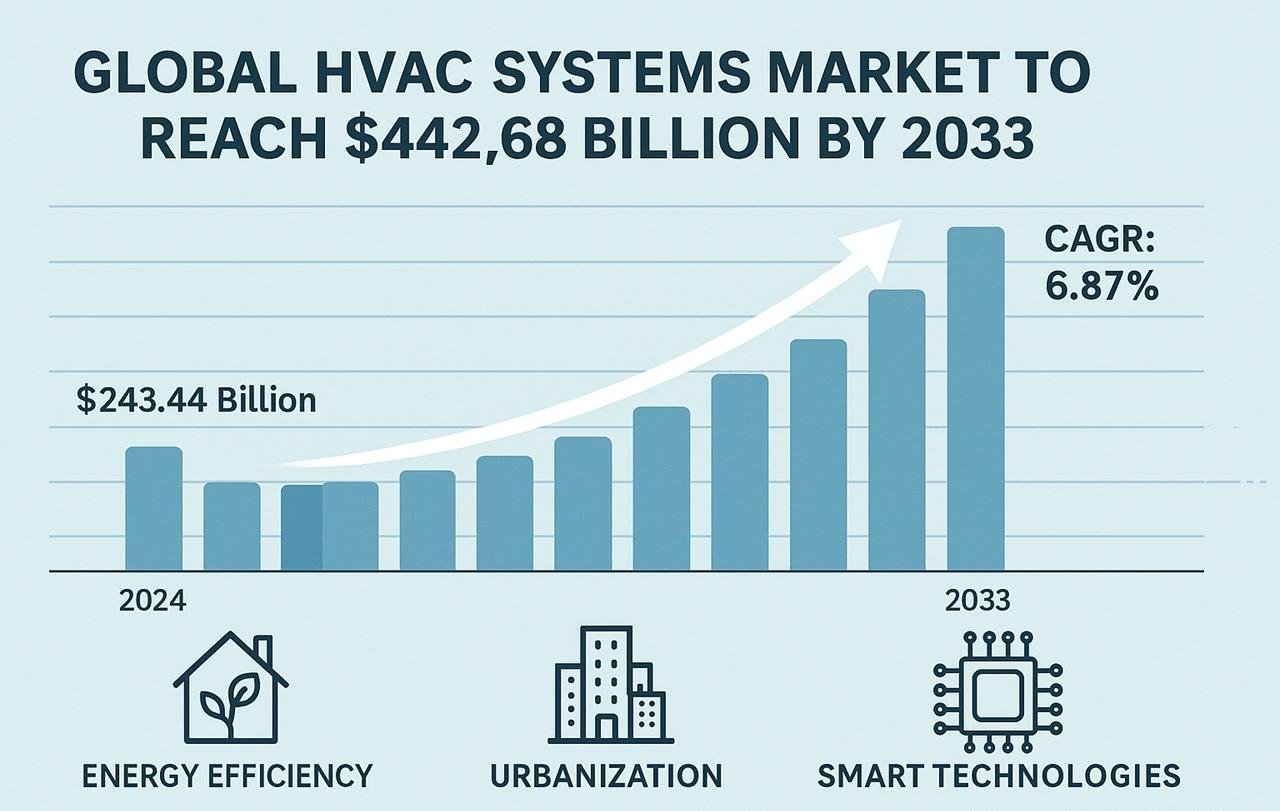

Global HVAC Systems Market to Reach $442.68 Billion by 2033

The global HVAC systems market is projected to grow from USD 243.44 billion in 2024 to USD 442.68 billion by 2033, at a compound annual growth rate (CAGR) of 6.87%, according to a new report by ResearchAndMarkets.com. This growth is driven by increasing urbanization, rising demand for energy-efficient climate control technologies, smart system advancements, and expanding construction activities in residential, commercial, and industrial sectors.

Demand for HVAC systems is increasing globally, particularly in North America, Europe, and Asia-Pacific, due to extreme seasonal temperatures and new infrastructure projects. The adoption of smart controls, IoT integration, and eco-friendly refrigerants is contributing to market growth through both system replacements and new installations.

Energy efficiency remains a key driver, with governments implementing stricter efficiency standards and offering incentives for green technologies. Manufacturers are responding by developing inverter-based systems, variable refrigerant flow (VRF) technologies, and IoT-enabled products. In February 2025, Mojave Energy Systems introduced ArctiDry HP, a liquid desiccant HVAC system with a reversible heat pump designed for year-round energy-efficient performance.

Urbanization and construction trends also support market expansion. With over 4 billion people currently living in cities—a figure expected to nearly double by 2050—the demand for advanced climate control in high-rise buildings, shopping centers, and industrial facilities continues to rise, especially in Asia-Pacific and the Middle East.

Technological innovation is reshaping the sector through the integration of AI, IoT, and predictive maintenance, enabling remote monitoring and performance optimization. In February 2025, Midea acquired ARBONIA Climate and merged it with its existing subsidiary Clivet to form MBT Climate. The new entity aims to expand localized HVAC solutions in Europe by combining ARBONIA's sustainable technologies with Midea's R&D capabilities.

However, challenges remain, including high installation and maintenance costs for advanced HVAC systems. These costs can be prohibitive in price-sensitive residential markets. Regulatory requirements on refrigerants and emissions, such as those outlined in the Kigali Amendment, also necessitate costly redesigns and compliance measures.

In the heating segment, demand is strong for energy-efficient furnaces, boilers, and heat pumps in colder climates, especially in Europe and North America. In the cooling segment, growing urbanization and rising temperatures are increasing demand for air conditioners, chillers, and cooling towers, particularly in Asia-Pacific, led by China and India. Adoption of inverter-based ACs and systems using green refrigerants is supporting this trend.

The report includes analysis of major global players such as Carrier Corporation, Daikin Industries Ltd., Fujitsu, Haier Group, Honeywell International Inc., Panasonic Corporation, LG Electronics, Lennox International Inc., Mitsubishi Electric Corporation, and Bosch Group.

Read More