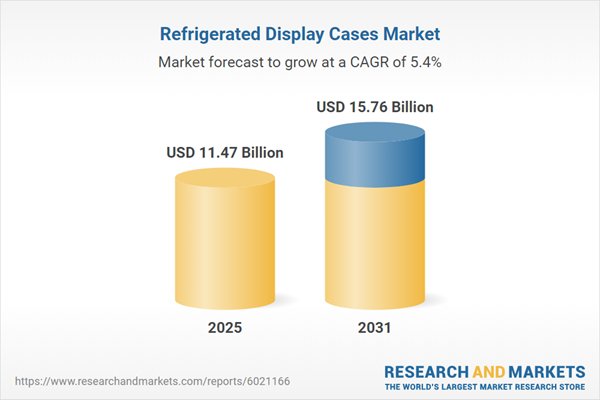

Global Refrigerated Display Cases Market to Reach USD 15.76 Billion by 2031

The global refrigerated display cases market is projected to grow from USD 11.47 billion in 2025 to USD 15.76 billion by 2031, registering a compound annual growth rate (CAGR) of 5.44%, according to a new report from Research and Markets.

This growth is primarily driven by the expansion of the grocery retail sector and rising consumer demand for fresh, frozen, and ready-to-eat products. Retailers are investing in advanced refrigeration infrastructure to ensure food safety and minimize waste. Data from FMI: The Food Industry Association shows that sales in the meat department increased by 4.7% in 2024, reaching USD 105 billion.

Environmental regulations present a major challenge for the market. Manufacturers and retailers face high costs as they transition from hydrofluorocarbon refrigerants to natural alternatives. The need to upgrade legacy systems to meet new energy efficiency mandates adds further financial pressure. FMI estimates that the grocery industry spent USD 5 billion in 2025 to comply with updated refrigerant regulations, reducing profitability by 22%.

The market is also influenced by changing consumer behavior. Demand for chilled and frozen convenience foods is prompting retailers to expand frozen food departments and adopt display units that offer greater storage density and temperature stability. The American Frozen Food Institute reported USD 74 billion in frozen food sales in 2024, supporting the trend toward multi-deck and island cabinet installations.

Innovation is also being driven by the adoption of eco-friendly refrigerants and digital monitoring technologies. Retailers are shifting to natural refrigerants like CO2 and propane to meet environmental standards. For example, ALDI transitioned to natural refrigerants in more than 600 stores as of August 2024. Epta S.p.A. reported a consolidated turnover of 1.4 billion euros in 2023, reflecting strong activity in sustainable refrigeration.

Technological advancements such as IoT-enabled monitoring systems are becoming standard, allowing real-time tracking of unit performance to reduce downtime and spoilage. Danfoss, in its 2024 annual report, highlighted the role of its Alsense IoT platform in supporting system reliability. The market is also seeing increased adoption of closed-door display models that help lower energy consumption and improve the shopping environment. Epta S.p.A. reported a turnover of 1.682 billion euros in 2024, citing demand for energy-efficient solutions as a growth factor.

Key companies profiled in the report include Frigoglass Services Single Member S.A., Epta S.p.A., True Manufacturing Co., Inc., Arneg S.p.A., Haier Group Corporation, Illinois Tool Works Inc., Fagor Industrial S. Coop, Hussmann Corporation, Daikin Industries, Ltd., and Zero Zone Incorporated.