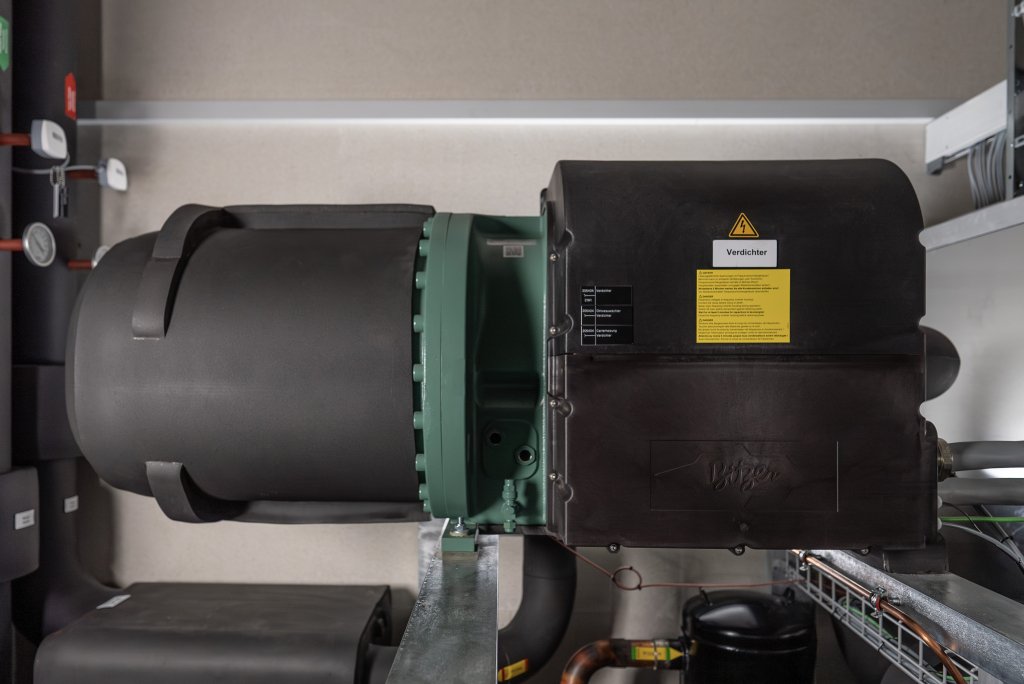

BITZER & Scheco – SFS Group, Switzerland

SFS Group Schweiz AG upgraded its Heerbrugg facility with a custom water-to-water heat pump developed by Scheco AG. Powered by a BITZER CSV screw compressor, the system recovers groundwater waste heat to supply building heating up to +75 °C, replacing fossil-fuel boilers and cutting emissions while improving overall energy utilization.

Frascold & Tecnofreddo – High-Temperature R290 Heat Pump

Through a joint effort, Frascold and Tecnofreddo developed a propane-based heat pump designed for industrial and commercial applications. Equipped with ATEX-HT compressors and an LSPM motor, it operates at up to 80 °C with improved COP and energy savings, serving food, pharmaceutical, and HVAC sectors with a sustainable, high-efficiency solution.

Want to explore all these case studies in detail?

They are featured in the special edition of Refindustry Magazine 2025 / Issue 4.