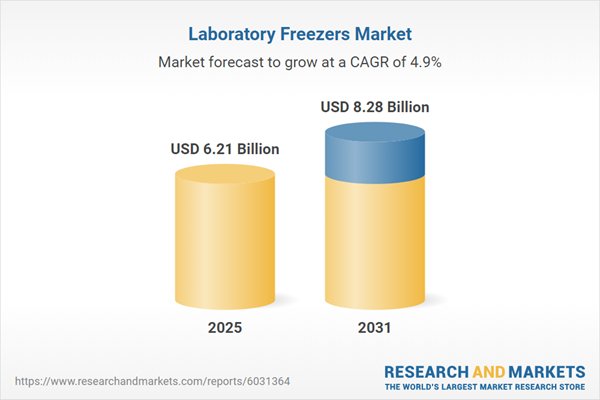

Laboratory freezer market to reach USD 8.28 billion by 2031

The global laboratory freezers market is projected to grow from USD 6.21 billion in 2025 to USD 8.28 billion by 2031, with a compound annual growth rate (CAGR) of 4.91%, according to a new report published by Research and Markets.

Laboratory freezers are critical for storing temperature-sensitive pharmaceuticals, chemicals, and biological samples. The sector’s growth is supported by expanding global biobank infrastructure and rising research and development investments in the biopharmaceutical industry. The European Biobanking and BioMolecular resources Research Infrastructure (BBMRI-ERIC) reported in 2024 that its network included approximately 500 biobanks across 32 countries.

However, high energy consumption from ultra-low temperature units presents a significant challenge. These freezers often result in elevated operational costs and make environmental compliance more difficult. In the 2024 International Laboratory Freezer Challenge, participating laboratories saved over 31.8 million kWh of energy, highlighting the sector’s substantial energy demand.

Pharmaceutical and biotechnology firms’ increased R&D investments are a key market driver. For example, Johnson & Johnson increased its 2024 R&D budget by over USD 2 billion, according to a March 2025 report by Fierce Biotech. This growth in research activity is increasing demand for ultra-low temperature storage solutions.

To address energy and environmental concerns, manufacturers are integrating variable-speed compressors and hydrocarbon refrigerants into their products. The US Environmental Protection Agency finalized the Energy Star Version 2.0 specification in October 2024, reporting that certified laboratory freezers consume 37% less energy than conventional models. This shift is urgent given that the biotech and pharmaceutical sectors produced 397 million metric tons of CO2 equivalent emissions in 2023, according to My Green Lab.

The adoption of IoT-based monitoring systems and automation is also shaping market trends. In September 2024, Thermo Fisher Scientific introduced the Connect Edge platform, enabling remote monitoring of up to 10 laboratory devices through one gateway. Automation is also being used to manage large sample volumes, with Hamilton Storage installing four high-capacity robotic units at the UK Biobank in May 2024 to handle over 12 million biological samples.

Key companies profiled in the report include ARCTIKO Ltd., Avantor, Inc., BioLife Solutions Inc., Blue Star Limited, Changhong Meiling Co. Ltd., Evermed s.r.l, Felix Storch, Inc., Haier Biomedical, Helmer Scientific Inc., and The Middleby Corporation.