Refrigerant Compressors Market 2023-2032

Market Dynamics

The refrigerant compressors market is primarily driven by various factors such as growth in food and beverages and pharmaceutical industries, rise in cold-chain industries, and increase in industrialization in developing economies. In these industries, refrigerant compressors are used for maintaining a conducive environment for the storage and transportation of perishable goods, as well as volatile chemicals.

Refrigeration systems are integral systems of food & beverage, and pharmaceutical industry, as these industries handle and produce products that need to be stored in a refrigerated environment to prevent their decay or deterioration. A refrigeration system maintains a lower temperature where the food & beverages and pharmaceutical products are stored, preventing them from decaying, and preventing bacteria and pathogens infestation.

Both the food & beverages, and pharmaceutical industries are witnessing a rise across the world. The primary reason for the growth of the food & beverages industry is the increased disposable income of the people and change in general lifestyle trends where dining out and fast food are promoted. Thus, various companies are expanding their production capabilities. For instance, in October 2022, Hi-Food, a subsidiary of CSM Ingredients, opened its new headquarters and production plant for producing and developing ingredients for the food and beverage sectors in Parma, Italy. Similarly, in August 2021, McCain Food, a Canada-based French fries' producer, invested $20 million to modernize its factory and add a new packaging line at its plant in Béthune, a town in France. On the other hand, the onset of new viruses, the aging population, and the increase in the trend of health supplement consumption propels the demand in the healthcare sector including the pharmaceutical industry. Thus, various companies are increasing their production to meet the increasing demand, and many governments are offering tax and other benefits to them. For instance, in 2021, the Indian government introduced Production Linked Incentive (PLI) to pharmaceutical producers for the domestic production of drugs and other medicines. Similarly, China and Germany are also witnessing an increase in demand for pharmaceuticals.

The growth in food & beverages, and pharmaceutical industries have driven demand for new and sophisticated refrigerant compressors systems. Thus, various companies such as Blue Star, Carrier Global, Daikin, and others, have launched refrigeration systems for cold storage requirements from food and beverages, pharmaceutical industries, cold-chain industries, and others. For instance, in February 2021, Blue Star Limited, launched temperature-controlled refrigerators and transporters for vaccine distribution in India. Therefore, growth of food & beverage, and pharmaceutical is driving the growth of the refrigerant compressors market.

However, according to the U.S. Environment Protection Agency, a typical food retail store leaks an estimated 25% of refrigerant annually, leading to negative impact on the environment. This emphasizes the importance of regulating the use of refrigerants to protect the planet. Thus, governments across the world have implemented strict regulations on a wide range of refrigerants that have adverse effects on the environment, which is expected to restrain the market growth.

Moreover, technological developments in the refrigerant compressors industry are expected to provide lucrative opportunities for the key market players. For example, technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), cloud connectivity, and others are also being incorporated into refrigerant Compressors. For example, the Danfoss iMCHE allows different circuits to use a single coil's heat transfer area, eventually boosting the efficiency of the system by over 20%. This also helps in maximizing heat-transfer efficiency, and reducing refrigerant charge in a compact, lightweight design. Moreover, it also offers the CO2 Adaptive Liquid Management (CALM) Solution for its Refrigeration category.

The refrigerant Compressors market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and the economic slow-down due to inflation across the world. Earlier, the worldwide lockdowns due to COVID-19 resulted in reduced industrial activities, eventually leading to reduced demand for refrigerant Compressors from various sectors such as food and beverages sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rising global inflation which is soon expected to cause recession in major economies is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of food and oil & gas, including raw materials used for manufacturing refrigerant Compressors systems. Furthermore, the countries in Europe, Latin America, North America, the Middle East, and Sub-Saharan Africa are experiencing severe negative impacts on industrial production, including the production of refrigerant compressors systems. However, India and China are performing relatively well, and the refrigerant compressors market outlook is positive in these countries. In addition, inflation is expected to worsen in the coming years, as the possibility of the war between Ukraine and Russia ending is less. Moreover, the cost of food products has risen substantially, discouraging their trade, which is also expected to have slight negative effects on the refrigerant compressors market growth. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Segmental Overview

The refrigerant compressors market is segmented into Type, Refrigerant and End User Industry. Depending upon type, the market is categorized into centrifugal, rotary, and reciprocating. On the basis of refrigerant type, it is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), hydrochlorofluorocarbons (HCFC), and others. As per end user industry, the market is classified into food & beverage, chemical & petrochemical, pharmaceutical, domestic and other. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Malaysia, Indonesia, Singapore, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

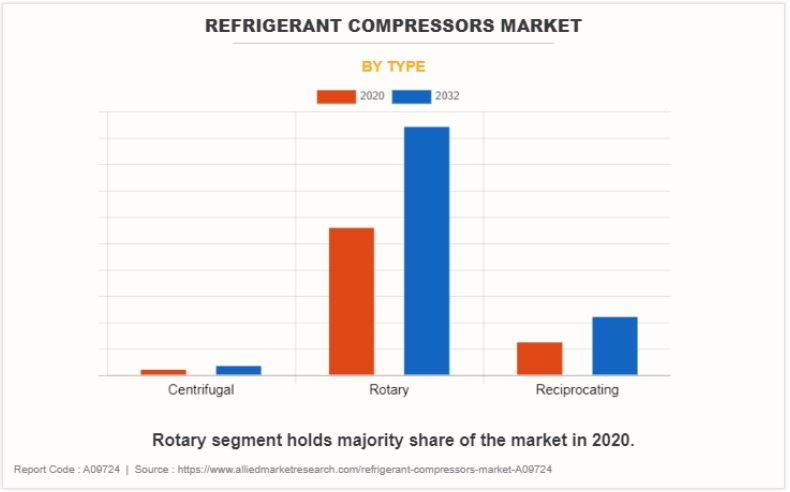

By type: The refrigerant Compressors market is divided into centrifugal, rotary, and reciprocating. In 2022, the reciprocating compressor segment dominated the refrigerant compressors market, in terms of revenue, and the rotary segment is expected to grow at a higher CAGR during the forecast period. Reciprocating compressors can efficiently handle a wide range of operating conditions. In addition, reciprocating compressors have fewer moving parts, thereby requiring less maintenance and provide higher reliability. Hence, the technical and economic advantages of rotary compressors fuel the growth of the market.

