The global Commercial Refrigeration Equipment market size is expected to be worth around US$ 53.16 billion by 2030, according to a new report by Trends Market Research.

The global Commercial Refrigeration Equipment market size was valued at US$ 43.53 billion in 2020 and is anticipated to grow at a CAGR of 10.2% during forecast period 2021 to 2030.

Growth Factors

The increase in demand for items and the thriving hospitality and tourism industries are some of the factors driving the market growth. The growing environmental concerns related to the emission of harmful refrigerants such as Chlorofluorocarbons (CFC) and Hydro-chlorofluorocarbons (HCFC) have led to the implementation of regulations favoring the use of efficient alternatives in commercial refrigeration equipment globally. Under its Clean Air Act, the U.S. Environment Protection Agency (EPA) has mandated the regularized use of low Global Warming Potential (GWP) refrigerants in the equipment for the commercial sector. Such regulations are encouraging commercial refrigerator manufacturers to seek low energy consuming refrigerants to minimize the adverse effect of Greenhouse Gas (GHG) emissions. For instance, in 2020, Hiber, a brand of Ali Group S.r.l. a Socio Unico, added bidirectional IoT connectivity integrated refrigeration cabinets optimized with self-learning systems for reducing energy consumption when the equipment is not in use.

the COVID-19 catastrophe majorly disrupted the commercial foodservice industry and retail industries, adversely impacting the growth of the market for commercial refrigeration equipment. However, since December 2019, the research institutes and pharmaceutical companies have highly demanded and utilized vaccine storage refrigerators during their R&D processes to come up with a life-saving vaccine against the coronavirus.

Report Highlights

The refrigerators and freezers segment accounted for the highest revenue share of nearly 35.0% in 2020 and is anticipated to retain its dominance over the forecast period. The thriving travel and tourism sector globally, which has encouraged the establishment of several food service joints, including restaurants, has contributed to the strong growth of the segment in recent years. The segment also covers blast chillers utilized for promptly freezing or cooling items at lower temperatures and stopping the growth of bacteria in the stored item. The widespread adoption of chillers by healthcare professionals globally, to store tissue samples of controlled tests, vaccines, and critical medicines, is also a key factor contributing to the market growth.

The self-contained segment accounted for over 85.0% of the commercial refrigeration equipment market in 2020. Easy and low-cost installation and low relocation and maintenance costs of the appliances are some of the key factors that contribute to the segment’s dominance in the market. According to the Environmental Protection Agency (EPA), in 2020, emissions from self-contained commercial refrigeration equipment accounted for nearly 26% of the total global HFC emissions. To abide by the stringent HFC emission norms, manufacturers are replacing R-404A refrigerant with R-448A refrigerant, reducing the GWP of the refrigeration equipment by up to 70%.

The 51 cu. Ft. to 100 cu. Ft. segment accounted for a revenue share of close to 50.0% of the overall market in 2020. The segment’s dominance can be attributed to the rising number of hypermarkets, specialty food stores, and supermarkets worldwide. Reach-in refrigerators are among the most rapidly deployed equipment in commercial spaces, with the most popular storage capacity being 50 cu. Ft to 75 cu. Ft. Manufacturers are offering several turn-key products that could fit well with the diverse requirements of customers.

The food and beverage distribution segment is likely to register the highest CAGR of over 15.0% from 2021 to 2030. Rapid developments in cold channel logistics and a rise in refrigerated transportation activities for shipping temperature-sensitive products to any part of the world have worked in the favor of the segment. Furthermore, the availability of cutting-edge temperature-controlled refrigerators for food trucks and other transport vehicles allows for the reliable distribution of fish, beverages, liquor, biopharmaceutical, and other perishable items to remote locations. The rising adoption of sectional refrigerated trailers by capital-intensive customers in the food & beverage distribution industry is likely to favor the growth of the segment over the forecast period.

The foodservice segment accounted for a revenue share of over 30.0% of the overall market in 2020. This can be attributed to the increasing penetration of Quick-Service Restaurants (QSRs) and food trucks in the global foodservice industry.

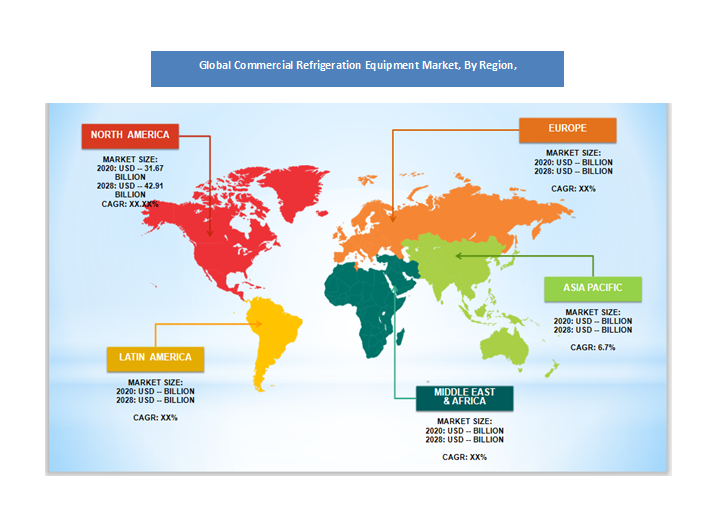

North America dominated the global market in 2020 and is anticipated to account for nearly 31.0% of the overall revenue share by 2030. This can be chiefly attributed to the well-established retail industry in the U.S. The strong growth of the regional market can also be attributed to the presence of several leading commercial refrigeration equipment manufacturers. The early adoption of smart equipment in commercial kitchens in the region is also expected to work well for the market over the forecast period.

Visit For More Information: https://www.trendsmarketresearch.com/report/sample/13638