COVID-19 Impact on the global commercial refrigeration equipments market

The pandemic is estimated to have an impact on various factors of the value chain of the commercial refrigeration equipments market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

COVID-19 had a significant economic impact on various financial as well as industrial sectors, such as travel & tourism, manufacturing, construction, and aviation. The end-use sectors of commercial refrigeration equipment, such as hotels & restaurants, supermarkets & hypermarkets, convenience store, and bakeries have been impacted. Hotels & restaurants and bakeries was one of the severely impacted sectors due to strict lockdowns and curfew in most countries to prevent the spread of coronavirus.

Commercial refrigeration equipments Market Dynamics

Driver: Growing demand for frozen and processed food across word

The food processing sector requires equipment and solutions to produce, process, and distribute food to billions of households across the world as it services a multi-faceted value chain from farming to logistics. This sector has become increasingly important as the world’s population is on the rise, and dietary preferences are evolving, reflecting higher incomes and a shift to value-added products. The global demand for fresh and processed fruits and vegetables is increasing because of the changing food consumption habits of the urban population. The rise in disposable incomes in emerging economies has led to an increase in demand for fresh and processed fruits and vegetables. Frozen food products are increasingly becoming an integral part of daily diet across the world. Also, rapid urbanization in developing countries and rising living standards are fueling the demand for processed and packaged food, thereby leading to higher commercial refrigeration equipment sales, which is expected to propel the demand for commercial refrigeration equipment market during the forecast period.

Restraints: Stringent regulations against the use of fluorocarbon refrigerants

Fluorocarbon refrigerants adversely affect the ozone layer. In regard to this, governments of several countries worldwide are imposing regulations to limit the use of fluorocarbon refrigerants. They have agreed to phase out the use of HCFCs and HFCs by imposing limits on their consumption.

Regulations imposed on certain refrigerants such as R22 under the Montreal Protocol are hampering the growth of the commercial refrigerant equipment market. The main aim of this protocol is to minimize the damage caused to the ozone layer due to the use of refrigerant gases. Under this protocol, countries have agreed to phase out the use of ozone-depleting fluorinated refrigerant gases

Opportunity: Improvements in the efficiency of refrigeration systems with the use of natural refrigerants

Several government agencies and R&D companies are focused on improving the coefficient of performance, efficiency, lifetime, and total ownership cost of commercial refrigeration systems. With the Kyoto Protocol and the recent EU F-Gas regulations, manufacturers are trying to develop natural refrigerant technologies that can boost the energy efficiency of commercial refrigeration systems. Companies such as Carnot Refrigeration, Danfoss, and Carrier Commercial Refrigeration are introducing ammonia and CO2 refrigerant technologies. Earlier, cascade refrigeration systems using CO2 and ammonia as refrigerants were confined to limited refrigeration applications. However, with the increasing awareness regarding eco-friendly refrigerants, cascade refrigeration systems are preferred for a wide range of refrigeration applications. The Clean Development Mechanism (CDM) defined in article 12 of the Kyoto Protocol encourages the use of natural refrigerants. The CDM allows a country with an emission-reduction commitment under the Kyoto Protocol to implement an emission-reduction project. Such projects can earn saleable Certified Emission Reduction (CER) credits, each equivalent to one ton of CO2, which can be counted toward meeting the Kyoto targets. These projects include the installation of energy-efficient equipment in industries.

Challenge: Few purification companies

There are different grades of ammonia and CO2 that can be used as refrigerants in commercial refrigeration equipment. These grades need to be of very high purity. Refrigerant grade ammonia is 99.95% pure, with a water content within 33 parts per million (ppm) and oil content within 2 ppm. Preserving the purity of ammonia is essential to ensure the proper functioning of refrigeration systems. The cost of purifying natural refrigerants is high, and the process is quite complex. Therefore, there are limited companies that produce refrigerant grade ammonia. Similarly, for refrigerant grade CO2, the water content has to be less than 10 ppm. However, there are very few companies that provide this grade of CO2. Thus, the presence of a few purification companies is acting as a challenge to the growth of the commercial refrigeration equipment market.

