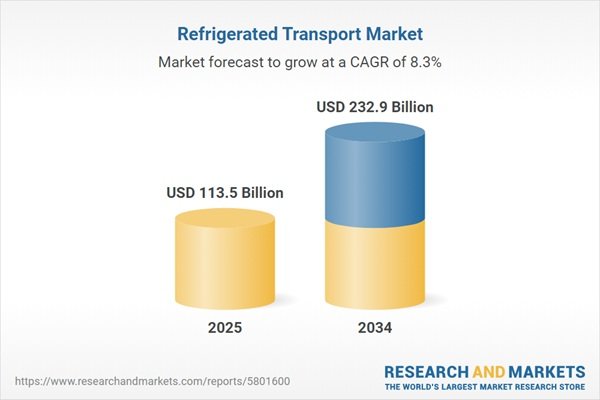

Global Refrigerated Transport Market to Reach USD 232.9 Billion by 2034

The global refrigerated transport market is projected to grow from USD 113.5 billion in 2025 to USD 232.9 billion by 2034, registering a compound annual growth rate (CAGR) of 8.3%, according to a new report from Research and Markets. The growth is driven by increased demand for temperature-sensitive goods and innovations in logistics technologies across multiple transport modes.

The refrigerated transport sector plays a critical role in moving perishable goods—such as fresh produce, dairy, meat, seafood, and pharmaceuticals—under temperature-controlled conditions across road, rail, sea, and air. Rising demand from the pharmaceutical industry, especially for biologics and vaccines, is further accelerating investments in cold chain infrastructure and transport.

Technological advancements are reshaping the industry, including the adoption of real-time monitoring systems, environmentally friendly refrigerants, and AI-based logistics tools. In 2024, electric refrigerated vehicles gained traction in last-mile deliveries, particularly in response to stricter emission mandates. The integration of telematics and IoT systems enabled operators to track cargo conditions and optimize maintenance.

Reefer containers equipped with smart sensors supported data-driven compliance in seaborne logistics, while modular and multi-compartment containers improved flexibility across transport modes. Retailers in e-commerce and quick commerce increasingly utilized refrigerated transport to meet fast delivery expectations.

Looking ahead, the market is expected to benefit from digitalization and sustainability trends. AI-driven platforms will enhance route optimization and fuel efficiency. The adoption of electric and hydrogen-powered refrigerated trucks is projected to expand, supported by government incentives and green financing. Demand for ultra-cold transport solutions is rising in line with pharmaceutical developments.

Key challenges remain, including high capital and operational costs for refrigerated fleets. Nonetheless, the market is expected to become more efficient and resilient, supported by greater cold chain transparency and traceability solutions, including blockchain.

The 150-page report includes insights across five global regions and 27 countries, as well as profiles of 28 leading companies, including Hyundai Motor Company, DB Schenker, Daikin Industries Ltd., and Ingersoll Rand.