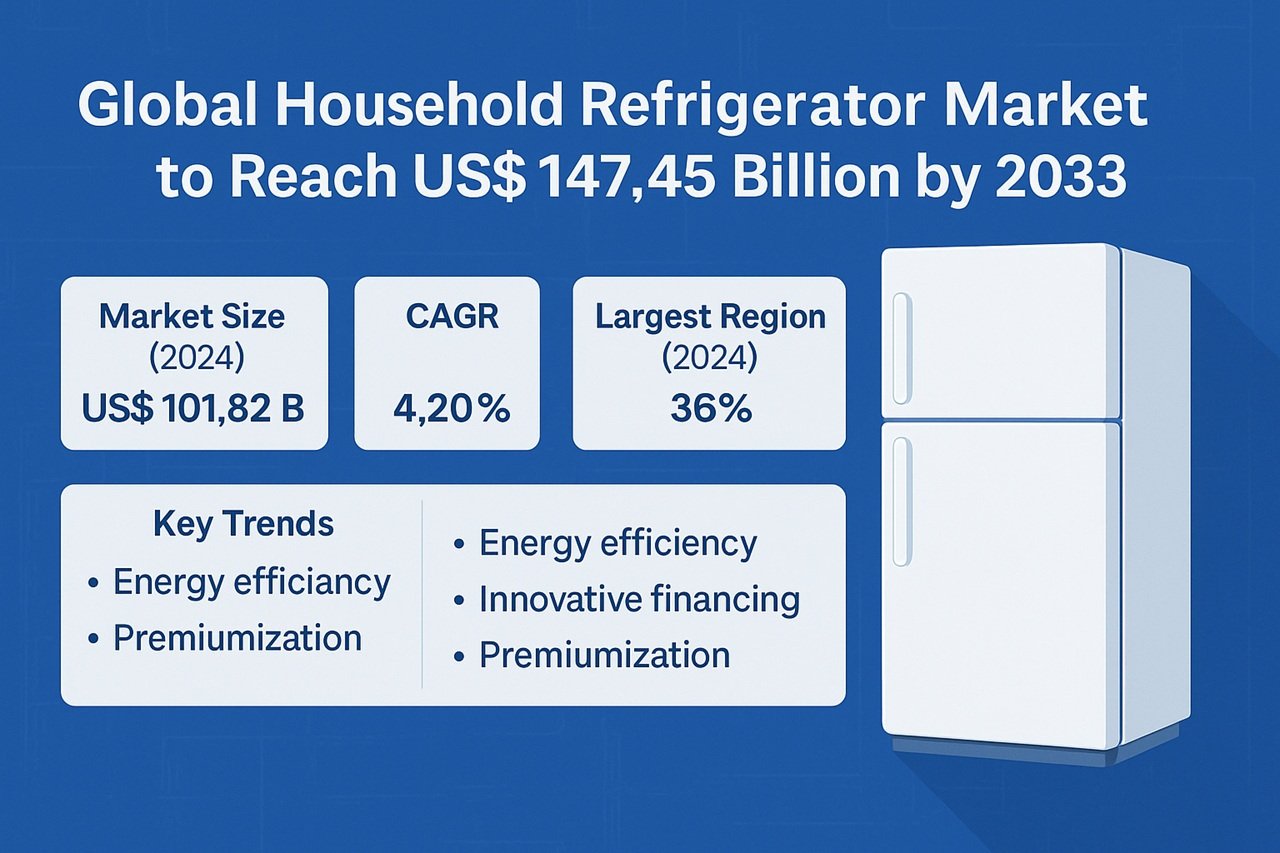

The global household refrigerators and freezers market is projected to grow from US$ 101.82 billion in 2024 to US$ 147.45 billion by 2033, according to Astute Analytica. This represents a compound annual growth rate (CAGR) of 4.20% over the forecast period.

The market is evolving in response to stricter energy efficiency regulations in regions such as California, South Korea, and the European Union, leading manufacturers to shift toward high-efficiency technologies. Chinese OEMs including Haier, Midea, and Hisense are expanding their use of variable-speed inverters and dual-evaporator systems. In 2024, global shipments of microcontroller-based smart compressors reached 48 million units.

Developing countries are shaping the market through voluntary energy labeling programs. In India, Whirlpool’s R&D center modified vacuum-insulated panels to meet Star-5 efficiency criteria. In Latin America, Electrolux is testing aerogel door gaskets. In 2024, online search filters for energy-saving models increased fivefold, indicating growing consumer awareness.

Access to refrigeration is expanding through innovative financing. Indonesia’s Akulaku partnered with Sharp for weekly payment models, and Mexico’s Kueski Pay integrated with Whirlpool to offer installment plans. In Kenya and Pakistan, pay-as-you-go and subsidized financing are enabling ownership among low-income households. Midea and Sun King offer modular or delayed-payment models tailored to local needs.

Premiumization is gaining traction globally as urban middle-class consumers seek advanced features and aesthetics. Shipments of side-by-side and multi-door units rose to 62 million in 2023. Brands like Samsung and LG are integrating AI, color-changing LEDs, and recipe platforms. In markets such as India and Mexico, financing options have made premium models more accessible.

In regions with unstable power supply, demand remains high for chest freezers. Nigeria imported 1.4 million deep-freezer units in 2023. Off-grid solutions are being deployed with solar-powered models and tropicalized compressors designed for harsh environments. Agencies like the UNDP are supporting freezer adoption for vaccine and food preservation.

Omni-channel strategies are becoming essential as consumers combine online research with in-store purchases. Direct-to-consumer platforms from Haier and JD.com are expanding rapidly, while traditional retailers like Best Buy focus on same-day services and haul-away options. Social commerce and mobile integration are influencing final purchase decisions.

Manufacturers are addressing supply chain constraints through regionalized production. Electrolux opened a coil plant in Mexico, while Haier and Hisense localized sourcing in Egypt and South Africa. Embraco licensed inverter-compressor production to Tata Power, reflecting a shift toward decentralized supply chains to reduce risk and improve compliance.

Environmental regulations are accelerating refrigerant innovation. R-600a is widely adopted for low-charge applications, and Europe is transitioning to R-290. Solid-state and magnetocaloric prototypes are under development, offering alternatives to traditional compressors. Liebherr and GE Appliances are exploring vacuum-insulated materials and magnetic cooling in new models.

Prominent market players include Whirlpool, Haier, LG Electronics, Samsung, Electrolux, Panasonic, Bosch, and others.

Read More