Global ammonia refrigeration power plant market forecast to hit $13.1B by 2033

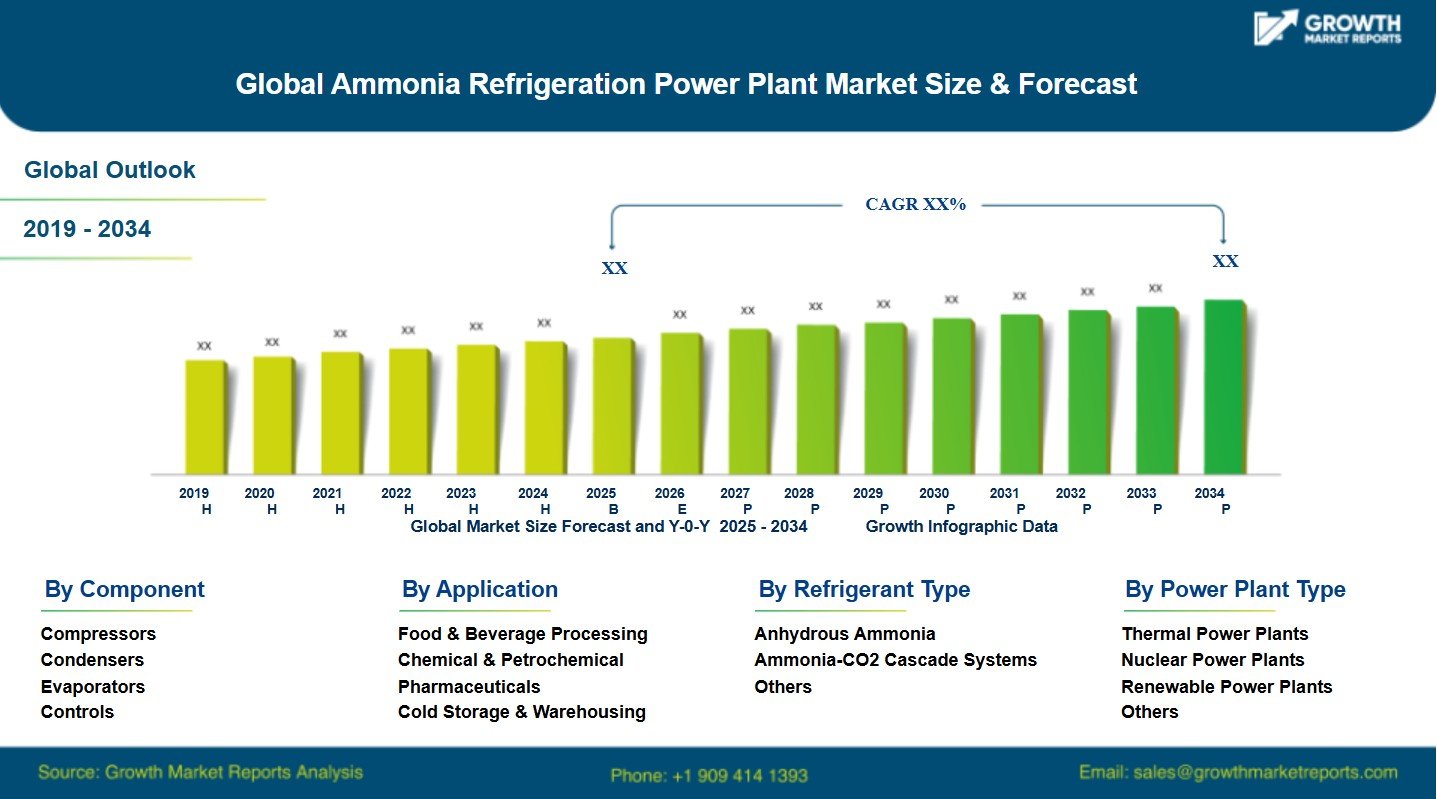

A Growth Market Report values the global ammonia refrigeration power plant market at USD 7.8 billion in 2024 and projects it will reach USD 13.1 billion by 2033, reflecting a 5.6% CAGR from 2025 to 2033. The report links growth to rising demand for energy-efficient and eco-friendly cooling in industrial and commercial sectors, and to stricter regulations phasing out high-GWP synthetic refrigerants. It also cites increased activity in food processing, cold chain logistics, and a broader shift toward sustainable industrial practices.

The report describes ammonia (NH3) refrigeration systems as vapor-compression systems and highlights properties including zero Ozone Depletion Potential (ODP), zero Global Warming Potential (GWP), strong thermodynamic efficiency, high latent heat of vaporization, and a strong odor used for leak detection. It also notes the phase-down of HFCs under the Kigali Amendment as a factor accelerating adoption.

On demand, the report points to large-scale industrial applications where efficiency and reliability are critical, including food and beverage processing (meat and poultry, dairy, seafood freezing, beverage manufacturing) and large cold storage warehouses. It also lists pharmaceutical and chemical temperature-controlled production and storage, along with ice plants and district cooling, particularly in hot climates. Additional factors cited include urbanization in emerging economies and renewable-powered industrial systems.

On technology, the report says modern ammonia refrigeration power plants are increasingly “intelligent,” with development of low-charge ammonia systems such as compact systems, packaged units, reduced ammonia charge designs, and secondary loop systems. It also highlights IoT and digital monitoring features including real-time leak detection, predictive maintenance algorithms, energy optimization dashboards, and remote diagnostics. Hybrid systems are also noted, including ammonia + CO2 cascade configurations that use ammonia in machine rooms and CO2 in occupied spaces.

The report also lists barriers including safety concerns—ammonia is described as toxic in high concentrations and mildly flammable—driving the need for strict safety standards, skilled operators, and regulatory compliance. It adds that industrial ammonia systems can require higher initial capital investment than smaller synthetic refrigerant units, and cites a skilled workforce gap. Companies named in the competitive landscape include Johnson Controls International, Danfoss, GEA, Emerson Electric, Mayekawa, BITZER, Trane Technologies, The Linde Group, and Daikin Industries, among others.

Looking ahead, the report describes investment interest in automated cold storage facilities, pharmaceutical-grade refrigeration, agro-processing hubs in developing nations, and “experimental but emerging” data center cooling, as well as synergies with green hydrogen and ammonia infrastructure. It also outlines recommendations including a focus on Asia-Pacific expansion, low-charge and modular system innovation, workforce training programs, integration with renewable microgrids, and compliance-focused product development, alongside expectations for more automation and AI integration, more compact and safer designs, stronger regulatory support, and greater integration with smart grids over the next 10 years.