Taiwan Data Center Market size will witness investments of USD 4.47 billion by 2026, growing at a CAGR of 23.60% during 2021-2026

The Taiwan Data Center Market Research Report Includes Size in Terms of Investment, Area, Power Capacity, and Colocation Revenues. Get Insights on 11 Existing data centers and 1 Upcoming Facility Spread across 4 Cities Including Taipei and Other Cities (Taichung, Tainan, and Taoyuan).

Taiwan Data Center Market Insights

- Taiwan is one of the major connectivity hubs in secondary APAC markets. Over USD 1 billion will be invested in data center development across Taiwan during 2021-2026.

- In Taiwan, Taipei city and New Taipei city are favorable locations for the development of data center facilities, as they are the most connected locations and the economic hubs in Taiwan. Locations such as Taichung city and Kaohsiung city are upcoming data center hubs that expect to grow during the forecast period

- Chief Telecom, Chunghwa Telecom, Taiwan Power Company, and hyperscale operator Microsoft have planned data center projects in Taiwan. They are expected to be operational in the forecast period.

- Many companies, especially those in the BSFI and government sector, have deployed on-premises data centers in the country. For instance, the Taipei city government has collaborated with Amazon Web Services (AWS) and seven local universities to promote cloud-based Big Data in the education sector.

- In March 2021, TECO Electric & Machinery signed an MoU with Chunghwa Telecom and Microsoft to develop Industry 4.0 in Taiwan.

- A majority of opened and under development projects across the country fall under the Tier III category with new data centers with minimum N+1 redundancy.

Key Highlights Of The Report

- In May 2021, a telecom operator, Chief Telecom, announced its plans to build a fourth data center facility (LY2) in Taipei, which is expected to be operational by 2023.

- Hyperscale operators in Taiwan are developing their own data centers and collocating their workloads with local colocation operators. For instance, Microsoft is building its own data center in the country, which is expected to be operational by 2022.

- The 42U rack cabinets are likely to dominate the Taiwan market in the forecast period. 45U-47U rack cabinets will also witness increased adoption.

- The availability of skilled professionals at a low cost is a major driver for the rise of the ICT industry in Taiwan. The availability of a strong and smart supply chain also fuels the growth of the Taiwan data center market.

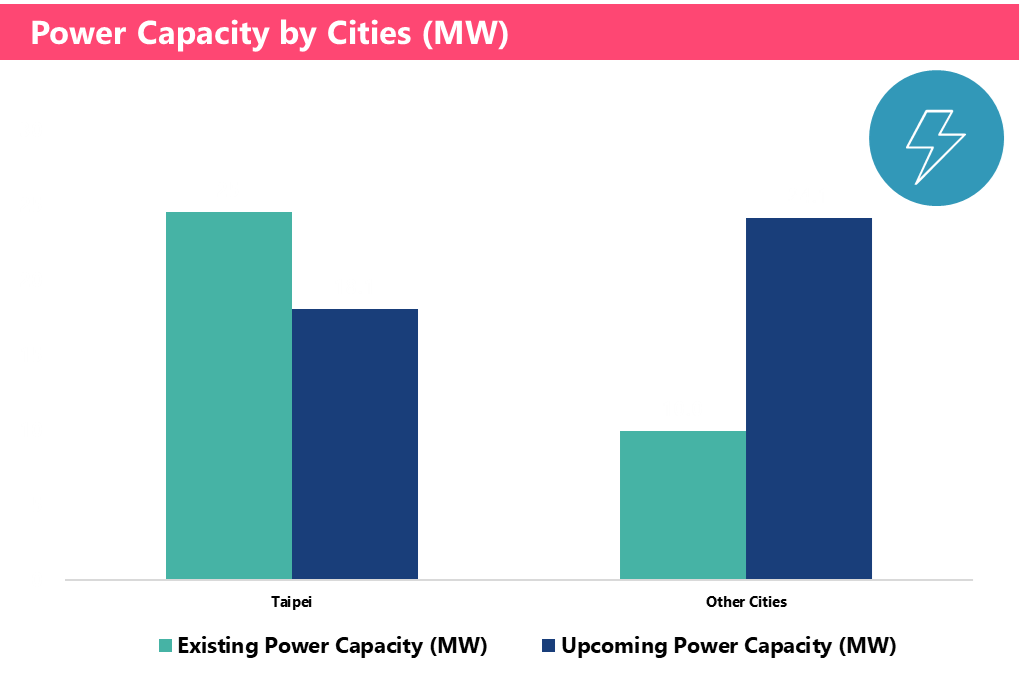

- In Taiwan, Taipei city and New Taipei city are favorable locations for developing data center facilities, as they are the most connected locations and the economic hubs in Taiwan. The Taipei data center market hosts over 70% of the third-party data centers, most developed according to Tier III requirements.

Taiwan Data Center Market Vendor Landscape

Some key IT infrastructure providers are Atos, Broadcom, Cisco Systems, Dell Technologies, Extreme Networks, Fujitsu, etc. In Taiwan, cloud services have gained importance after COVID-19. Modular design and construction of data centers are increasingly adopted in Taiwan to increase scalability and reduce construction costs for operators.For instance, Chunghwa Telecom, one of the Taiwanese data center providers, has used modular design in its data center in Taipei to decrease the construction cost. In December 2020, Trend Micro, a major player in cybersecurity, used Microsoft Azure to develop cloud-based cybersecurity solutions. 5G network connectivity is also increasingly gaining importance, and vendors have a great opportunity in this trend. In June 2020, Chunghwa Telecom was the first telecom operator to receive a license from the National Communications Commission (NCC) to deploy 5G commercial services. It is going to have 10,000 base stations across Taiwan by 2021 end.

Report Coverage:

This report analyzes the Taiwan data center market share. It elaboratively analyzes the existing and upcoming facilities and data center investments in IT, electrical, mechanical infrastructure, general construction, tier standards, and geography. It discusses market sizing and investment estimation for different segments.Read More