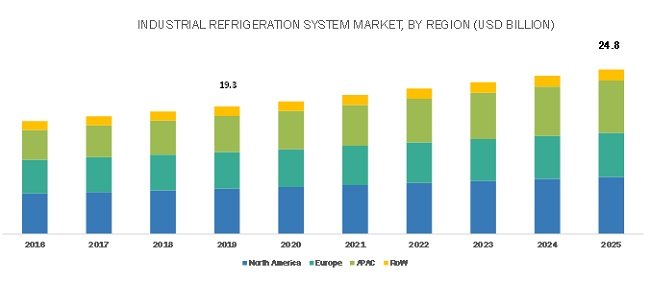

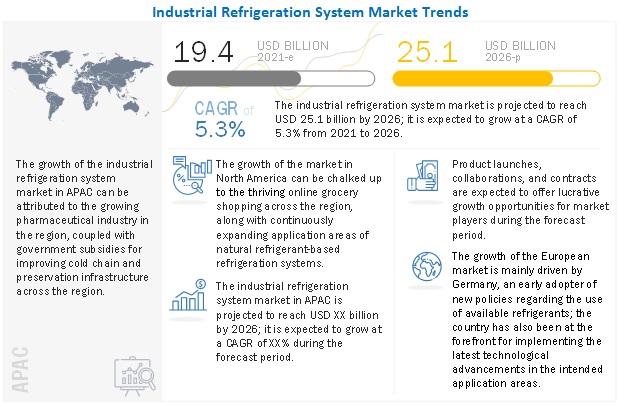

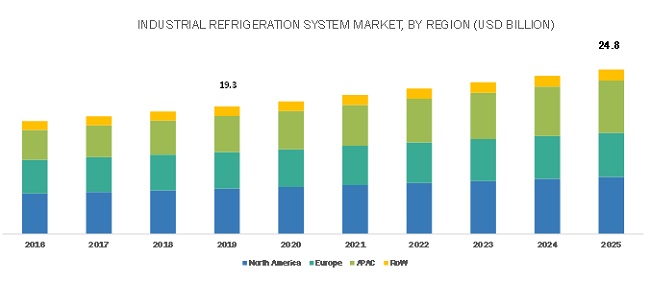

The global industrial refrigeration system market is expected to grow from USD 19.3 billion in 2019 to USD 24.8 billion by 2025, at a CAGR of 4.3%. The rising demand for innovative and compact refrigeration systems is one of the key factors driving the growth of the market. The increasing government support to strengthen the cold chain infrastructure in developing countries, along with the growing adoption of natural refrigerant-based systems due to stringent regulatory policies, is the other factor driving the market growth.

Compressors to dominate global industrial refrigeration system market during forecast period

Compressors are expected to hold a majority of the global industrial refrigeration system market share in 2019, and the segment is projected to dominate the market during the forecast period. In industrial refrigeration systems, compressors play a vital role by increasing refrigerant vapor pressure in a condenser to ensure suitable temperature for food storage and preservation applications, thereby propelling the refrigerant compressor market growth. The increasing focus of companies to develop new compressors to meet the diverse needs of customers is expected to drive its market during the forecast period.

Ammonia refrigerant-based systems to dominate industrial refrigeration system market during forecast period

Ammonia has a higher cooling capacity than other refrigerants; hence, ammonia-based refrigeration systems are more energy-efficient than those based on other refrigerants. Further, ammonia-based refrigeration systems are less expensive as ammonia is readily available at a low cost, thereby reducing the maintenance and service costs compared to Freon refrigeration systems. Moreover, rising trends of low-charge ammonia refrigeration systems will provide growth opportunities for ammonia-based refrigeration systems during the forecast period.

