The cold chain market is projected to grow at a CAGR of 7.0%, in terms of value, from 2017 to reach a projected value of USD 271.30 Billion by 2022. The growing consumer demand for perishable foods, growth of international trade due to trade liberalization, and expansion of food retail chains by multinationals are the factors driving the cold chain market. Government support for infrastructure development drives the cold chain industry.

The cold chain market has been segmented by type into refrigerated storage and refrigerated transport. Refrigerated storage capacities are growing in the Asia-Pacific countries due to the increased need to reduce the loss of perishable foods. In North America and Europe, in the refrigerated transport industry is booming, mainly due to the advancement of technology in refrigerated trucks, vans, trailers, and maritime reefer containers. The refrigerated transport market is further segmented into subtypes which include air-blown evaporators and eutectic devices.

Based on temperature type, the frozen segment is estimated to account for the largest market share in 2017. The global demand for frozen food products is higher than chilled food products. The chilled segment is expected to grow due to the wide usage of chilled temperatures for food preservation to extend the shelf life from a few days to a few weeks.

The cold chain market has been segmented on the basis of application into fruits & vegetables, bakery & confectionery, dairy & frozen desserts, fish, meat, & seafood, and others which include sauces, condiments, salad dressings, and dips. Dairy & frozen desserts are also witnessing high demand due to economic growth and rapid urbanization, along with sophisticated marketing channels which have led to significant changes in dietary patterns. Frozen fruits & vegetables are often available in easy-to-open re-sealable packaging, allowing for longer storage and portion control without wastage.

The European region is estimated to account for the largest share, in terms of value, in the global cold chain market, in 2017. There is a steady increase in demand, particularly for cold chain due to a continuous increase in domestic consumption of high quality of perishable commodities. Asia-Pacific region indicates significant growth potential for the cold chain industry due to increasing awareness about the prevention of food wastage before consumption, growth of the organized retail sector, rising consumer demand for perishable foods, and government support & initiatives in this sector.

High energy & infrastructure costs are the growing concerns for cold chain service providers and environmental concerns regarding greenhouse gas emissions restrains the total market for cold chain.

The leading players that dominated the cold chain market include Americold Logistics (U.S.), Preferred Freezer Services (U.S.), Burris Logistics (U.S.), Lineage Logistics Holding LLC (U.S.), and Nichirei Logistics Group Inc. (Japan).

The key players have been exploring the market in new regions by adopting mergers & acquisitions, expansions, investments, new service launches, agreements, collaborations, and joint ventures as their preferred strategies. Key players have been exploring new geographies through expansions and acquisitions across the globe to avail competitive advantage through combined synergies.

The years considered for the study are as follows:

- Historical year: 2015

- Base year: 2016

- Estimated year: 2017

- Projected year: 2022

- Forecast period: 2017–2022

Objectives of the study are as follows:

- To define, segment, and measure the cold chain market with respect to type, application, temperature type, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders

- To project the size of the market, in terms of value (USD million) in the key regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To project the market size, in terms of volume (million cubic meters) for refrigerated storage and in terms of volume (units) for refrigerated transport—which are the infrastructure types of cold chain

- To project the market size, in terms of value (USD million) on the basis of different applications—fruits & vegetables, bakery & confectionery, dairy & frozen desserts, meat, fish & seafood, and others (sauces, condiments, salad dressings, and dips)

- To project the market size, in terms of value (USD million) on the basis of the temperature type chilled and frozen which are classified according to the temperature ranges

- To strategically profile the key players and comprehensively analyze their market share and core competencies2 To analyze the competitive developments such as expansions & investments, new service launches, mergers & acquisitions, partnerships, collaborations, agreements, and joint ventures in the cold chain market

- Micromarkets are defined as the further segments and subsegments of the global cold chain market included in the report.

- Core competencies of the companies are captured in terms of their key developments, SWOT analyses, and key strategies adopted by them to sustain their position in the market.

Research Methodology

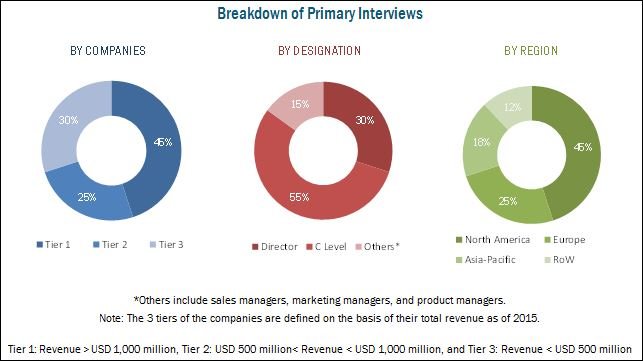

This report includes estimations of market size in terms of value (USD billion) and volume (million cubic meters) (units). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the cold chain market and of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources, such as Global Cold Chain Alliance (GCCA), European Cold chain Manufacturers Association (EFEMA), Food Additives and Ingredients Association (FAIA), Food and Agriculture Organization (FAO), European Food safety Authority (EFA), and Food and Drug Administration (FDA) to identify and collect information useful for this technical, market-oriented, and commercial study of the cold chain market.

Market Ecosystem

The various contributors involved in the value chain of food cold chain include raw material suppliers, manufacturers, cold chain service providers, wholesalers/distributors, retailers, and end users. Major manufacturing companies outsource their logistics activities to cold chain service providers to produce their products into the market. The type of cold chain service to be used depends on the type of the food product, its shelf life, storage, and movement of food products by various modes of transport such air, water, rail, and road. The market is dominated by key players such as Americold Logistics (U.S.), Preferred Freezer Services (U.S.), Burris Logistics (U.S.), Lineage Logistics Holding LLC (U.S.), and Nichirei Logistics Group Inc. (Japan). Other players include AGRO Merchants Group, LLC (U.S.), Cloverleaf Cold Storage (U.S.), Kloosterboer Group (Netherlands), Swire Cold Storage Ltd (Australia), and Interstate Cold Storage Inc. (U.S.).

Target Audience:

- Raw material suppliers

- Secondary sources, which include the following:

- European Cold chain Manufacturers Association (EFEMA), Food Additives and Ingredients Association (FAIA), and Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFA) and Food and Drug Administration (FDA)

- Food safety agencies

- End applications, which include the following:

- Food processing companies

- Livestock producers

- Agro products

- Intermediary providers

- Logistics service providers

- Cold logistics players

- Warehousing agents

Scope of the Report

Based on Type, the market has been segmented as follows:

- Refrigerated storage

- Refrigerated transport

Based on Technology, the refrigerated transport market has been segmented as follows:

- Air-blown evaporators

- Eutectic devices

Based on Temperature Type, the market has been segmented as follows:

- Chilled

- Frozen

Based on Application, the market has been segmented as follows:

- Fruits & vegetables

- Bakery & confectionery

- Dairy & frozen desserts

- Fish, meat, & seafood

- Others (sauces, condiments, salad dressings, and dips)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

- Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe cold chain market into Russia, Ireland, Poland, and Sweden

- Further breakdown of the Rest of Asia-Pacific cold chain market into Malaysia, Indonesia, and Thailand

- Further breakdown of the RoW cold chain market into the Middle Eastern countries and Rest of Africa

Company Information

- Detailed analysis and profiling of additional market players (Up to five)