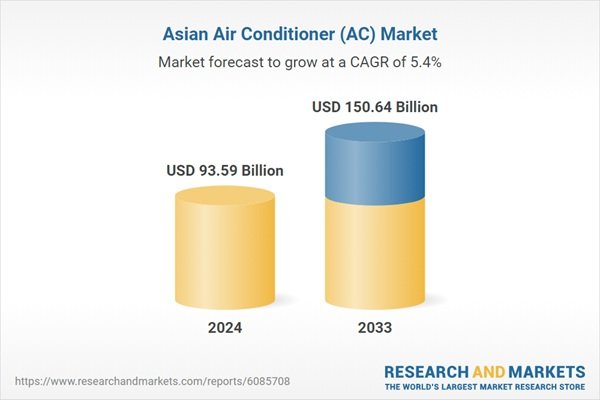

Asia Air Conditioner Market to Reach USD 150.64 Billion by 2033

The Asia Air Conditioner (AC) Market is projected to grow from USD 93.59 billion in 2024 to USD 150.64 billion by 2033, registering a compound annual growth rate (CAGR) of 5.43%, according to a new report by Research and Markets. The expansion is driven by rising urbanization, increasing disposable incomes, and growing demand for energy-efficient cooling systems across China, India, Japan, and Southeast Asia.

Air conditioners are widely used in residential, commercial, and industrial sectors to maintain indoor temperature, humidity, and air quality. The technology has gained strong traction in Asia’s hot and humid climate, where long summers and peak temperatures are common. Demand is further supported by trends in real estate development and the hospitality sector, along with government initiatives promoting energy-efficient models.

Urban development across countries like China, India, and Vietnam continues to boost installations, particularly in new housing complexes, offices, and hotels. Rural-to-urban migration and government-backed infrastructure and smart city projects are also fueling demand for both standard and technologically advanced AC units.

A growing middle class is contributing to increased consumer spending on home comfort appliances. In markets such as India, Indonesia, and the Philippines, income growth and accessible financing options are helping consumers adopt mid-range and premium AC systems. This shift is accelerating the uptake of smart and inverter models that combine convenience with energy efficiency.

Climate change is another key factor, with intensifying heatwaves and rising average temperatures pushing demand higher. Countries like India, Pakistan, and others in Southeast Asia face extreme summer temperatures, making air conditioning a necessity. Extended hot seasons and climate-related health risks are prompting governments and NGOs to promote energy-efficient cooling solutions.

However, challenges remain. High energy consumption of conventional AC units places strain on power infrastructure, especially in regions with unstable electricity grids. In countries such as Bangladesh and Myanmar, limited energy capacity and frequent outages constrain broader adoption. Additionally, affordability in rural and low-income areas limits market penetration due to high upfront costs and limited access to financing or installation services.

The report includes analysis of major companies operating in the region, including Daikin Industries, Carrier, Electrolux, Emerson Electric Company, Hitachi-Johnson Controls Air Conditioning Inc., Trane Technologies plc, Mitsubishi Heavy Industries Ltd, and Ingersoll-Rand plc.