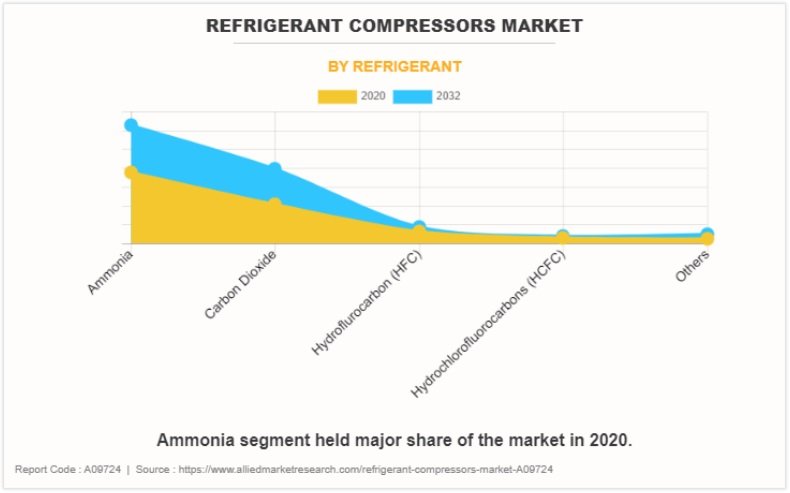

By refrigerant type: The refrigerant compressors market is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), hydrochlorofluorocarbons (HCFC), and others. In 2022, the hydrofluorocarbons (HFC) segment dominated the refrigerant compressors market, in terms of revenue, and the carbon dioxide segment is expected to witness growth at a higher CAGR during the forecast period. HFCs have been used for decades, and a majority of the refrigeration systems are made for HFCs, which is a reason for its high revenue generation in 2022. However, Hydrofluorocarbon (HFC) refrigerants are being phased out from commercial applications due to increasing concerns of environmental issues such as the depletion of the ozone layer and global warming. Furthermore, carbon dioxide is a cheap refrigerant, widely available and easily obtainable from the combustion of hydrocarbons, which is a reason for its high CAGR throughout the forecast period.

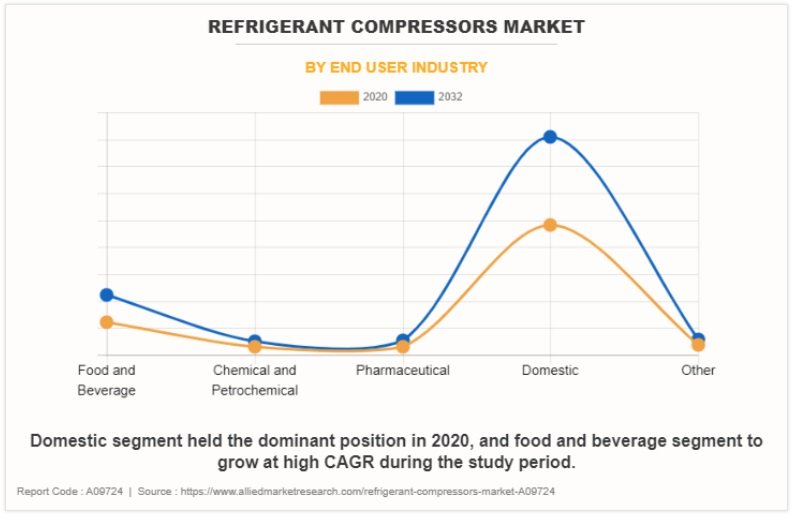

By end user industry: The refrigerant compressors market is categorized into food & beverage, chemical & petrochemical, pharmaceutical, domestic and other. The domestic segment accounted for a higher market share in 2022. This is attributed to increased consumption of these products driven by the rising disposable income of people. However, the chemical & petrochemical segment is anticipated to register a higher growth rate throughout the forecast period, owing to the increased demand for chemicals from almost all types of manufacturing industries, including textiles, petrochemicals, electronics, plastic, and other industries.By region: Asia-Pacific was the largest contributor to the market revenue in 2022 and is expected to maintain its dominance during the forecast period. On the other hand, LAMEA is expected to emerge as a region with maximum growth potential in the coming years. Asia-Pacific is the fastest growing refrigerant compressors market. The increase in food demand, growth in the cold storage market, and rise in the number of refrigerated warehouses in the region have fueled the growth of the refrigerant compressors market. Major demand is generated especially from countries such as China and Japan. Moreover, the surge in demand for frozen and processed food items in LAMEA has boosted the growth of the refrigerant compressors market. Further, increase in the export of perishable products to the U.S. has supplemented the growth of the refrigerant compressors market in LAMEA.

Competition Analysis

Competitive analysis and profiles of the major players in the industry are provided in the refrigerant Compressors market forecast report. Major companies in the report include Bitzer, Danfoss, Tecumseh Products Company LLC, Copeland LP, Panasonic, Mitsubishi Electric Corporation, LG Electronics, Carrier, Samsung, and Johnson Controls. To remain competitive, major players adopt development strategies such as product launch, business expansion, acquisition, and others.