Manufacturer's interest in the EMI's market data broke records this year, seeing that over 280 HVAC&R industry manufacturers have participated in its sales data collection. As such, they recorded an increase of 26% compared to last year, or 44% if we include the new heat recovery system and pool dehumidifier programs. This growth in the number of participants in the collection offers multiple benefits to industry manufacturers, since on the one hand it helps increase the reliability and the representativeness of market data they receive, and on the other hand it improves their global understanding of the market by the broad range of products studied.

Chillers and hydronic heat pumps: a historic growth in the number of participants in 2015 The number of participants in chiller and hydronic heat pump programs increased by over 40% this year, a leap forward for this program which now has 39 participants, becoming the most representative collection on a European level. This growing interest by manufacturers is due to major changes yet to come (in the framework of the new F-Gas regulation and Ecodesign directives) but also by the continuous arrival of heating engineers in this industry. The level of detail offered by the collection itself is at the same time adapted to manufacturers' needs, since, for the fifty countries studied, it now offers a very detailed analysis by type of compressor, refrigerant and energy class (in addition to traditional analysis by capacity and technology).

Data collection on air-handling unit manufacturers has become the largest in the world. The number of participants in the air-handling unit statistic program reached a historic high with 85 participants, strengthening the representativeness of the data collected on the European market. This year, several German manufacturers have joined the collection, but also many Turks, English, Indian and Eastern European manufacturers. This interest can be explained by the dynamism of the air-handling unit market, but mostly again by adapting the collection format to new European market stakes. Therefore, besides the airflow and energy class, EMI is now collecting information on the type of on-board equipment, either at the level of the heat recovery unit, compressor or integrated controls.

Fan coils: a representation rate close to 100%. The fan coil program also had a good year, from 29 to 36 participants, and has brought together all major European fan coil manufacturers. This success reflects the concern of manufacturers in this market, which has been declining in recent years and suffered the brunt of the transition in energy efficiency in buildings. As such, EMI collects data on the types of controls and on-board motors, but also on the product's energy class.

The HVAC&R market in the EMEA region in 2014/2015 Fan Coil Units: A new market decline for 2014

The fan coil market suffered a decline in 2014 of 6% compared to 2013 to reach 1.35 million units sold in the EMEA region (Europe, Middle-East and Africa). This decline has been shared by many countries that saw their situation deteriorate compared to the previous year: England, Benelux, Germany, Russia, and the Middle East (Arabian Peninsula and Levant) have experience declines between 10% and 15% this year while their situation was positive in 2013. Meanwhile, Italy continues to fall this year with a decline of around 10%. However, the situation is improving for France and Spain, with increases of 3% and 9% respectively. Regarding Turkey, its market growth has slowed and stabilized around 5%. This year, Africa has been successful, reaching a growth of 16%. Approximately 20% of total sales have taken place on the Italian market, which equates to 262,000 units sold. Also in Europe, France came in second with a market share of around 11%. After the European Union, the Middle East comes in second in the EMEA region, despite a drop of 4 points compared to 2013. This year, there is still not change in terms of different types of fan coils. "2 pipes" represent 75% of the market and "4 pipes" the remaining 25% except in Saudi Arabia, where only "2 pipes" exist. From a design and general point of view, casing and without casing fan coils represent respectively 30% of the market and "cassette" and "ducted" fan coils share the remaining market. Turkey stands out with three quarters of the without casing model market as wells as Saudi Arabia, where only "ducted" and without casing models exist.

Rooftops units: A growing market with mixed developments

The rooftops market amounts to about 67,000 units sold, which equates to 12% more than the previous year. It is no surprise to see that the market is still dominated by the Middle-East with an 80% market share. Within this region, Saudi Arabia comes in first position with 40% of the market followed by the UAE with 23% of the market. In addition, these two countries bring this year's growth with 35% and 7% respectively compared to 2013. In Europe, it is respectively France, Spain, Turkey and Italy who have the largest market share. This year, the situation has improved for France and Italy, who have experienced growth of 18% and 7% respectively. However, the situation has deteriorated considerably for Spain and Turkey, who have suffered declines of 15% and 30%. From a technological point of view, the reversible rooftop unites are leading the pack in Europe. Nevertheless, in the Middle East, close to 100% of reversible rooftop unites sold are cooling units only. On the capacity side, the medium capacity units, between 17 and 120kW, are the most popular in Europe as well as the Middle East, whose market share is slightly above 80%. The difference between the two geographic areas comes from small-capacity machines (less than 17kW) which represent the rest of the market for the Middle East while the rest of the European market consists of big-capacity machines (over 120kW).

The market growth in rooftop units should continue in 2015 at a more moderate pace than in 2014.

