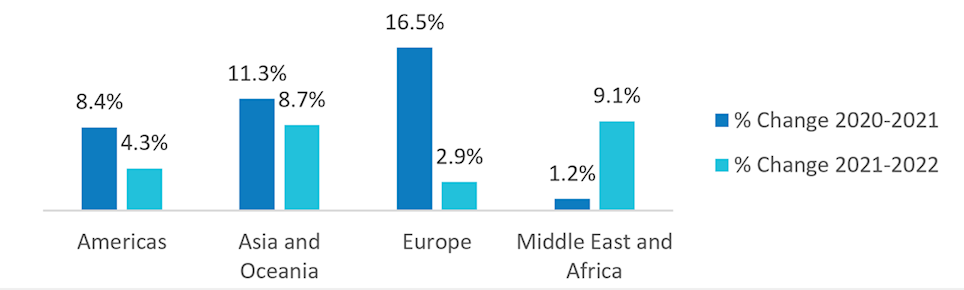

As economies worldwide have been recovering from contraction, restrictions and lockdowns, the air conditioning market has continued to stabilise, and growth has been recorded for most segments in 2021 around the globe. However, in the short term, inflation and supply chain crisis remain primary concerns.

The unprecedented challenges experienced by markets due to the pandemic have had far-reaching effects for the chiller market. The shortages of semi-conductors, raw materials and rising shipping costs have all added to the difficulties facing manufacturers. There is now a demand for greater air quality products such as air cleaning/filtering features and higher energy efficiency. Moreover, during the pandemic some verticals such as hospitality, retail and aviation sector investments declined significantly, leaving a gap in the market for non-residential products.

The downturn has encouraged companies to investigate expansion in process cooling and heating technologies. Furthermore, major economies signing up to the Net-Zero Emissions by 2050 commitment is driving the sale of electric heating and cooling products, especially heat pump chillers*.

Cooling-Only versus Heat Pumps: Key regional findings from BSRIA’s Global Annual Chiller Data Output

Americas – In the US, screw chillers continue to dominate the market, but the oil-free centrifugal market is seeing the fastest growth albeit from a low base. Even though most chillers remain cooling-only, there has been recent interest in heat pumps, although this is confined to select regions in the US.

In Canada there has been a slow recovery after the market fall in 2020. The use of heat pumps in Canada is very limited because of the climate conditions. The efficiency of heat pumps declines when outside temperatures fall below freezing.

Asia and Oceania – The Indian air conditioning market is on the road to recovery in 2021/2022 after a devastating drop for 2020 sales. The heat pump segment is currently almost negligible, except for some parts of the country (mostly in the north), where heat pump mode is used in the hospitality sector and, since very recently, in the health sector. Water-cooled heat pumps are also sometimes used in process cooling.

In Australia, the 2-pipe AC Heat Pump is increasing its share of the market. Comfort cooling has the greater share of chiller sales. Data Centres form the largest share of the process market. There is a market for other process applications in Queensland and Western Australia, where there are mines. Melbourne also has a bit of process in the plastics industry.

In Indonesia, there are not many heat pump installations as there are few applications for them. Some screw chillers, installed in some hotels, have a heating function, but otherwise all units are cooling-only. There has been further market decline in the second year of the pandemic.

Middle East and Africa – In Saudi, the chiller market has been suffering in the last several years due to a lack of larger projects and cash flow problems of construction companies. Heat pumps started appearing on the market very recently; however, the actual sales are currently very small. Consultants have increasingly started including heat pump specifications for hospitals and hotels, following the trend coming from Europe.

Europe – In France, the chiller market was supported by subsidies. The proportion of screw chillers used in process applications and data centres is estimated to be over 75%. The Spanish chiller market returned to growth in 2021, after suffering steep losses in the previous year. In Germany, the chiller market in 2021 began recovering in most segments but did not return to the sales level of 2019. Most chillers are for comfort cooling; the rest are used in process cooling.

BSRIA expands its Global Annual Chiller Data Output

Responding to the demand for global data with more detailed segmentation, BSRIA Worldwide Market Intelligence has expanded the scope of its Global Annual Chiller data output.

The new reports offer a more comprehensive picture of the market by including analysis by compressor type and kW size. The reports also include a breakdown of Inverter vs. Non-Inverter type and market leaders by compressor type. The new output contains analysis by cooling-only or heat pump applications. Previously, most chiller sales were comfort cooling only applications, and although there has always been a mixed use, manufacturers could not separate sales of their comfort cooling chillers from process applications. As there are constant changes in the use of refrigerants, there is a section on the type of refrigerant used by compressor type.

First evidenced in the Asia Pacific Regional study at the beginning of the year, the additional data is now included in BSRIA’s Global Worldwide Air Conditioning (WWAC) market reports to be published at the end of April 2022. Results are available at a global, regional, or country level, focusing on 2021 with forecast by product to 2026.

*Ammonia chillers/heat pumps are excluded from the data, as well as any units that are assembled on site.

Read more