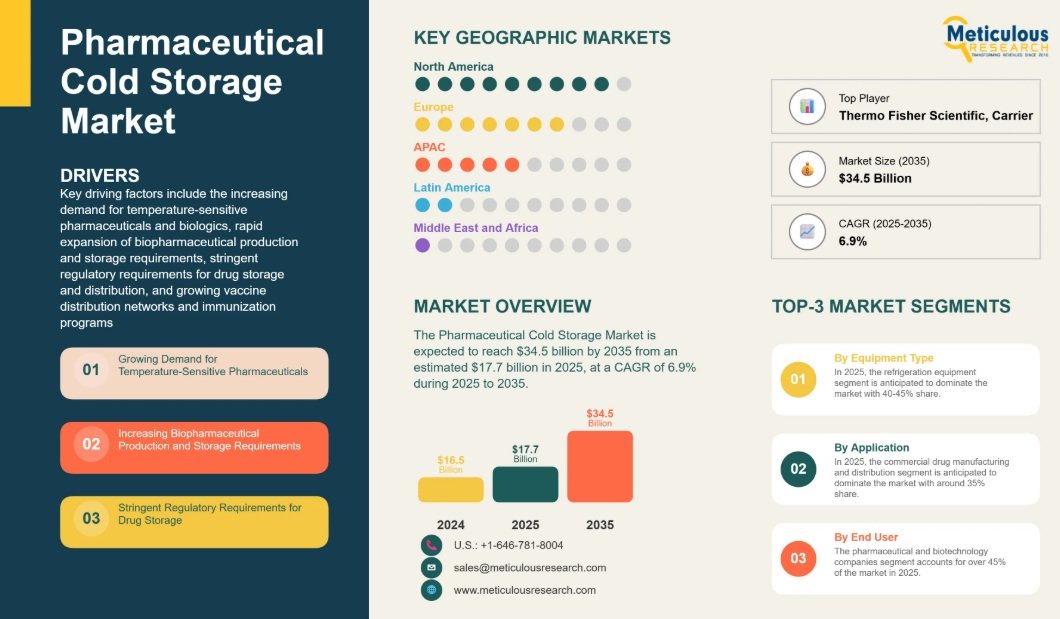

The global pharmaceutical cold storage market is projected to grow from $17.7 billion in 2025 to $34.5 billion by 2035, achieving a compound annual growth rate (CAGR) of 6.9%, according to a report by Meticulous Research.

Growth is driven by increasing demand for temperature-sensitive pharmaceuticals and biologics, expansion of vaccine distribution networks, and rising adoption of personalized medicine and cell & gene therapies. Regulatory requirements and infrastructure upgrades are also contributing to the expansion.

The market is evolving with the integration of IoT-enabled monitoring systems, ultra-low temperature solutions, and automated storage systems. Companies are also adopting blockchain for supply chain transparency and investing in sustainable, energy-efficient technologies.

In 2025, the Refrigeration Equipment segment accounts for 40–45% of the market, while Monitoring and Control Systems represent the fastest-growing category. The 2°C to 8°C range dominates the temperature segments, mainly due to vaccine and insulin storage, whereas the ultra-low temperature ranges (-40°C to -80°C and below -80°C) are projected to see the highest growth.

Commercial Drug Manufacturing and Distribution leads by application, representing about 35% of the 2025 market. The Biologics and Cell & Gene Therapy Storage segment is expected to grow at a CAGR of 9.2%. Pharmaceutical and biotechnology companies make up over 45% of the end-user market, with third-party logistics providers also experiencing notable growth.

Regionally, North America holds approximately 40% of the global market share in 2025, supported by a mature pharmaceutical sector and advanced healthcare systems. Asia-Pacific is the fastest-growing region, with a projected CAGR of 8.3%, driven by rising pharmaceutical production in China and India. Europe ranks second in size, supported by a strong manufacturing base and regulatory environment.

Key players include Thermo Fisher Scientific, Carrier Global, Daikin Industries, PHC Holdings, Haier Biomedical, Eppendorf, Cryoport, Cold Chain Technologies, Envirotainer, va-Q-tec, DHL, FedEx, UPS, Americold, Lineage Logistics, World Courier, Marken, Tippmann Group, Kuehne + Nagel, DB Schenker, Maersk, and Vetter Pharma.

The report notes recent innovations such as cryogenic storage for mRNA vaccines and CAR-T therapies, real-time monitoring with predictive analytics, and a focus on energy-efficient refrigeration. Despite high investment and operational costs, growth opportunities are strong in emerging markets, automated cold storage, and direct-to-patient delivery models.

Read More