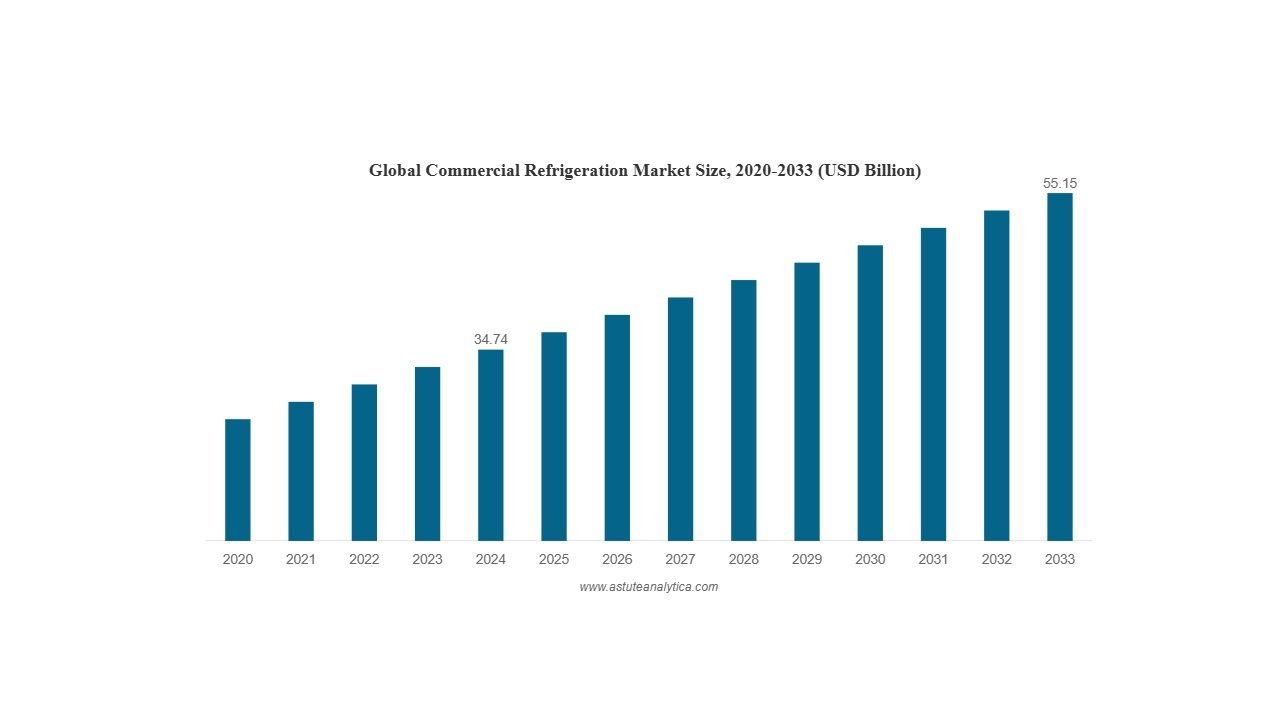

Global commercial refrigeration market to reach USD 55.15 billion by 2033

The global commercial refrigeration market is projected to grow from USD 34.74 billion in 2024 to USD 55.15 billion by 2033, at a CAGR of 5.27%, according to Astute Analytica. Key growth drivers include the rise of e-grocery, pharmaceutical cold chains, and energy-efficient cooling solutions in retail sectors across North America, Europe, and Asia Pacific.

The International Institute of Refrigeration estimates a global installed base of 155 million commercial refrigeration units, increasing by 5–6% annually. Plug-in merchandisers, reach-ins, and walk-ins account for most new installations. High-efficiency variable-speed systems using R-290 and CO₂ now make up 44% of 2024 shipments, offering up to 28% energy savings compared to legacy HFC systems. Supermarket racks typically deliver 40–300 kW of cooling, while cascade systems for cold storage can exceed 1 MW. Demand for ultra-low freezers (-80 °C) grew 17% year-on-year, driven by mRNA vaccine logistics.

Grocery chains, quick-service restaurants, pharmaceutical firms, and third-party logistics (3PL) warehouses represent 77% of total unit demand, supported by stricter spoilage-reduction and emissions regulations. Retailers such as Walmart, Carrefour, and Freshippo report 90% indirect emissions reductions and one-third lower maintenance costs after retrofitting CO₂ systems. In Asia, cloud kitchens and convenience stores are expanding rapidly, with 8,500 new outlets added per quarter, each installing two 1.5 kW plug-in freezers.

Decentralized cold storage is becoming critical for e-grocery logistics, now comprising 12% of global food retail. Retailers are deploying refrigerated micro-fulfillment centers, dark stores, and click-and-collect lockers near consumers. These nodes require 15–60 kW of cooling and must meet Ecodesign Tier 2 (EU) or equivalent U.S. DOE 2024 efficiency standards. Hydrocarbon cabinets with variable-speed compressors now represent 38% of new e-grocery installations, offering 20–25% energy savings and fast deployment.

Kroger reports food spoilage below 0.3% at its micro-fulfillment centers using IoT-connected propane freezers, equating to USD 180,000 in annual savings at a 22-kW site. High utilization in e-commerce nodes shortens equipment life cycles to five years, increasing aftermarket demand. In 2023, major manufacturers—Carrier, Daikin, Hussmann-Panasonic, Dover’s Hillphoenix, and Haier’s Hisense—shipped approximately 4.4 million units, with 68% including IoT controllers.

Merchandise refrigeration represents 24% of global market revenue, driven by its impact on retail sales and in-store advertising. Door-lit display coolers yield 18% more impulse purchases than ambient shelving. Brands often subsidize 60% of hardware costs, promoting advanced models with panoramic glass and LEDs. Regulatory shifts have reduced cost differences between plug-in and remote systems, simplifying return-on-investment decisions for retailers.

Europe holds a 24% share of the commercial refrigeration market in 2024, supported by high supermarket density and climate policy. Germany, France, the UK, Italy, and Spain account for 70% of new installations, with Germany alone reporting 8,600 transcritical CO₂ rack deployments since January 2023. The revised EU F-Gas Regulation mandates a 95% HFC phase-down by 2030 and prohibits refrigerants with GWP >150 in self-contained units from 2025. Additionally, Ecodesign Tier 2 will limit vertical beverage cooler energy use to 4.8 kWh/day starting July 2026. Pharmaceutical warehousing needs in the EU also support increased demand for cascade systems.

Major market players include AHT Cooling Systems GmbH, Daikin Industries, Haier Inc., Hoshizaki Corporation, Hussmann Corporation, and Panasonic Corporation, among others.