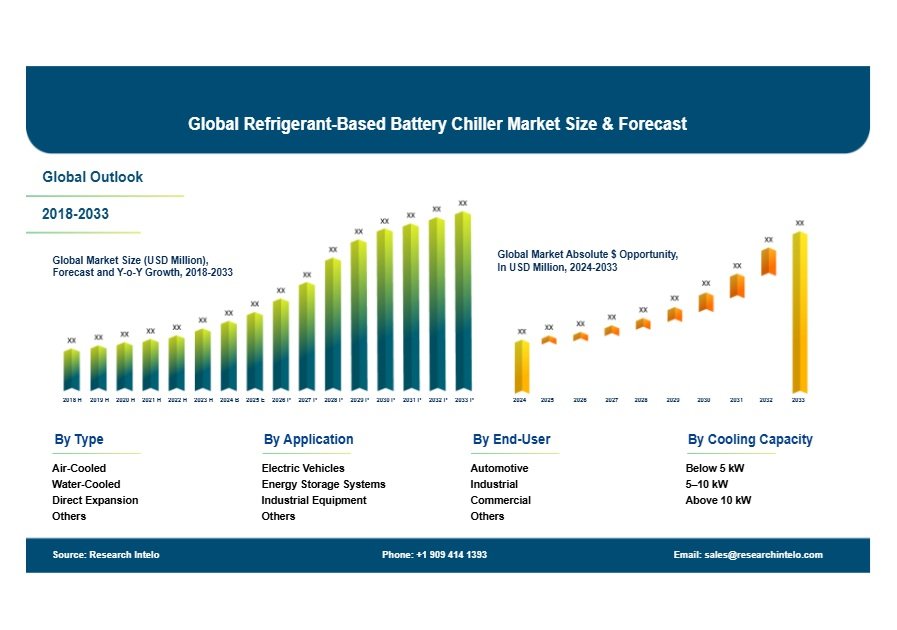

The global refrigerant-based battery chiller market is projected to grow from $1.2 billion in 2024 to $3.7 billion by 2033, at a compound annual growth rate (CAGR) of 13.2%. This growth is primarily driven by the increasing adoption of electric vehicles (EVs), which require advanced thermal management systems to enhance battery performance, safety, and longevity.

North America holds the largest share of the market in 2024, accounting for 36% of global revenue. Factors supporting this dominance include a mature automotive sector, extensive EV infrastructure, and stringent battery safety regulations. The region’s growth is also supported by the deployment of battery energy storage systems in the United States, aimed at grid stabilization and renewable integration.

Asia Pacific is the fastest-growing region, forecast to expand at a CAGR of 16.8% from 2024 to 2033. This trend is led by countries such as China, Japan, and South Korea, where government support for EVs and energy storage systems is strong. Investment in manufacturing capacity and energy projects is accelerating demand for battery cooling technologies in the region.

Air-cooled chillers continue to be widely used, particularly in automotive and small-scale industrial applications. Water-cooled systems are gaining popularity for larger energy storage systems due to their higher cooling capacity and energy efficiency. Direct Expansion (DX) chillers are being adopted in high-performance EVs and industrial use cases, offering rapid thermal response and precise temperature control.

Electric vehicles represent over 48% of global demand for refrigerant-based battery chillers in 2024. Energy storage systems and industrial equipment also account for a growing share, with increasing application in renewable integration, automation, and backup power. Commercial applications—including data centers and telecom infrastructure—are emerging as additional growth segments.

The automotive industry is the leading end-user, driven by global vehicle electrification trends and safety requirements. Industrial and commercial sectors are expanding their adoption, supported by demand for uninterrupted battery performance and scalable cooling solutions.

In terms of capacity, systems above 10 kW are seeing increasing adoption in large-scale industrial and utility settings. Mid-range units (5–10 kW) are gaining popularity in medium-sized EVs and distributed energy systems, while systems below 5 kW remain relevant for compact applications.

Key players in the market include Johnson Controls, Daikin, Schneider Electric, GEA Group, and Thermo King. Companies are focusing on product innovation, energy efficiency, and smart connectivity. Emerging competitors are targeting niche markets with proprietary technologies and agile service models.

Technological trends such as IoT integration, low-GWP refrigerants, and modular system designs are reshaping the competitive landscape. Real-time monitoring and predictive maintenance capabilities are becoming standard features, while digital twin technology is supporting development and performance optimization.

The market is expected to continue evolving, driven by the intersection of regulatory support, electrification, and innovation across automotive, industrial, and commercial applications.

Source