This new US HVAC field device study covers valves, dampers, actuators, and sensors in commercial buildings worth an estimated USD 1.2 billion in 2019.

The US commercial field device market was estimated at just over USD 600 million in 2019 and was, pre-Covid, expected to show moderate growth of around 3% per year up to 2024. The market is driven by construction, which has been severely affected by Covid-19, and trends in energy efficiency thus increasing sales of more sophisticated dampers including motorised actuators and dampers.

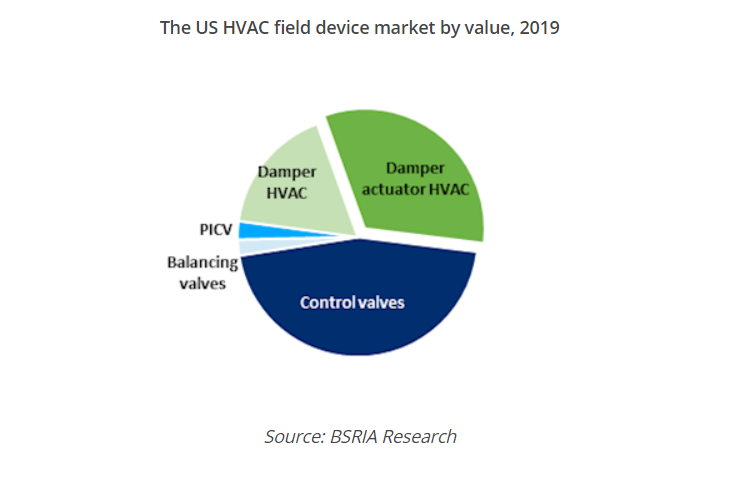

The value of the commercial HVAC FD market is equally split between valves and dampers & actuators and many suppliers are present in all three segments. The dominant suppliers of valves and actuators include JCI, Honeywell, Belimo, Siemens and Schneider Electric, while dampers are supplied by Daikin, Nailor, Trane, Greenheck and United Enertech.

The uptake of IoT valves remains marginal in the commercial HVAC market compared to the more rapid uptake in the residential market. Connected Bus accounts for a decent share of motorised, PICV and pneumatic valves, but analogue still dominate the market.

The study also covers fire damper and actuators, which are excluded from the valve, dampers and actuators market mentioned above.

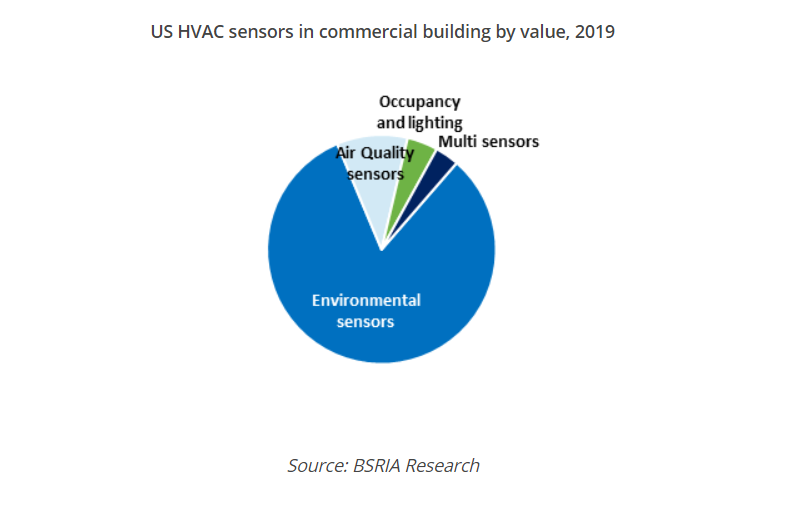

The US market for HVAC sensors in commercial buildings increased by 10% in 2019 and was, pre-Covid, expected to continue to grow at the same level. The biggest growth is expected for multi sensors.

Most of the sensors are installed in ducts and pipes accounting for almost two thirds of the market followed by wall and ceiling mounted. The third segment, outdoor, accounts only for a minor share. The need for air quality monitoring, temperature zoning and occupancy detection will boost the sensor market.

The majority of sensors sold are wired analogue followed by wired Bus which mostly use BACNet and EnOcean via gateways. Wireless accounts for 5% and is mostly used when wiring is not possible or is too expensive. The use of batteries is a barrier as these need to be replaced. Wired IoT accounts for a marginal share mostly sold by start-ups. Most IoT sensors are used in residential applications, which are outside the scope of this study.

The suppliers of sensors are control companies and specialist sensor manufacturers with a large share sold via the OEM channel. The market is very fragmented with the top 3 players accounting for around a third of the market. Some of the large suppliers (OEM sales excluded) are Honeywell, ACI, JCI, BAPI, Siemens, Dwyer and Schneider Electric.

This study is confined to the market of HVAC systems for commercial buildings (excluding industrial and processing). It includes intelligent buildings equipped with an HVAC system integrated in a Building Automation and Control System (BACS) and traditional buildings, equipped with standalone HVAC solutions.

The HVAC field device studied includes mechanical elements of HVAC systems, distributing hot and cold fluid and air in the building for cooling and heating floor space (valves and valve actuators, dampers and damper actuators). It also includes fire safety dampers and actuators as they are a part of the controlled ventilation system.

The study includes sensors used for traditional HVAC systems but BSRIA also added to the scope sensors commonly installed with an HVAC system when it is designed to be integrated in a smart building, notably occupancy sensors and light sensors.