Industrial HVAC Market size is set to grow by USD 7.00 billion from 2024-2028

The industrial HVAC market size is forecast to increase by USD 7.01 billion at a CAGR of 8.63% between 2023 and 2028. The market's growth is influenced by several factors, including the increasing demand for energy-efficient HVAC systems, the growing adoption of cleanrooms across industries, and stringent regulations governing the use of explosion-proof HVAC equipment in hazardous environments. Energy-efficient HVAC systems are sought after for their ability to reduce energy consumption and lower operating costs. The proliferation of cleanrooms in various sectors, such as pharmaceuticals and electronics, drives the need for specialized HVAC solutions to maintain strict environmental controls. Additionally, stringent regulations mandate the use of explosion-proof HVAC equipment in hazardous environments to ensure safety and compliance.

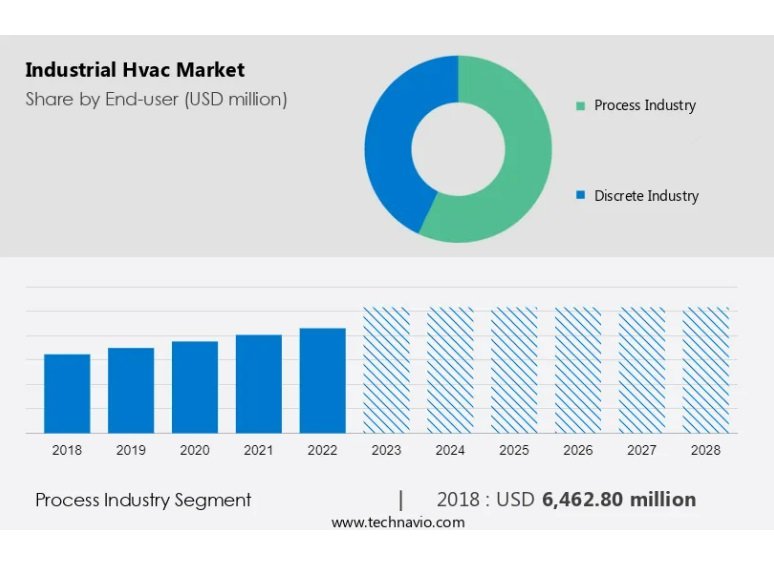

It also includes an in-depth analysis of market trends and analysis, market growth analysis and challenges. Furthermore, the report includes historic market data from 2018 - 2022.

Market Dynamic and Customer Landscape

The market is experiencing significant growth due to the rising demand for sustainable buildings in residential buildings, commercial buildings, and industrial buildings. Advanced climate control technologies are essential for ensuring thermal comfort and maintaining optimal indoor air quality. These systems are crucial for space cooling and heating applications in the commercial sector. The increasing need for affordable housing units and commercial infrastructure drives product demand. Components such as thermostats, dampers, condenser fans, compressors, and evaporators play pivotal roles in commercial HVAC systems, enhancing the building's interior and regulating indoor air and humidity levels. The market also benefits from improvements in domestic HVAC systems, contributing to a higher standard of living and reducing mortality rates. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing demand for energy-efficient HVAC systems is notably driving market growth. End-user industries are increasing their production volume to cater to the growing demand, which has augmented the need for energy-efficient equipment for different industrial processes. According to Technavio estimates, on average, almost 9% of the cost of production is spent on electricity in most industries. The increasing consumption of electricity in energy-intensive industries has propelled regulatory authorities to encourage the adoption of energy-efficient equipment.

Regulatory authorities across the world have implemented many stringent guidelines related to energy efficiency. According to the US Energy Information Administration (EIA) estimates, US residential consumers used about 3,802 terawatt-hours of electricity in 2020, of which 1.61 trillion kWh was consumed for heating, ventilation, air conditioning, and refrigeration (HVAC and R) applications, forming about 42% of the total energy consumption. These end-users persistently need to increase operational efficiency. This is encouraging process and discrete industries to shift from traditional HVAC systems to more energy-efficient ones.

In February 2022, Hitachi Air Conditioning India Ltd launched its range of energy-efficient and state-of-the-art air conditioning solutions for industrial and residential purposes. Thus, the growing demand for energy-efficient HVAC systems and the launch of new products by the vendors will drive the market in focus during the forecast period.

Major Market Trend

Increasing the use of renewable energy sources for HVAC systems is the primary trend in the market. The shift toward renewable energy sources is also gaining traction in the market. Strict environmental regulations will pave the way for the adoption of renewable sources. In the industrial sector, development is still in its nascent stage. The adoption of renewable sources is expected to be experienced in changing the energy mix for industrial heating, especially in Europe. Solar space heating is a method of using solar energy to reduce energy consumption for heating purposes. A solar space heating system works in conjunction with the existing building heating system, such as the oil or gas-fired heater, or independently to provide heated air for indoor space heating.

The use of solar space heating systems can enable end-users to cut down on heating fuel costs considerably. This hybrid system can also provide large-scale, cost-effective reductions in greenhouse gas emissions. The cost benefits that hybrid systems offer, in conjunction with the strict environmental regulations, will mold the market toward renewable energy sources, significantly impacting the market.

Significant Market Challenge

Environmental pollution due to HVAC systems is the major challenge impeding market growth. Pollution, especially air pollution, is a growing concern for the government in countries such as the US, China, and India. Pollution-related problems are encouraging the governments in these countries to launch various regulations to curb emissions. HVAC systems can cause air and noise pollution, which can have a negative impact on the environment. The use of HVAC systems is adding to the problem of air pollution as they release hazardous gases such as hydrochlorofluorocarbons and chlorofluorocarbons into the environment. These gases have a negative impact on the environment as they are greenhouse gases that trap heat and lead to the depletion of the earth's ozone layer.

Moreover, as global climate change is increasing the average global temperatures, the use of HVAC is also increasing, which is contributing to environmental pollution and climate change. HVAC systems consume a lot of electricity, which puts a strain on the power generation sector. It also leads to more pollution, as many countries use coal for electricity generation. In addition, electricity generators are used in many places that face fluctuations in the power supply or frequent power outages, which leads to the release of carbon monoxide and other hazardous gases into the atmosphere, thus resulting in air pollution. Hence, an increase in air pollution levels because of HVAC systems can hinder the growth of the market during the forecast period.

Key Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Robert Bosch GmbH - The company offers industrial HVAC such as Solar thermal heating systems, Ventilation, and air conditioning systems, and Intrusion alarm systems.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Alfa Laval AB

- Carrier Global Corp.

- Daikin Industries Ltd.

- Emerson Electric Co.

- Furukawa Electric Co. Ltd.

- Hitachi Ltd.

- Honeywell International Inc.

- Ingersoll Rand Inc.

- Johnson Controls International Plc.

- Lennox International Inc.

- LG Electronics Inc.

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Shield Air Solutions Inc.

- Specific Systems LLC

- Stryker Corp.

- WHESCO Group Inc.