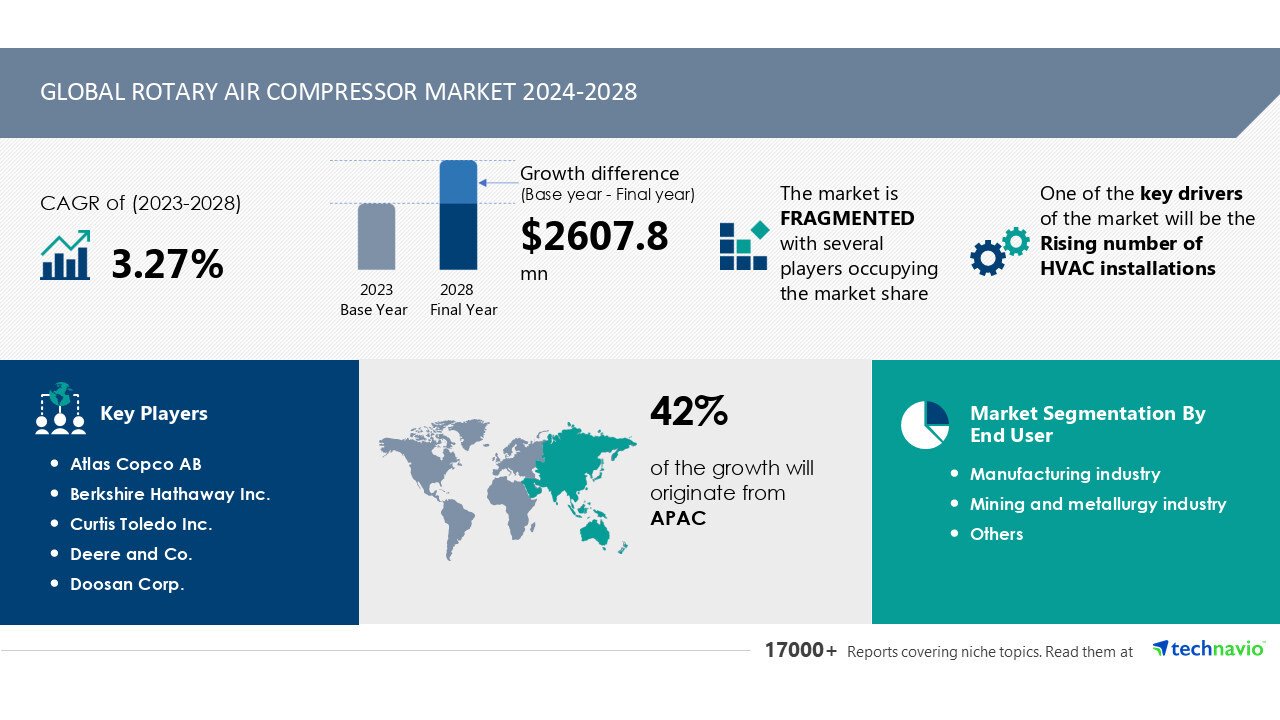

The rotary air compressors market is projected to grow by US$ 2.60 billion during 2024–2028

The Rotary Air Compressor Market is set to experience significant growth, with projections indicating a market size increase of USD 2.60 billion from 2024 to 2028. According to a report by Technavio, the market will expand at a CAGR of 3.27% during this period. Key factors driving this growth include rising HVAC installations, the integration of AI-powered technologies, and the trend towards mergers and acquisitions (M&A) within the industry. Despite the positive outlook, the market faces challenges related to raw material price fluctuations and high production costs.

Market Drivers and Opportunities

-

Increasing HVAC Installations: HVAC systems, which rely on rotary air compressors for efficient operation, are witnessing heightened demand across various industries, including manufacturing, construction, and automotive. The compressors are integral in maintaining optimal working conditions, powering pneumatic tools, and reducing energy consumption.

-

AI-Powered Market Evolution: The adoption of AI and machine learning is revolutionizing the rotary air compressor market. AI optimizes performance through real-time monitoring and predictive maintenance, allowing operators to address potential issues before they become critical. This advancement is driving growth and attracting investments from industry leaders.

-

Mergers and Acquisitions: M&A activity continues to shape the market, with companies like Atlas Copco, Ingersoll Rand, and Elgi Equipments actively expanding their market presence through acquisitions. These mergers aim to reduce production costs, enhance operational performance, and expand distribution channels. For example, Atlas Copco's acquisition of Quincy Compressor and Gardner Denver’s merger with Ingersoll Rand are notable instances of M&A activities that are reshaping the competitive landscape.

-

Energy Efficiency and Sustainability: With rising power consumption and electricity costs, industries are increasingly adopting energy-efficient rotary air compressors. The market is also driven by the shift towards clean energy solutions, particularly in sectors such as renewable energy (wind and solar), medical devices, semiconductors, pharmaceuticals, and food & beverage.

Challenges in the Rotary Air Compressor Market

-

Raw Material Price Volatility: The cost of essential raw materials like aluminum, steel, and castings impacts the production costs of rotary air compressors. These materials are subject to price fluctuations due to supply chain disruptions and inflationary pressures. For instance, the price of steel (rebar) fluctuated between USD 530–650 per metric ton in 2019, negatively affecting vendor margins as they struggled to pass on the added costs to customers.

-

High Maintenance Costs: The requirement for constant maintenance and technical support for rotary air compressors further increases the total cost of ownership, especially for industrial users. Vendors must manage these costs while maintaining competitive pricing in a crowded marketplace.

-

Technological Transition: The market is also navigating the transition from traditional internal combustion engines to electric motor-driven compressors, which offer better energy efficiency but present challenges related to emissions and fuel costs.

Technological Advancements

Liquid cooling technologies are becoming increasingly popular, particularly in high-performance computing (HPC) and data centers. Liquid-cooled rotary compressors are more efficient than traditional air-cooled models, reducing energy consumption and operational costs. This is particularly relevant in sectors with high-density workloads, such as AI, IoT, and big data applications.

Market Segmentation

- Component: Chillers, air conditioning systems, heat exchangers, cooling towers, air handling units, humidifiers, etc.

- Cooling Type: Room-based, rack-based, and row-based cooling, with room-based cooling currently dominating the market.

- Data Center Type: Enterprise, colocation, wholesale, and hyperscale data centers, with hyperscale centers expected to see the most growth.

- Industry Vertical: Key sectors include BFSI, manufacturing, IT & telecom, healthcare, and government & defense, with IT & telecom leading in market demand.

Regional Market Analysis

The market is divided into major regions:

- North America: Dominates the market due to rising data center installations and increasing adoption of eco-friendly cooling technologies.

- Europe and Asia Pacific are also experiencing substantial growth due to rapid industrialization and infrastructure development.

Conclusion

The rotary air compressor market is on a trajectory of consistent growth, driven by rising demand in various industrial applications, AI-driven innovations, and strategic acquisitions. Companies that invest in energy-efficient solutions and advanced cooling technologies will be well-positioned to thrive in this evolving market. However, they must remain vigilant to raw material cost fluctuations and continue optimizing operational efficiency to maintain their competitive edge.