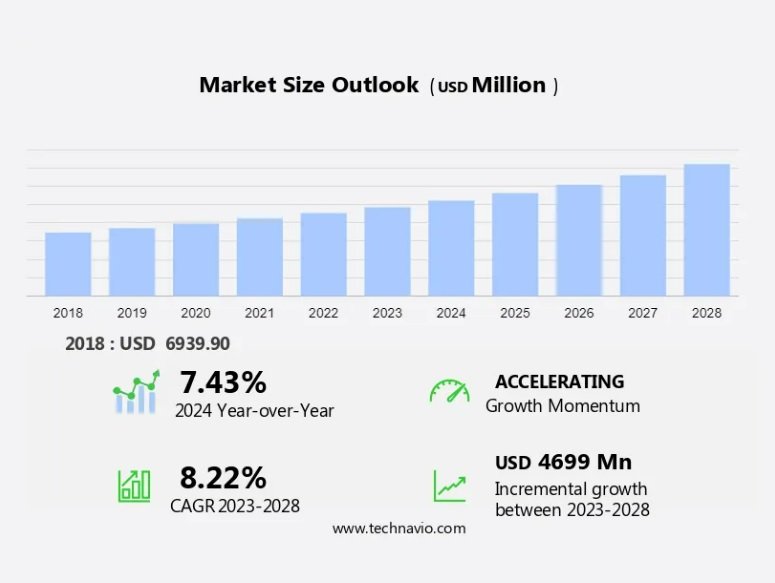

Market Dynamic

In the realm of HVAC systems, Air Handling Units (AHUs) play a pivotal role in providing comfortable indoor environments. These systems are essential components in Ventilation, Heating, and Air Conditioning (VHAC) systems. AHUs consist of various components such as cooling coils, heating valves, filters, and dampers. The Air Handling Unit market is witnessing significant growth due to the increasing demand for energy-efficient systems and the need for better indoor air quality. Coils, an integral part of AHUs, are subjected to corrosion over time, leading to a decrease in their efficiency. To mitigate this issue, manufacturers are focusing on developing coatings for cooling coils that enhance their durability and efficiency. Moreover, the use of advanced technologies like IoT and AI in AHUs is gaining popularity, enabling predictive maintenance and optimizing energy consumption. The market for Air Handling Units is expected to grow substantially in the coming years, driven by these factors and the increasing focus on sustainable and energy-efficient buildings.

Key Market Driver

The increasing focus on indoor air quality in both commercial, residential, and other sectors is a key factor driving growth. The construction sector plays a major role in driving the demand for HVACs, in turn driving the demand for AHUs. The rise in the construction of commercial and residential buildings majorly contributes to the growth of the market. The construction industry is expanding at large across the globe. There are a lot of factors leading to the expansion of the construction industry.

Moreover, energy-efficient technologies like energy-efficient HVAC systems, energy-efficient products, and energy conservation are essential for thermal comfort in shopping malls, hotels, and lounges. The AHU industry incorporates advanced technologies like CIArb, UV-curable, and nanotechnology-based coatings for blower sections and duct systems. These coatings enhance energy efficiency and reduce GHG emissions. Heating coils and energy-efficient HVAC systems play a crucial role in maintaining optimal indoor air cleanliness and temperature. Such factors will increase the market growth during the forecast period.

Significant Market Trends

Advanced monitoring systems and intelligent technologies are the key trends in the market. The evolution of monitoring systems and intelligent technology is a driving force for the market. Monitoring systems help in tracking the energy consumption of a building, while intelligent technology controls the energy output of an HVAC system, including handling units.

The integration of IoT with HVAC systems and AHU is opening new avenues for the market in terms of revenue. The commercial building sector is likely to be the early adopter of this technology, as this integration will enhance the efficiency and reliability of BAS. IoT links components or systems with network connectivity to the Internet and enables them to send and receive data over a network. Thus, the growing advancement in technology will drive market growth and trends in focus during the forecast period.

Major Market Challenge

Compliance with stringent environmental regulations is a major challenge hindering growth. Compliance related to carbon dioxide emissions and energy consumption, necessitates the use of energy-efficient HVAC systems. These systems incorporate components like ventilators, heating & cooling coils, sound attenuators & dampers, filter chambers, and blower fans.

However, in countries like India, Japan, and China, the AHU industry is witnessing significant growth due to increasing demand for energy-efficient products and energy conservation. Key components of AHUs include the blower section, duct system, and heating coil. CIArb regulations and GHG emissions concerns further emphasize the importance of energy efficiency and energy-efficient technologies in the AHU market. Applications include shopping malls, hotels & lounges, and other establishments prioritizing thermal comfort. Such factors will hinder the market growth during the forecast period.

