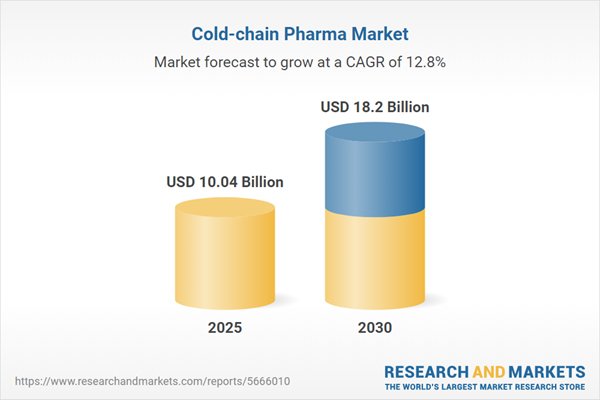

The global pharmaceutical cold-chain market is projected to grow from USD 10.04 billion in 2025 to USD 18.20 billion by 2030, according to a new report published by Research and Markets. This expansion, at a compound annual growth rate (CAGR) of 12.75%, is driven by increasing demand for biologics, vaccines, and advanced therapies that require temperature-controlled logistics.

The report highlights growing investments in blockchain-enabled tracking platforms, which enhance end-to-end supply chain visibility and regulatory compliance. These technologies are helping stakeholders mitigate temperature excursion risks and ensure secure, real-time monitoring throughout distribution.

Packaging solutions in the market include active types, such as refrigerated containers and temperature-controlled pallets, and passive types, including insulated shippers and gel packs. Temperature ranges covered span controlled ambient, refrigerated, frozen, deep frozen, and ultra frozen categories.

Distribution channels range from in-house operations to third-party logistics providers. Services include cold storage, multimodal transportation (air, rail, road, sea), and value-added offerings like repacking and shipment monitoring. The market serves a wide range of product types including biologics, small molecule drugs, diagnostics, and vaccines.

End users include hospitals, clinics, contract research organizations, and retail pharmacies. The report provides analysis across major global regions, including the Americas, Europe, the Middle East & Africa, and Asia-Pacific.

Technological advancements such as AI-powered monitoring platforms, predictive analytics, and real-time sensor arrays are increasingly adopted. The market is also responding to sustainability pressures by introducing bio-based insulation, energy-efficient refrigeration, and optimized routing.

In the United States, new tariffs on imported refrigeration equipment and packaging materials are prompting shifts toward local sourcing and modular container designs. Collaborative strategies between logistics companies and packaging suppliers are being adopted to maintain compliance and cost-efficiency under new trade conditions.

The report includes profiles of major global cold-chain logistics providers such as Americold Logistics, Lineage Logistics, Kuehne + Nagel, Deutsche Post DHL, UPS, FedEx, DB Schenker, DSV Panalpina, CEVA Logistics, and Agility.

Read More