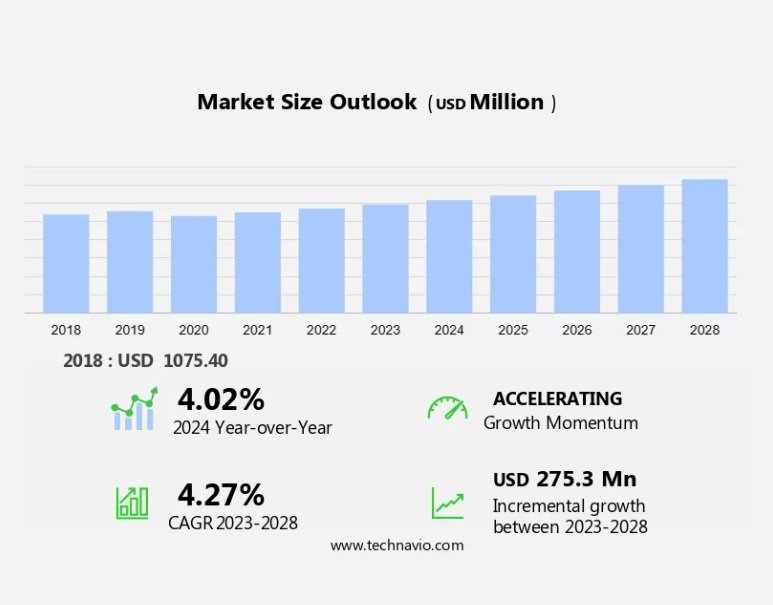

Market Dynamics

The market is experiencing significant growth due to the increasing demand for energy efficiency and process optimization in various industries. These play a crucial role in maintaining optimal temperature levels in industrial processes, ensuring efficient energy consumption and product quality. They are designed to automatically regulate temperature by responding to changes in temperature, making them an essential component in industries such as Chemical, Pharmaceutical, Food and Beverage, and Oil and Gas. The market is driven by factors such as rising energy costs, stringent regulations, and the need for improved process control. The market is expected to grow at a steady pace in the coming years, with key players focusing on innovation, product development, and expansion into emerging markets. The use of advanced materials and technologies in the production is also contributing to their growing popularity. Overall, the market is poised for continued growth, driven by the need for efficient and effective temperature control solutions in various industries.

Key Driver - Growing power generation activities in APAC

The power generation plants are substantially growing in APAC due to aggressive government investment and rising urbanization. The market in APAC is experiencing significant growth due to increasing investments in automation across the manufacturing sector. With a focus on operational efficiencies and reducing losses, suppliers are prioritizing the development and implementation of advanced control valve technologies. These modern ones ensure consistent liquid level maintenance and precise pressure differential control, minimizing malfunction, periodic overhaul and leak detection. Manufacturers are investing in periodic overhauls to integrate new automation technologies, such as OPAF and decarbonization efforts, into their work processes. The economic benefits of these innovations include increased performance, cross-industry initiatives, and the reduction of unnecessary costs and inefficiencies. The density and concentration of industrial applications call for high-performing valve bodies that can withstand pressure differentials and maintain optimal temperature control. As the market evolves, suppliers are focusing on developing modules that cater to various industries and applications, ensuring cost-effective and complex automation solutions for future success. Consequently, the market will be driven by the growth of the power industry through the increased deployment of smart grid technology in the region, propelling the growth of the market in focus during the forecast period.

Major Trends - Emerging demand for smart valves

Diagnostics and smart technology are the two emerging concepts that can significantly contribute to the growth of the industrial thermostatic market. The market is experiencing significant growth due to the integration of diagnostics and smart technology. These advanced ones monitor various process parameters, including liquid level, pressure differential, and temperature, enabling operational efficiencies and reducing losses. Suppliers of valve bodies leverage automation technologies to facilitate real-time data transfer for diagnostics, control instructions, and documentation. Smart ones play a crucial role in detecting malfunctions and leaks, minimizing the need for periodic overhauls and reducing manpower requirements. New technologies, such as OPAF (Online Process Analyzer and Filter), are being implemented to enhance performance and contribute to cross-industry initiatives, including decarbonization efforts. The economic benefits of smart variants include reducing unnecessary costs and inefficiencies through innovative approaches to work processes. Modern technologies, such as modules for pressure differential and concentration measurement, are essential for maintaining optimal performance and ensuring compliance with industry standards. Despite the advantages, the implementation of these advanced valves may come with a higher cost and complexity. However, the long-term economic benefits and future success of industrial processes justify the investment.

