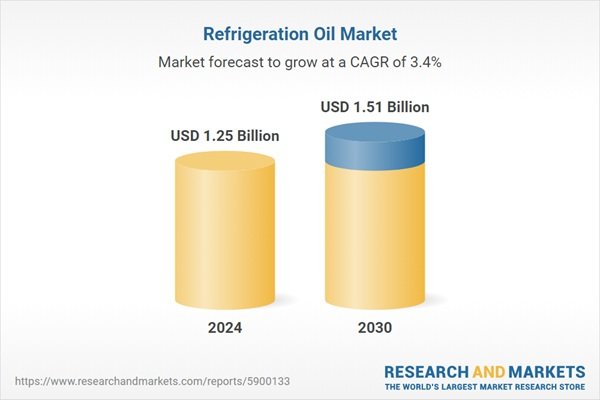

The global refrigeration oil market is projected to grow from USD 1.25 billion in 2024 to USD 1.51 billion by 2030, registering a compound annual growth rate (CAGR) of 3.35%, according to a new report by Research and Markets.

This growth is driven by the increasing use of refrigeration oils in compressor systems, particularly in industrial heat pumps and food sector applications. The expansion of cold chain infrastructure across regions—including large-scale investments in India, the United States, China, and the European Union—is boosting demand. These oils are essential for maintaining compressor performance and ensuring the efficient cooling required in food preservation and transport.

In the United States, food and beverage manufacturing shipments rose to over USD 1.3 trillion in 2023, up from USD 1.1 trillion in 2018, as reported by the USDA. India’s Ministry of Food Processing Industries noted that the sector contributed nearly 12% to national manufacturing GDP in 2022–23, supported by investments in cold storage. China’s cold storage capacity surpassed 200 million cubic meters in 2022, and the EU also reported growth in food production and exports, increasing reliance on refrigerated logistics.

At the same time, the market faces challenges in used oil disposal and recycling. Improper handling of used refrigeration oil, often mixed with ozone-depleting refrigerants, can result in environmental damage. Recycling processes are technologically demanding and energy-intensive, requiring specialized facilities to ensure sustainability and regulatory compliance.

A significant market trend is the transition to low-GWP refrigerants such as CO2 (R-744), R-290 (propane), and R-1234yf. This shift is being driven by regulatory frameworks like the U.S. Environmental Protection Agency’s AIM Act, which mandates an 85% phasedown of hydrofluorocarbons (HFCs) by 2037, and the European Union’s F-Gas Regulation. These refrigerants require refrigeration oils compatible with new chemical and thermal conditions, accelerating demand for advanced lubricants.

Major companies profiled in the report include Eneos Holdings Inc., Idemitsu Kosan Co. Ltd., ExxonMobil Corporation, Royal Dutch Shell PLC, Total Energies SE, Chevron Corporation, Johnson Controls International plc, Cosmo Oil Lubricants Co., Ltd., National Refrigerants, Inc., and BASF SE.

Read More