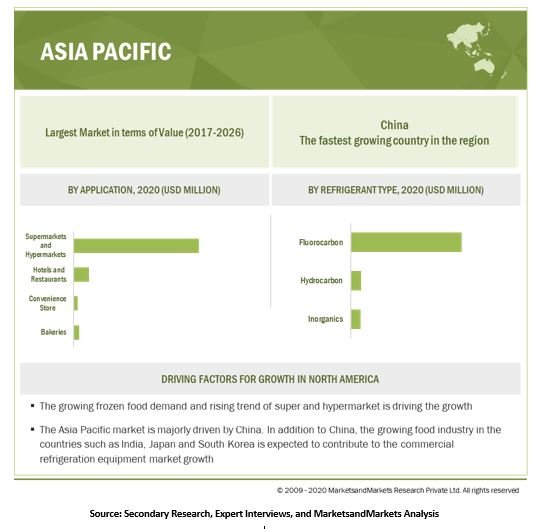

By application, supermarkets & hypermarkets segment is expected to account for the largest share for commercial refrigeration equipments market during the forecast period

By application, supermarkets & hypermarkets segment is projected to be the largest application segment of the commercial refrigeration equipment market from 2021 to 2026. The advanced commercial refrigerators provide for practical designs to capture the attention of customers at any such point of sale. Also, Changing food consumption trends and rising international food trade are additional factors contributing to the growth of the market.

By refrigerant type, fluorocarbons segment is expected to lead the commercial refrigeration equipments market during the forecast period

The fluorocarbons segment is estimated to be the largest refrigerant type segment of the commercial refrigeration equipment market in 2021. Fluorocarbons are chemical compounds comprising carbon, hydrogen, chlorine, and fluorine as their major constituents. However, not all fluorocarbons may consist of both chlorine and fluorine atoms. The applications of these refrigerants are in refrigerators (domestic, transport, and commercial) and large-scale refrigerators (supermarket/ hypermarket). Fluorocarbons are further sub-divided into three types – HFCs, HCFCs, and HFOs.

By product type, transportation refrigeration segment is expected to lead the commercial refrigeration equipments market during the forecast period

Countries such as Asia Pacific has large consumer base and offer lucrative opportunities for chilled and frozen food products such as dairy products, beverages, ice creams, frozen dairy products, processed meat, and fish & seafood products, among others. Such products have a very less shelf life if kept at normal temperature. Thus, transportation refrigeration is required to transport the products from one place to other, creating a demand for commercial refrigeration equipments.

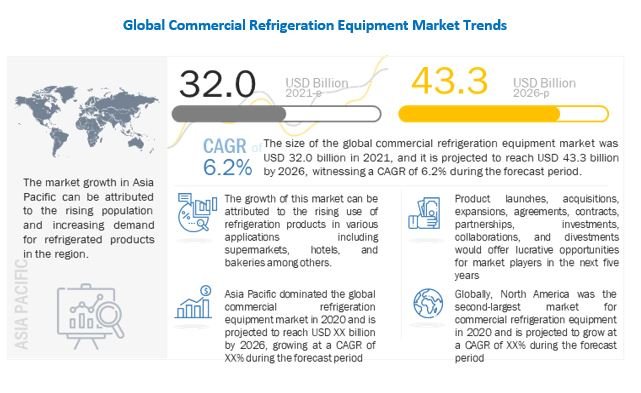

Asia Pacific dominated the global commercial refrigeration equipment market, in terms of value, in 2020

The Asia Pacific is expected to be the largest market of commercial refrigeration equipment during the forecast period. The increasing population in the region, improving economic conditions, such as rising GDP & disposable incomes, and a booming consumer appliances sector have led to growth in the commercial refrigeration equipment in the region. In addition, the growth of the commercial refrigeration equipment market in this region is fueled by growth in the manufacturing sector; increase in spending on private & public infrastructure development; and rapid urbanization.

Key Market Players

The key market players include Carrier (US), Emerson Electric Company (US), Daikin (Japan), Danfoss (Denmark), and GEA Group (Germany). These players have adopted product launches, acquisitions, expansions, partnerships as their growth strategies.