U.S. Central Air Conditioning Market Poised for Steady Growth Through 2030

The U.S. Central Air Conditioning (CAC) Systems market has demonstrated resilience and growth, with unit shipments projected to rise from 7.8 million in 2024 to 11 million by 2030, reflecting a 6% compound annual growth rate (CAGR), according to a new report from ResearchAndMarkets.com.

Market Performance and Key Drivers

The industry saw significant growth in 2020, achieving an 8.4% increase in production despite challenges posed by the COVID-19 pandemic. Strong residential demand, fueled by historically low interest rates and increased disposable incomes, played a crucial role in sustaining sales. In contrast, commercial construction activity faced setbacks due to pandemic-related uncertainties.

Demand remained strong in 2021 and 2022, supported by economic recovery and government-led initiatives, including the Inflation Reduction Act (IRA) of 2022. This legislation introduced $9 billion in home energy rebate programs and long-term tax incentives for energy-efficient HVAC solutions. These policies helped push the shipment value of U.S. CAC systems to a record $20 billion in 2022.

However, economic uncertainty and rising interest rates in 2023 led to a decline in housing demand, impacting CAC shipments, which fell to $16.5 billion. Despite this downturn, the industry rebounded in 2024, with production increasing by 8.1% to match the 7.8 million units shipped in 2020.

Future Growth and Industry Trends

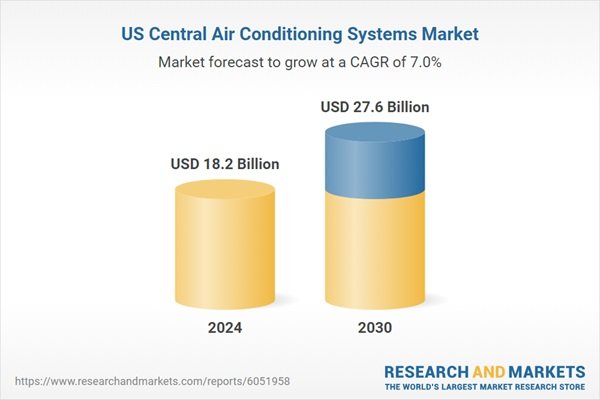

The market outlook remains strong, with shipment value expected to grow at a 7.2% CAGR, reaching $27.6 billion by 2030. Growth will be primarily driven by the increasing adoption of Variable Refrigerant Flow (VRF) systems and heat pumps, reflecting a shift toward energy-efficient cooling solutions.

In terms of product segments, Direct Expansion (DX) CAC Systems dominate, accounting for 95.3% of total unit shipments in 2024. This segment is forecasted to grow at a CAGR of 6.2% through 2030, largely due to rising heat pump adoption. Meanwhile, within the Central Plant Systems segment, chillers hold the largest share in shipment value, making up 47.5% in 2024, followed by air handling units.

Industry Players

Major companies shaping the U.S. CAC market include Carrier Global Corporation, Daikin U.S. Corporation, Johnson Controls (York), Lennox International, Nortek Global HVAC, Rheem Manufacturing, and Trane Technologies. Other key players include Mitsubishi Electric Trane HVAC US, LG Air Conditioning Technologies, Panasonic Corporation of North America, and Fujitsu General America.

The market report covers trends, corporate developments, and projections for CAC system shipments and values through 2030, providing insights into the evolving landscape of the U.S. HVAC industry.

Source