Cold chain tracking market to reach 1.1 million units by 2029

The cold chain tracking and monitoring market is projected to grow steadily through 2029, driven by demand for real-time tracking of refrigerated cargo to reduce food wastage, improve supply chain efficiency, and meet regulatory requirements. According to the latest edition of the "Cold Chain Tracking and Monitoring Market" report by Research and Markets, the sector is expanding due to lower device costs and advances in AI-based monitoring solutions.

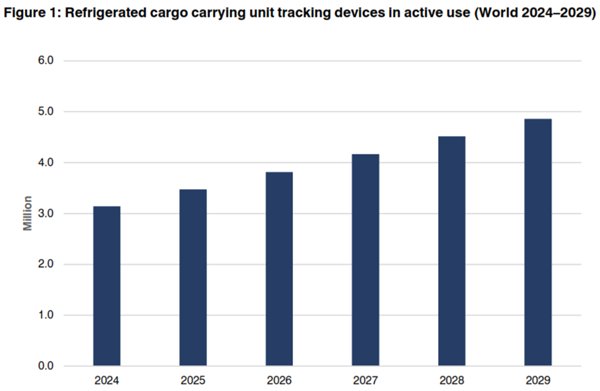

Remote tracking system shipments with cellular or satellite connectivity for refrigerated cargo units reached 865,000 units worldwide in 2024 and are expected to grow at a CAGR of 4.7% to nearly 1.1 million units by 2029. The installed base is forecasted to increase from 3.1 million units in 2024 to 4.9 million by 2029, a CAGR of 9.1%.

For general cargo tracking, the number of active devices and real-time data loggers stood at approximately 4.5 million units by the end of 2024. This segment, which includes both reusable and disposable devices, is expected to grow significantly, with the installed base reaching 14.7 million units and annual shipments rising from 6.5 million in 2024 to 33.2 million in 2029.

Key solution providers for refrigerated container tracking include ORBCOMM, Maersk, and Globe Tracker, while Sensitech, DeltaTrak, Controlant, Tive, Frigga, and Copeland are major players in cargo-level tracking. Other notable contributors include Schmitz Cargobull, Spireon, Samsara, and Intermodal Telematics.

The report notes a growing trend toward the integration of smart labels and small-form tracking technologies, with many logistics companies — including FedEx, UPS, and Schenker — now offering cargo monitoring as a service. Real-time data capabilities now cover not only location but also metrics such as temperature, humidity, and shock, and are becoming standard in cold chain logistics.

The report includes insights from 30 executive interviews, updated company profiles, and market forecasts through 2029.