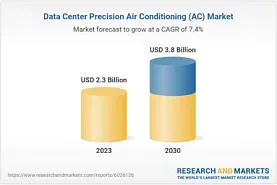

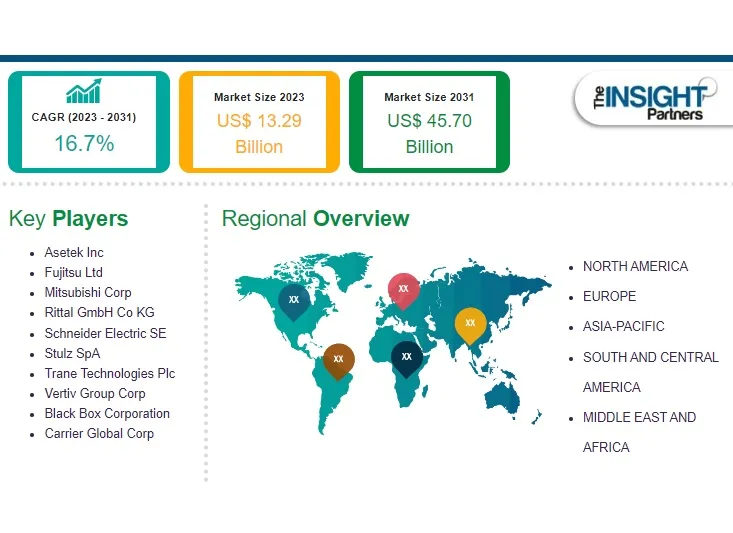

Data Center Cooling Market Projected to Reach $45.70 Billion by 2031

The global data center cooling market is expected to grow significantly, with its value forecasted to reach US$ 45.70 billion by 2031, up from US$ 13.29 billion in 2023. The market is projected to grow at a compound annual growth rate (CAGR) of 16.7% during the 2023-2031 period. The rising demand for AI-optimized and quieter cooling solutions is expected to drive new trends in the market.

Market Growth Drivers

Key factors driving the market include increasing demand for compute-intensive workloads, such as artificial intelligence (AI) and machine learning, and substantial investments in high-performance data centers. The growing use of high-performance computing (HPC) and strategic partnerships to develop cutting-edge cooling technologies are also contributing to the market's expansion.

Companies like Intel and Submer are collaborating to develop innovative solutions for cooling chips with high Thermal Design Power (TDP), while energy-efficient cooling technologies are becoming critical due to the widespread adoption of technologies like cloud computing, Internet of Things (IoT), and big data. Liquid cooling technologies, in particular, are gaining traction as they can efficiently manage high-density heat removal, reducing energy consumption and operational costs.

Market Overview

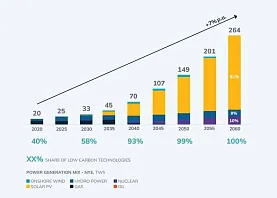

Data center cooling refers to the technologies used to maintain optimal temperatures in data centers to ensure the smooth functioning of IT equipment. As data centers consume approximately 3% of the world's electricity, significant heat is generated, making effective cooling systems crucial for avoiding equipment failure, operational downtime, and costly damages.

The growing demand for energy-efficient cooling systems is becoming more critical as higher-density hardware in data centers leads to increased power consumption and heat generation. Liquid cooling has emerged as a popular solution, particularly for HPC, as it reduces the need for continuous air circulation, improving energy efficiency.

Advancements in Liquid Cooling Technologies

Liquid cooling is rapidly becoming the preferred solution in the data center industry, accounting for approximately 40% of data center cooling solutions. Recent strategic collaborations are advancing this technology. For example, Mitsubishi Heavy Industries (MHI) and ZutaCore partnered to enhance sustainable liquid cooling solutions for data centers. Their combined technology aims to improve energy efficiency, reduce operating costs, and enable heat reuse.

ZutaCore's HyperCool technology, a direct-liquid-cooling solution, helps bridge the gap between data center sustainability and computing power demands. It offers a 50% reduction in total cost of ownership (TCO) and significantly lowers CO2 emissions. Such collaborations are expected to accelerate the adoption of liquid cooling and contribute to the growth of the data center cooling market.

Segment Analysis

The data center cooling market is segmented based on components, cooling type, data center type, and industry verticals:

- Component: Chillers, air conditioning systems, heat exchangers, cooling towers, air handling units, humidifiers, and others.

- Cooling Type: Room-based, rack-based, and row-based cooling, with room-based cooling leading the market in 2023.

- Data Center Type: Enterprise, colocation, wholesale, and hyperscale data centers, with hyperscale dominating in 2023.

- Industry Verticals: BFSI, manufacturing, IT & telecom, media & entertainment, retail, government & defense, healthcare, energy, and others, with IT & telecom leading in 2023.

Geographic Market Share

The data center cooling market is divided into five regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America held the largest market share in 2023, driven by the rise of data centers and the adoption of environmentally friendly cooling solutions. Companies in this region are introducing advanced modular data center solutions to meet the growing demand for efficient cooling systems.

In conclusion, the data center cooling market is poised for substantial growth, driven by advancements in liquid cooling technologies, increasing demand for compute-intensive workloads, and ongoing investments in sustainable and energy-efficient solutions. As enterprises continue to adopt AI and HPC, the demand for reliable cooling infrastructure will remain a critical factor in the future of data centers.

Related News