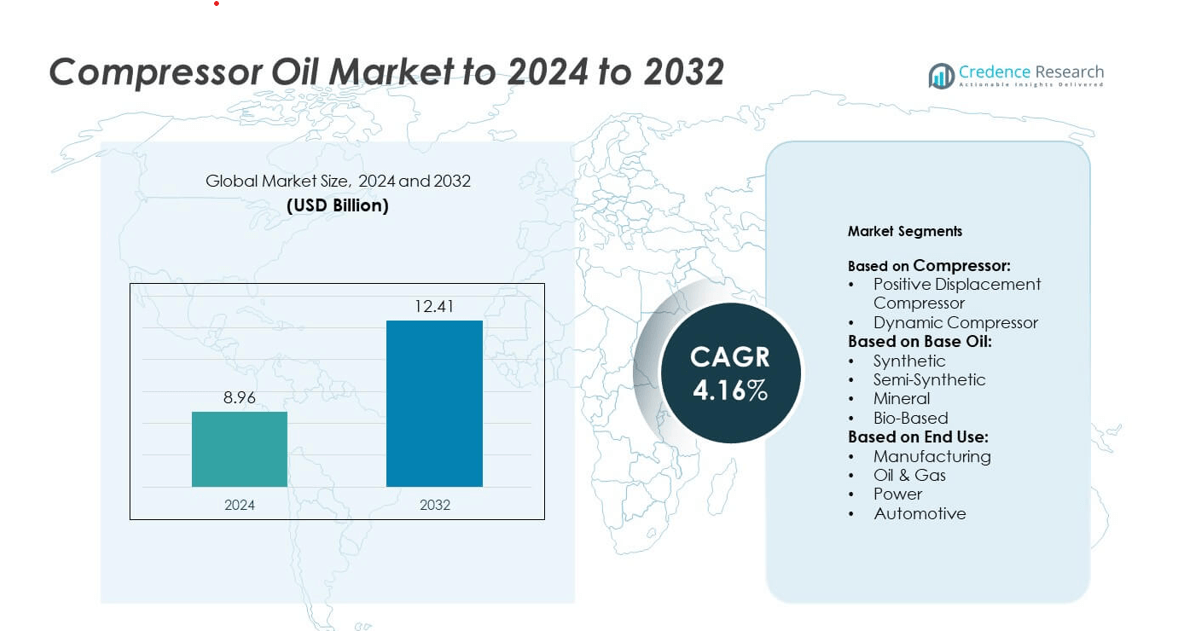

Global Compressor Oil Market to Reach USD 12.41 Billion by 2032

The global compressor oil market is projected to grow from USD 8.96 billion in 2024 to USD 12.41 billion by 2032, at a CAGR of 4.16%, according to a report by Credence Research. Growth is driven by industrial automation, expansion of HVAC systems, and increasing adoption of synthetic and bio-based lubricants.

Compressor oils are used across end-use sectors including manufacturing, automotive, oil and gas, construction, power generation, and HVAC. The market includes synthetic, mineral, semi-synthetic, and bio-based oils. Recent product launches, such as ExxonMobil’s synthetic compressor oil and TotalEnergies’ biodegradable variant, reflect ongoing innovation in the sector.

In Asia Pacific, industrialization and infrastructure development support strong market demand. A joint venture between Daikin India and Rechi Precision announced in December 2024 aims to produce compressors for the Indian HVAC industry. China remains a key market due to its large vehicle production and demand for air conditioning systems.

The HVAC sector significantly contributes to lubricant demand. For example, the U.S. Energy Information Administration notes that 88% of U.S. households use air conditioning, most of which rely on compressors that require lubricants. The sector’s energy efficiency goals further support the adoption of advanced oils.

Technological advancements in synthetic and biodegradable formulations are key market drivers. These lubricants offer thermal stability, oxidation resistance, and extended drain intervals. Leading companies such as ExxonMobil and TotalEnergies are expanding their offerings to meet regulatory and performance standards.

However, the market faces barriers including raw material price volatility, competition from oil-free compressor technologies, and complex regulatory compliance requirements. Variability in crude oil pricing and regional disposal regulations increase costs for manufacturers and end-users.

Notable trends include the shift toward synthetic base stocks and growing adoption of environmentally sustainable products. Companies are investing in PAO-based and bio-based formulations to meet performance and regulatory demands. In March 2025, Honeywell acquired Sundyne for USD 2.16 billion, integrating IoT capabilities for predictive maintenance of compressor equipment.

Asia Pacific led the market in 2024 with a share exceeding 41%. India shows strong growth potential, while North America and Europe also maintain significant demand, supported by manufacturing, HVAC adoption, and environmental regulations. In Europe, biodegradable oils are gaining traction, with companies like TotalEnergies tailoring products to regional standards.

Major players include Shell, ExxonMobil, BP, Chevron, TotalEnergies, Sinopec, Lukoil, Indian Oil Corporation, FUCHS, and others. Competitive strategies focus on product differentiation, OEM approvals, sustainability initiatives, and digital integration.