Industrial Refrigeration Market Grows with Applications in Food, Pharma, and Cold Chain

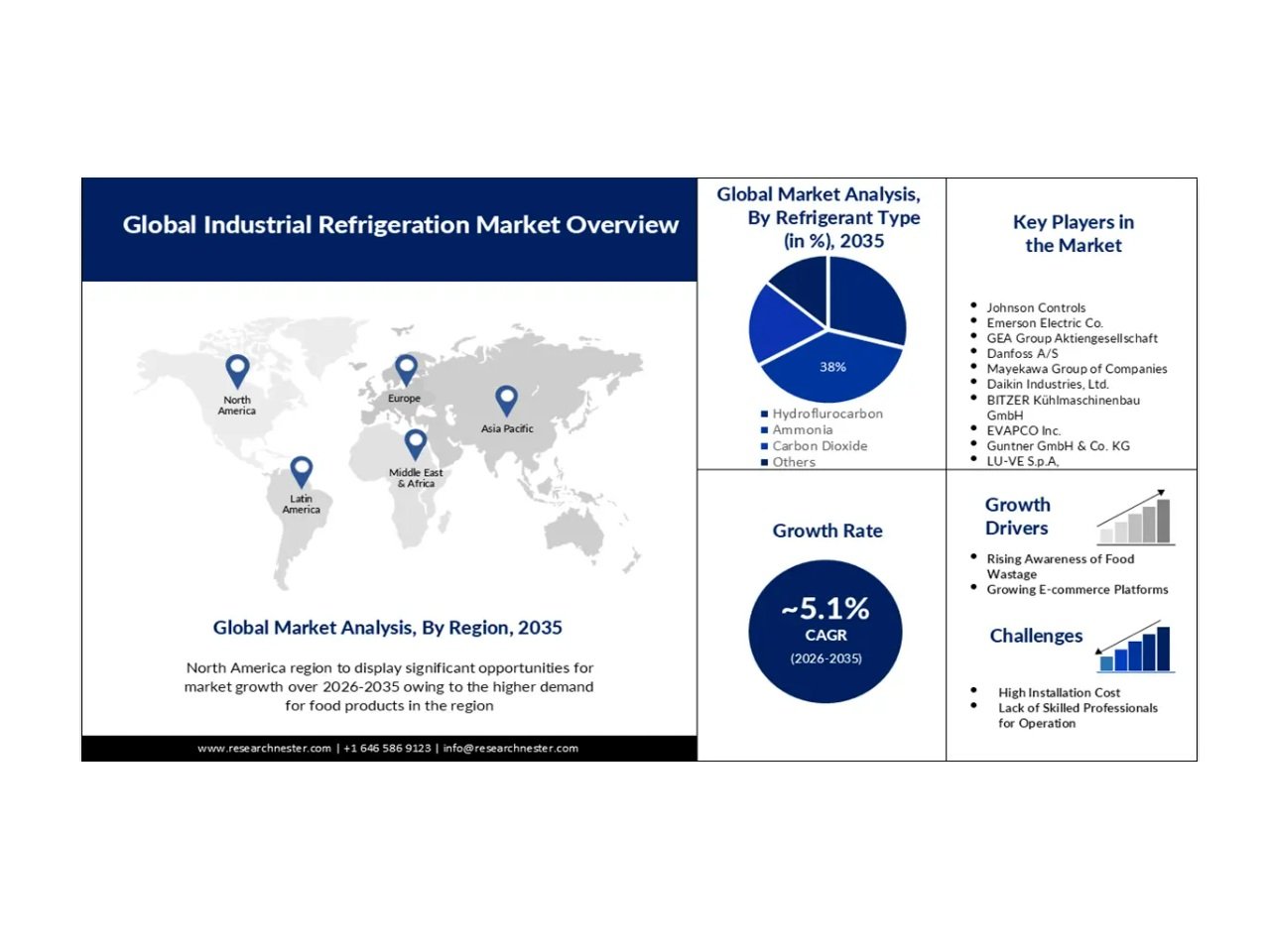

The global industrial refrigeration market reached USD 23.18 billion in 2024 and is projected to grow to USD 44.25 billion by 2037, with a compound annual growth rate (CAGR) of 5.1%. Growth is driven by increasing demand for cold chain infrastructure, a rise in perishable goods production, and a global focus on energy-efficient refrigeration systems.

Industrial refrigeration systems are widely used across multiple industries. In the chemical and petrochemical sectors, these systems support operations such as gas sweetening, liquefaction, flare gas recovery, and boil-off gas handling. In 2023, global petrochemical production capacity was approximately 2.41 billion metric tons, prompting increased adoption of refrigeration technology to boost plant efficiency.

The pharmaceutical industry also significantly relies on industrial refrigeration. According to the World Health Organization (WHO), up to 50% of vaccines are wasted annually, highlighting the importance of controlled temperature storage. Refrigeration systems are used across several temperature ranges — from room temperature (20–25°C) to ultra-low storage (-70 to -40°C) — to store products such as insulin and typhoid vaccines. These applications help reduce microbial growth and maintain the chemical stability of sensitive medications.

In the food sector, industrial refrigeration plays a critical role in preserving meat and fruits. Research Nester reported that 350 million metric tons of meat were produced globally in 2023. Refrigeration is used at slaughterhouses, in packaging areas, and during distribution, with storage temperatures reaching -30°C to maintain freshness. For fruit, refrigeration slows ripening and reduces spoilage, while smart technologies and natural refrigerants help lower energy consumption.

Cold storage demand is increasing, particularly in the Asia Pacific region. Government initiatives support the development of infrastructure in countries such as India (394 lakh metric tons capacity), Japan (37 million m³), and China (0.13 m³ per capita). Common refrigerants include CO2, ammonia, and HFC/HFO blends. A report from the European Fluorocarbon Technical Committee notes that 13% of global food loss is due to lack of refrigeration and that improved cold chains could feed 950 million people annually.

Refrigerated transport also supports logistics for sensitive goods. These vehicles help preserve pharmaceuticals, food, and flowers while offering improved shipping rates and expanded market reach.

Key market players include Johnson Controls, Ingersoll Rand, United Technologies Corporation, GEA, Daikin Industries Ltd, Emerson, EVAPCO Inc, Bitzer, Frick India Limited, Dorin, Industrial Frigo SRL, and M&M Systems Inc. In July 2023, Advansor introduced two new CO2-based systems — Low Superheat and Value Pack Light — designed to enhance energy efficiency in food retail refrigeration.

Despite the market's potential, high initial installation costs and fluctuating refrigerant prices remain challenges. Nonetheless, the increasing need for food preservation and growing demand for frozen and ready-to-eat products continue to propel market expansion.