Refrigerated warehouse application to dominate industrial refrigeration system market during 2019–2025

The refrigerated warehouse application is expected to dominate the industrial refrigeration system market during the forecast period. The rising population and growing disposable income have resulted in an increased demand for frozen and processed food. This growing demand for convenience products has increased the number of refrigerated warehouses globally, with improved capacity in the last few years. Also, various governments in developing countries such as India and China are promoting the creation of cold chain facilities through various schemes and by providing various subsidies. These initiatives toward strengthening cold storage and warehousing infrastructure facilities in developing countries are expected to support the growing use of industrial refrigeration systems in refrigerated warehouse applications during the forecast period.

North America is expected to dominate industrial refrigeration system market during forecast period

North America is likely to continue to lead the global industrial refrigeration system market during 2019–2025. The rising demand for medicines, fresh food products, and beverages, as well as government initiatives to phase out HCFCs and adopt natural refrigerants in various refrigeration applications, is expected to propel the demand for industrial refrigeration systems in North America.

The US is expected to hold the largest market share and is likely to witness the highest CAGR in the industrial refrigeration system market during 2019–2025. The rising trend of online grocery shopping in the country is expected to increase the demand for refrigerated warehouses, which, in turn, will drive the industrial refrigeration system market in the US.

Key Market Players

Major companies in the industrial refrigeration system market are Johnson Controls (Ireland), Emerson (US), Danfoss (Denmark), GEA (Germany), Mayekawa (Japan), Ingersoll-Rand (Ireland), Daikin (Japan), BITZER (Germany), United Technologies (US), Evapco (US), Baltimore Aircoil (US), Güntner (Germany), LU-VE (Italy), Lennox International (US), Star Refrigeration (Scotland), KOBELCO (Japan), Parker Hannifin (US), Clauger (France), Rivacold (Italy), and Dorin (Italy).

Johnson Controls is among the important players for CO2/NH3 refrigeration systems and seeks opportunities in the cascade refrigeration system market. The company’s efforts to offer advanced products in the industrial refrigeration market would provide it a competitive edge. In the past 3 years, the company is demonstrating the execution of organic growth and free cash flow generation in the Building Technologies and Solutions business segment; it is building a more resilient business that is expected to generate multiple expansions over time. In November 2018, the company announced the sale of its Power Solutions business segment. This divestment, although dilutive in the near term, is expected to increase the flexibility to pursue acquisitions within the Building Technologies and Solutions business segment that could catalyze the growth of the company.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year |

2018 |

|

Forecast period |

2019–2025 |

|

Units |

Value (USD) |

|

Segments covered |

Component, Refrigerant Type, and Application |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Johnson Controls (Ireland), Emerson (US), Danfoss (Denmark), GEA (Germany), Mayekawa (Japan), Ingersoll-Rand (Ireland), Daikin (Japan), BITZER (Germany), United Technologies (US), Evapco (US), Baltimore Aircoil (US), Güntner (Germany), LU-VE (Italy), Lennox International (US), Star Refrigeration (Scotland), KOBELCO (Japan), Parker Hannifin (US), Clauger (France), Rivacold (Italy), and Dorin (Italy) A total of 20 players are covered. |

This report categorizes the industrial refrigeration system market based on component, refrigerant type, application, and region.

Industrial Refrigeration System Market, by Component:

- Compressors

- Condensers

- Evaporators

- Controls

- Vessels, Pumps, Valves, and Auxiliary Equipment

Industrial Refrigeration System Market, by Refrigerant Type:

- Ammonia

- Carbon Dioxide

- Others (HFCs, HCFCs, HCs, HFOs)

Industrial Refrigeration System Market, by Application:

- Refrigerated Warehouse

- Fruit & Vegetable Processing

- Beverage

- Meat, Poultry, & Fish Processing

- Dairy and Ice-cream Processing

- Chemical, Petrochemical, & Pharmaceutical

- Refrigerated Transportation

Industrial Refrigeration System Market, by Region:

- North America

- US

- Mexico

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- APAC

- China

- India

- Japan

- Rest of APAC

- RoW

- Middle East & Africa

- South America