Furthermore, because sensors are directly employed on the valves, process systems with smart valves are less prone to leaking than the normal valves that contain separate valves and sensors. While controlling emissions has become a concern in recent times, these advanced valves are likely to see growth of the market in focus during the forecast period.

Significant Challenge - High market dependence on the oil and gas industry

The decline in global crude oil prices since 2020 has severely affected the market, primarily in the oil and gas industry. The US has witnessed overproduction of shale gas and crude oil to a record high, while the Middle East has not reduced its oil and gas output because of the fear of losing market share. They use dense and concentration-resistant materials, such as stainless steel, hardened steel, cast iron, brass, bronze, and aluminum, in their manufacture. These materials, with their high melting points and ruggedness, are essential for meeting the demanding environmental requirements of various end-user applications. However, the cost instability of these raw materials in the international market poses a significant challenge for small and medium-sized manufacturers. Suppliers play a crucial role in maintaining operational efficiencies by ensuring consistent valve body specifications and managing pressure differentials. Malfunctions and leaks can lead to losses and necessitate periodic overhauls, which can be costly and complex. New technologies and automation technologies offer economic benefits and future success by improving performance and reducing unnecessary costs and inefficiencies. Cross-industry initiatives, such as OPAF, and decarbonization efforts are driving the implementation of modern technologies and innovative approaches. Modules, such as leak detection and decarbonization, are essential components of these advanced systems.

Moreover, the majority of the revenue when global oil and gas prices are low will result from thermostatic control valve retrofitting activities in the oil and gas industry. These mentioned factors will hamper the growth of the market in focus during the forecast period.

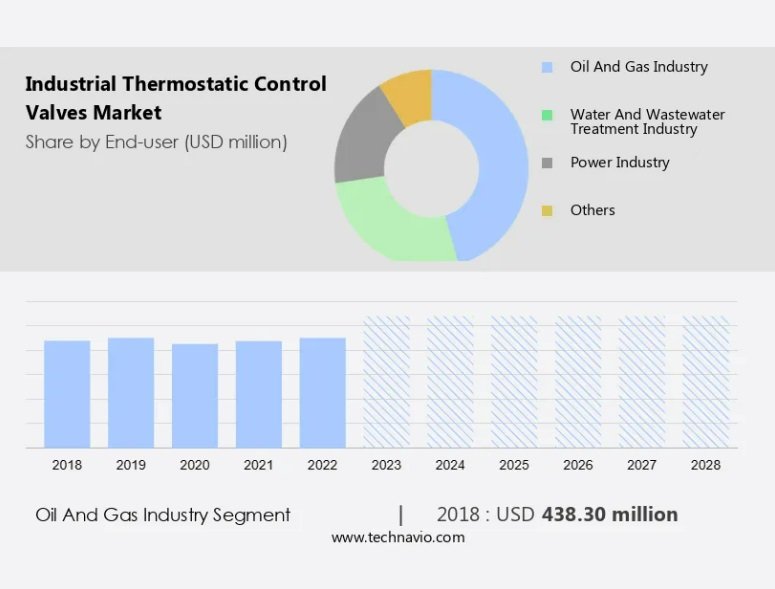

Market Segmentation

This report extensively covers market segmentation by end-user (oil and gas industry, water and wastewater treatment industry, power industry, and others), type (pneumatic thermostatic control and electric thermostatic control ), and geography (APAC, Europe, North America, Middle East and Africa, and South America). It also includes an in-depth analysis of drivers, trends, and challenges. The Valves market is a significant segment in the automation industry, with a growing demand for precise temperature control systems in various applications. These valves are essential components in power generation, oil and gas, chemical, and other process industries. They are designed to maintain consistent temperatures in industrial processes, ensuring optimal performance and energy efficiency. Control Valves come in various types, including bimetallic, thermocouple, and resistance temperature detectors.