Market Segmentation

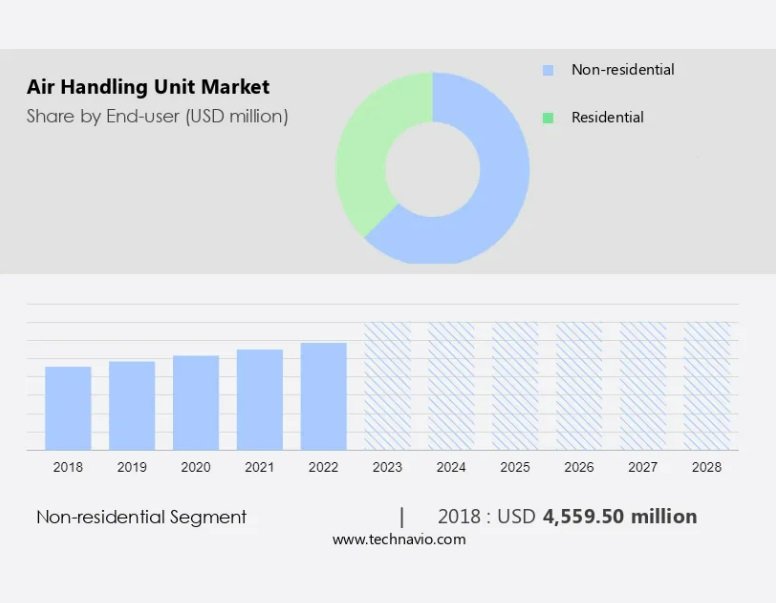

End-User Segment Analysis:

The market share growth of the non-residential segment will be significant during the forecast period. The non-residential end-users of units include manufacturing facilities, commercial and industrial buildings, data centres, retail stores, healthcare facilities, and educational institutions. The increase in construction activities in the non-residential end-user segment will drive the demand for air-handling units.

The oral therapy segment was valued at USD 4.56 billion in 2018. The commercial segment accounts for the largest revenue share of the market. This large share is mainly attributed to the rising need for energy efficiency among organizations. HVAC and lighting systems account for a major part of energy consumption in commercial buildings. Therefore, it is crucial for vendors to develop HVAC systems that are energy-efficient and comply with regional as well as international regulations. This is driving the flow of investments into more energy-efficient units by market players.

Capacity Segment Analysis:

Air handling unit, with a small capacity of up to 5,000 m3 per hour, cater to the needs of smaller premises, particularly in the residential sector. The rise in construction activities in the residential sector globally will propel the demand for air handling unit in this capacity range. In North America and APAC, countries such as the US, China, and India are the major markets for growing residential construction. Demographic changes, rising disposable incomes, and rapid urbanization in countries such as India and China add to the increasing demand for air handling unit systems.

Moreover, technological innovations and various new devices flooding the market have led to a significant increase in indoor pollutants. The major sources of indoor pollution include asbestos, biological pollutants, air fresheners, formaldehyde/pressed wood products, and other sources of CO emissions. Therefore, it is critical for residential and commercial establishments to opt for air pollution monitoring kits along with other equipment that offers effective means to monitor and control the level of air pollution. Several vendors offer a wide range of air handling unit, promising complete air quality management. These factors are expected to boost the demand for the segment and, in turn, the market in focus during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth by 2027. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. The AHU Industry in APAC experiences significant growth, driven by investments in construction projects in India and China. Indoor air quality solutions, including ventilators, heating & cooling coils, filter chambers, sound attenuators & dampers, and energy-efficient HVAC systems, are in high demand. India, Japan, and China are key markets for commercial and residential applications.However, carbon dioxide levels and air cleanliness are crucial concerns, leading to increased investments in blower fans and energy-efficient HVAC systems. CIArb focuses on reducing GHG emissions and energy consumption. Key sectors include restaurants, data centers, hospitals, schools, hotels, office buildings, and pharmaceutical manufacturing. Energy efficiency and energy-efficient technologies are essential for thermal comfort in shopping malls, hotels, and lounges. Air handling units, blower sections, and duct systems are integral to energy conservation and the AHU Industry. Energy-efficient products and HVAC systems are essential for maintaining thermal comfort and reducing energy consumption. Such factors will increase the market growth during the forecast period.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

American Air Filter Co. Inc., Arbonia AG, Ariston Holding NV, Breezeair Technology, Carrier Global Corp., Cooke Industries, Daikin Industries Ltd., Desiccant Technologies Group, Environmental Air Systems LLC, Euroclima AG, Fischbach Luft und Ventilatorentechnik GmbH, FlaktGroup Holding GmbH, Heinen and Hopman, Johnson Controls International Plc., Lennox International Inc., MANDIKA AS, MIDEA Group Co. Ltd., Systemair AB, and Trane Technologies plc.