Refrigerated Transportation Market size is set to grow by USD 39.15 billion from 2024-2028

Refrigerated Transportation Market Dynamics

The market is essential for temperature-controlled logistics, ensuring the safe delivery of temperature-sensitive cargo. Key components include cold chain transportation methods such as refrigerated trucks, reefer trucks, reefer containers, and refrigerated rail transport. This market is vital for perishable goods logistics, including fresh food logistics, seafood transportation, and the pharmaceutical cold chain within healthcare logistics. Innovations in transport refrigeration and refrigerated transport solutions address refrigerated transport challenges and improve cold chain logistics optimization. Adherence to refrigerated transport regulations and refrigerated transport standards is crucial. Continuous advancements in refrigerated transport innovations are driving efficiency in chilled transportation, frozen transportation, and refrigerated shipping. Our researchers studied the data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market.

Key Refrigerated Transportation Market Driver

The rising consumption of frozen food is the key driver for the growth of the market. Owing to the rising consumption of refrigerated foods such as dairy products and frozen foods the market is growing. The sales of frozen foods are rising because of the convenience they offer consumers in terms of easy and instant cooking.

Moreover, consumers perceive frozen food as an alternative option to fresh, home-cooked, and canned food. The convenience offered by ready-to-eat meals increases the consumption of frozen food. Factors such as busy lifestyles are attracting consumers to opt for frozen food. Furthermore, rapid urbanization is also driving the growth of the market. Therefore, the demand for frozen food, coupled with efficient Refrigerated Road Transportation, will drive the market during the forecast period. Refrigerated road transportation plays a crucial role in maintaining the quality and safety of frozen food products during transit, ensuring they reach consumers in optimal condition. This logistical support enables suppliers and retailers to meet the increasing consumer demand for frozen food products efficiently, contributing to market expansion amidst evolving consumption patterns and urban development trends.

Major Refrigerated Transportation Market Trends

Electrified trailer technologies is the primary trend in the market. Temperature-controlled trailers mostly depend upon dedicated diesel engines, but attraction toward increased efficiency and sustainability has resulted in the prevalence of solutions such as electrification, including hybridization, solar power, and optimizing of the incumbent technology. Carrier Transicold is a recently launched solution by the UK, the first fully autonomous, all-electric engineless trailer system.

Furthermore, electrified trailer technologies not only reduce emissions but also reduce noise pollution. For example, the operating noise of an eCool-equipped, refrigerated trailer is below 60 dB. Electrification technologies are capable of refrigerated van applications suitable for supermarket home deliveries to multi-wheel tractor units. In addition, in 2020, Tesco PLC added 30 new zero-emission electric vans with the new Thermo King E-200 refrigeration units to its fleet. Such factors are expected to increase the adoption of refrigeration transportation which will drive refrigerated transportation market growth during the forecast period.

Significant Refrigerated Transportation Market Challenge

Rising fuel costs and energy consumption associated with refrigeration systems is the major challenge for the market. Owing to rising fuel prices and energy consumption, the market faces significant challenges Energy-intensive refrigeration systems are needed to maintain perishable items at an appropriate temperature while transported. The rising cost of electricity and fuel directly affects operational costs, which reduces profit margins for companies.

Furthermore, a factor that affects the environment is increased energy use raises additional issues. To reduce energy usage and lower the carbon footprint of these operations, companies are concentrating on energy-efficient technology, alternative fuels, and enhanced insulation materials to overcome this challenge. Hence, increasing fuel costs and energy consumption associated with refrigeration systems is a significant challenge that can hinder the growth of the market during the forecast period.

Refrigerated Transportation Market Segmentation

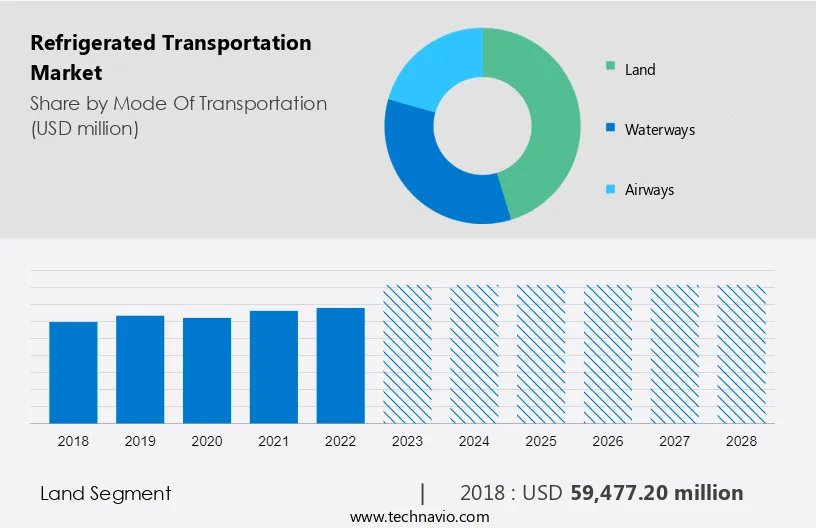

By Mode of Transportation

The land segment will account for a major share of the market's growth during the forecast period. Land transportation is widely used for carrying perishable commodities such as food and medications under temperature control. Refrigerated trucks and trailers ensure the freshness of products while transporting them. The factors such as adaptability, accessibility, and dependability enable direct delivery from manufacturing facilities to distribution centers or retail locations.

The land segment was valued at USD 59.47 billion. in 2018. Land-based refrigerated transportation continues to be an essential component in the global supply chain for perishable products. For instance, players like Knight-Swift Transportation to offer refrigerated transportation through the land are investing significantly. Such factors are expected to make the land a preferred mode of transportation for refrigerated transportation, which, in turn, is expected to drive the growth of the market in focus during the forecast period.

By Application

Based on application, the market has been segmented into chilled food and frozen food. The chilled food segment will account for the largest share of this segment. Fruits and vegetables are kept at a fixed temperature to retain freshness. The critical requirements for chilled food products are good quality and microbiological safety at the point of consumption. The ready-to-eat meals offer convenience which encourages consumers to chilled food consumption. However, due to the utilization of refrigerated shipping to preserve quality and freshness, buyers have to pay higher prices. Hence, such factors will increase the adoption in chilled food transportation applications, which is expected to drive the growth of the market during the forecast period.

By Region

North America is estimated to contribute 39% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. Factors such as expanding food and pharmaceutical industries driving this growth, as is the rising demand for temperature-controlled shipping services. China, India, Japan, South Korea, and Australia are among the APAC countries that are increasing in the construction of cold chain infrastructure and technological improvements. Major manufacturers in the region such as Carrier and Daikin are working on several factors such as boosting their fleet sizes, increasing energy efficiency, and enhancing the visibility and tracking capabilities of the cold chain. Owing to all these factors, refrigerated transportation market demand is set to grow during the forecast period.Company Overview

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

- Allen Lund Co.

- Bernard KRONE Holding SE and Co. KG

- Carrier Global Corp.

- Daikin Industries Ltd.

- Envirotainer AB

- Great Dane LLC

- Hapag Lloyd AG

- Hyundai Motor Co.

- Knight Swift Transportation Holdings Inc.

- LAMBERET SAS

- Rinac India Ltd.

- Sartorius AG

- Schmitz Cargobull AG

- Sdiptech AB

- Singamas Container Holdings Ltd.

- Tata Motors Ltd.

- Utility Trailer Manufacturing Co.

- Wabash National Corp.