Chillers: A European market for small and medium power appliances

This year, the chiller market represents 19.6MkW against 20.4MkW last year. As in 2013, the Middle East is the largest market (2.57MkW) followed by the German (2.48MkW), French (2.36 MkW) and Italian (2.29MkW) markets. In terms of market share, a geographic segment is clearly defined between the small and medium capacity machines (less than 700kW) and large capacity machines (over 700kW). The markets for machines whose capacity is less than 700kW is dominated by the European Union with an average market share of 85%. Italy has been the most successful, with a market share of 47% for less than 50kW and 17% for 50-700kW. Followed by France, Germany, and the Iberian Peninsula, with market shares of around 10%. Further north, it is Benelux and the Scandinavian countries who follow with a 6% market share. Regarding large capacity machines, the Middle East leads the pack with a 30% market share, followed by Turkey with 12%. Regarding development, it is the European Union countries who have experience growth compared to last year. Increases in France, Spain and the United Kingdom are between 8% and 10%. In Germany, growth reached 3%. However, Italy, the Middle East and Turkey experienced a slight decline of 1%. From a technological point of view, 80% of chillers are water-cooled and not ducted. Regarding their compressors which are mainly rotary, 80% of them are standard compressors while the remaining 20% are "inverter driven" compressors.

Computer Room Air-Conditioners (CRAC): No growth in 2014 for the CRAC market

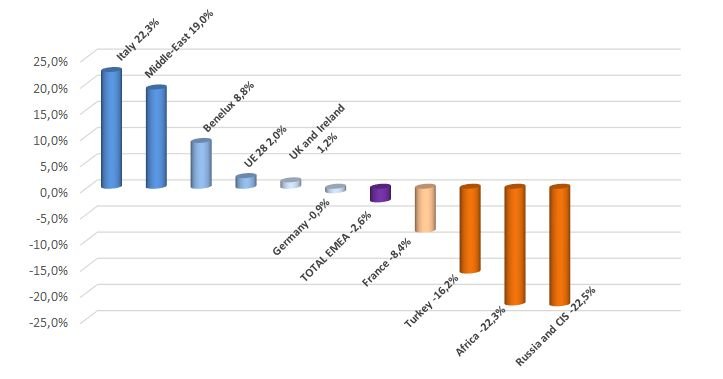

The CRAC market represents 30,000 units in 2014, which remains unchanged from 2013 in the EMEA region. As in 2013, the market is dominated at 80% by Europe. This year, Germany is slightly ahead (12%), followed by the United Kingdom (11.3%), the Middle East (11%) and Italy (10.3%). They are closely followed by Russia and France, who have an honourable market share of around 8%. Growth has been strong in Italy and the Middle East this year, with increases of around 20%. However, the situation is more complicated in France, who suffered a decline of 8.4%, and in Russia, who experienced a decrease of 20%. In the EMEA region, two-thirds of units sold are those with direct expansion and the rest are chilled water units. For France, Germany and the United Kingdom, the proportion is the same for both technologies. Regarding direct expansion units, 90% of units sold are those with a capacity less than 60kW. For chilled water units, there is no clear trend and the distribution is more equal between the different capacities between less than 15kW and more than 100kW.

Growth of 2.5% is expected for 2015. Forecasts are positive for countries with a high market share. France's situation should improve.

Air handling units: Growth will pick up again in 2014

The air-handling unit market amounted to 2.05 billion euros in 2014, which equates to 1.4% more than in 2013. This year growth has been driven by Scandinavian countries, the second largest market in Europe, which represents €324.82M - 16% market share- and an annual increase of 2.6%. Turkey, with its 6.3% market share, will also have something to say regarding this growth, since this year its market has risen by 11.9%, one of the biggest increases recorded this year. English and Italy are just behind, with growth of 9% and 5.6% respectively. Disappointingly, Germany, the market driver for the air-handling units with €360.27M units sold this year, experienced a decline of 3.3%, followed by France, who dropped by 5.4%. In terms of the unit distribution regarding air flow, there is no news compared to last year. Units with a small capacity of less than 5,000m3/h account for half of the market while units of more than 30,000 m3/h only represent 5% of the market. Components which can be found inside an air-handling unit have equal share, meaning plate heat exchangers, regenerative heat exchangers and well as on-board controls at 30%.

Air filters: A fairly soft market This year the market for filters is once again apathetic; to amounts to €1,084M for the EMEA region against €1,081M the previous year. The air filters market is shared by few countries in Europe. Germany is leading the pack with a 22% market share, followed by the Scandinavian countries, who represent 15% of the European market. France is in third position with 12%. Outside Europe, the Middle East stands out with a 7% market share. Regarding development, the situation is not so favourable within the European Union. The only two exceptions are Denmark and England who recorded a growth of 9%. In contrast, France, Sweden, Finland and the Iberian Peninsula suffered declines between 1% and 3.4%. Turkey recorded a growth of 9% while the Middle East clearly pulls ahead with an increase of 23%. Just like last year and in recent years, fine and medium filters represent almost two-thirds of the market. Behind them are coarse filters (19%) then HEPA-ULPA type filters (16%).