The choice of valve type depends on the specific application requirements, such as temperature range, process media, and pressure conditions. The market is driven by factors such as increasing industrialization, growing demand for energy efficiency, and stringent regulations for process safety. The market is also witnessing technological advancements, including the development of smart valves with digital communication capabilities and self-diagnostic functions. The market is highly competitive, with key players including Emerson Electric Co., Honeywell International Inc., Schneider Electric SE, and Siemens AG. In conclusion, the market is a critical segment in the automation industry, driven by the need for precise temperature control in various applications. The market is expected to grow significantly in the coming years, driven by factors such as increasing industrialization, growing demand for energy efficiency, and technological advancements.

End-user Segment Analysis

The market share growth by the oil and gas industry segment will be significant during the forecast period. The market plays a crucial role in oil and gas production, managing complex operations such as drilling and mud pumps. However, the 50% drop in crude oil prices in 2020 led to significant industry downsizing and financial strain for producers. This context pertains to the density and concentration of thermostatic control valves in oil and gas plants, their role in maintaining liquid level and pressure differential, and the subsequent impact on operational efficiencies and losses. A large number are employed in oil and gas plants to accommodate complex operations, such as draw works, drilling, service rigs, mooring, and mud pumps for oil explorations.

The oil and gas industry segment was valued at USD 438.30 million in 2018. Suppliers of valve bodies have faced challenges due to malfunctions and leaks, necessitating periodic overhauls. New technologies and automation have emerged as innovative approaches to implementation, offering economic benefits and future success. Unnecessary costs and inefficiencies have become a focus, with cross-industry initiatives and OPAF promoting decarbonization efforts and modular designs. Pressure differential and performance are key considerations, with leak detection and work processes essential for maintaining operational efficiencies. Economic benefits and future success hinge on addressing these challenges through modern technologies and cost-effective work processes. Leakage and spilling of harmful and toxic substances are being curbed to prevent detrimental effects on human life and the environment. These norms and directives are driving the demand during the forecast period.

Type Segment Analysis

The Control Valves market, specifically the segment for Pneumatic Thermostatic Control Valves, plays a significant role in Fluid Power Energy applications. Key players in this sector include Metrex Valve, AMOT, and Dwyer Instruments. Sales and production of these valves are driven by industries requiring precise temperature regulation, such as HVAC systems, industrial operations, and heating and cooling systems in the Chemicals industry and safety applications. Pneumatic Thermostatic Control Valves operate by utilizing compressed air to regulate liquid flow based on temperature sensed by the thermostat. They are widely used in Nuclear power plants, LNG processing, and fossil power plants for process automation and media flow control. Constraints in the market include inflation and demand for energy efficiency. The largest market share is held by rotary valves due to their ability to handle large flow rates and precise set point control. The Control Valves market is experiencing investment activity due to energy transition initiatives, focusing on energy security and R&D activities. Product parameters include flow rate, pressure, and temperature control, with Watts as a key energy consumption factor. Sales are influenced by system requirements, sanitation regulations, and industrial equipment outbreaks.

Regional Analysis

APAC is estimated to contribute 45% to the growth by 2028. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period.Metrex Valve, AMOT, Dwyer Instruments, and others are key players. Inflation and constraints impact sales and production. Nuclear power plants and the chemicals industry drive demand for valves, including control valves and rotary valves, in process automation and safety applications. Media flow, process variable, set point, flow rate, pressure, and temperature are crucial product parameters. R&D activities and energy transition initiatives, such as investment in LNG and fossil power, contribute to the largest market share. Demand for energy security and sanitation also influences the market. Watts, the Control Valves market leader, focuses on connected networks and system safety.

Moreover, as manufacturers are entering the price-sensitive APAC market, they need to focus on heightening the processes without compromising the quality of the product. APAC is enduringly seeing rising investment in the power industry, as developing countries in APAC, such as Indonesia, India, and Vietnam, among others, are witnessing rapid industrialization and urbanization. In addition, the population in this region is increasing at a greater rate when compared with the developed countries. Such factors are expected to drive market growth in the region during the forecast period.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

Albert Richter GmbH and Co. KG, AMOT Controls Corp., Armstrong International Inc., BOLA spol s.r.o., Cole Parmer, Danfoss AS, Dover Corp., Dwyer Instruments Inc., Fluid Power Energy, Fushiman Co. Ltd., Honeywell International Inc., Huegli Tech AG LTD., Metrex Valve Corp., Micromax Pty Ltd., Relevant Solutions LLC, Reliance Worldwide Corp. Ltd., ThermOmegaTech Inc., Thermoreg International Ltd., Watts Water Technologies Inc., and ZIMCO Instrumentation Inc.