Heat exchangers: 2014 is yet another good year In 2014, like the previous year, has positive results for the heat exchanger market. There was an increase of 3.5% compared to 2013, which equates to €837M this year. Germany continues its growth, which amounts to 4.5% this year so as to remain the leader of the €143.40M market. Italy is in second place with an 11% market share and an annual growth of 10%. Russia is closely behind with 9% of the market then France and the United Kingdom with 8% each. The largest increase recorded outside the European Union was for Turkey, with 25%. In terms of technology, evaporators represent two-thirds of the market and condensers 29%. Only 3% of the market is composed of air-cooled exchangers. This pattern is the same in almost all of the EMEA region apart from Spain or Turkey, were condensers represent almost half of the market.

Cooling towers: This situation improved slightly in 2014

The cooling tower market amounts to €232.67M this year, which is slightly more than the previous year. Following a slowdown between 2012 and 2013, the market stabilised in 2014. The EMEA region market leader is Germany, with 17%, but is closely followed by the Middle East and its 15% market share. The Italy/France/United Kingdom trio is just behind with market shares of around 7%. Although we cannot speak of growth for some countries, we can say that their situation has improved this year. This is the case for Germany and the United Kingdom, who experienced a drop of 4% against 15% last year. However, the situation is deteriorating for France and the Middle East. France's situation is the gloomiest, with a drop of 25% while the Middle East suffered a decline of 7%. Only Italy experienced a slight growth of 1.4% this year. As in 2013, most of the units sold are open cooling towers, representing two-thirds of the market.

Adiabatic coolers: A flourishing market and widespread growth for 2014

Last year we spoke of an emerging market, this year, we can talk about a flourishing market. The EMEA region has experienced strong growth of around 20%. This year, almost all countries in the EMEA region saw the number of adiabatic coolers increase on their soil, with the exception of Spain and Poland who experienced a slight decline. The market leaders are Germany and France with market shares of around 20%. Followed by Switzerland, Eastern Europe and Russia.

Heat recovery systems: a market subject to new European directives

This new collection was launched for the first year. Heat exchangers can be found within air-handling units. It is a collection that has and will be important and of great interest as these are the products that become the strategic benefits of the new ERP European or Ecodesign directives. Indeed, in order to contribute to the 20-20-20 triple goals for 2020 (reducing primary energy consumption by 20%, reducing greenhouse gas emissions by 20% and increasing the share of renewable energies by 20%) some rules have been imposed. From January 2016, all ventilation boxes used in tertiary whose air flow exceeds 250m3/h will have to meet certain requirements for equipment used, including heat exchangers. There are four types of heat recovery systems: regenerative heat exchangers, plate heat exchangers, run around coil and heat pipes. Plate heat exchangers are the most represented on the market. Their market share is between 80% and 95% in Europe. Currently, the main markets are in Germany, Spain, Nordic countries and Eastern Europe. Pool dehumidifiers: A mainly European market Pool humidifiers are specific units for air treatment and the management of temperature conditions and hydrothermics in swimming pools. This new statistical collection highlighted the fact that 95% of units sold are direct expansion and that among double-flux units, only 14% of them do not have thermodynamic dehumidification.

Interview with Yannick Lu-Cotrelle and Ghita Boudribila, specialists at EMI:

EMI has once again exceeded its goal of reaching 200 members in 2015, how do you explain this growing success year on year?

Indeed, with an average annual growth rate of 24% since 2009, the number of participants in our collection has been increasing since 2009. This rise is partly explained by the increasing need of manufacturers in terms of market data, but also by EMI's growing reputation. With 20 years' experience and 280 members, we are now considered the reference on the HVAC market in Europe, and the different market players, whether they are manufacturers, suppliers or institutions, look systematically to us as soon as they feel the need to understand how the market is structured and where it tends.

The day after the 20 year anniversary of its activity, can you tell us what has changed within Eurovent Market Intelligence?

Eurovent Market Intelligence's leitmotiv has always been continuous improvement. We strive to move forward, refine our analysis and above all, meet the needs of our members by listening to them. As we mentioned last year, we now offer our participants access to free reports of their choice. Thus, air filter manufacturers also receive information on air-handling units while heat exchanger manufacturers also receive information on liquid coolers or adiabatic coolers. However, the most notable development in 2015 has been our quarterly market reports. Consisting of two dozen pages, they have become much more detailed and comprehensive. In additional to traditional market data, they now include a range of qualitative, technical and macroeconomic information to better position its product compared to other countries and competition, and better understand the different trends. This somewhat overdue development as well as these now-available reports have been enthusiastically received by our participants. Do you have any plans for 2016? Several projects are underway, such as new collections on heat recovery units (or "residential air-handling units") and VRF type air conditioners. We are also studying the opportunity to relaunch market intelligence programs on air curtains and chilled beams. However, EMI's biggest priority for 2016 will be the freshness of data: we will try to ensure that the collection results are sent even sooner (in March) to allow manufacturers to anticipate market developments as soon as possible.

For further information, please do not hesitate to contact Eurovent Market Intelligence at statistics@eurovent-marketintelligence.eu

Source: Eurovent Market Intelligence