Refrigerant Compressors Market, Competitive Market Share & Forecast, 2020 – 2026

Refrigerant Compressors Market Size By Type (Positive Displacement [Reciprocating, Rotary], Dynamic Displacement [Axial Flow, Centrifugal]), By Construction (Open, Hermetic, Semi-hermetic) , By Cooling Capacity (Less than 100 kW, 100-400 kW, Above 400 kW), By Application (Domestic [Refrigeration, AC], Commercial [Refrigeration, AC], Industrial, Mobile, Transport), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026

Industry Trends

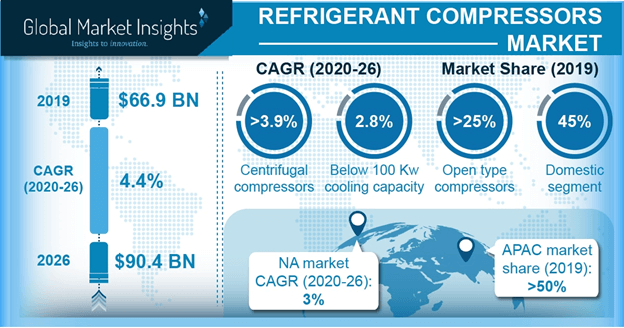

Refrigerant compressors Market size was USD 66.9 billion in 2019 and the industry will witness a CAGR of 4.4% between 2020 and 2026. Refrigerant compressor is a mechanical device in the refrigeration cycle that controls the circulation of refrigerant by increasing its pressure and reducing its volume. It converts the low temperature vapor into high temperature, high pressure vapor for facilitating the cooling process.

Proliferating demand for cooling in conjunction with surging economic development across the globe are positively influencing the demand for modern air conditioners and refrigerators. Cooling environments offer multiple benefits including prevention of heat strokes, spoiled vaccines & medication, curbing systematic food loss and improving employee productivity.

Higher spending power is providing potential opportunities for seeking modern conveniences and comfortable environments especially in hot conditions. Moreover, rising urbanization is supporting the heat trapping activity owing to the presence of majority of population in cities, further escalating the cooling demand. These trends will augment the refrigerant compressors industry over the study timeframe.

Direct and indirect emissions from the current HVAC equipment are substantially contributing towards the climate change. Increasing emissions of greenhouse gases through leakages of hydrochlorofluorocarbon (HCFC) or hydrofluorocarbon (HFC) refrigerants are resulting in global warming issues.

Significant improvement in product design, policymaking and greater engagement from industry players will result in mitigating the environmental effects. Penetration of new products with improved designs and energy efficiencies will drive the refrigerant compressors market share.

Evaporative cooling through natural ventilation and heat dispersion is obstructed owing to the growing construction of building structures in urban cities. Potential effects of climate change along with increasing household incomes are inducing the demand for air conditioning and refrigeration devices, further escalating the industry size.

Increasing capacities of refrigerated warehouses are prominently inducing the refrigerant compressors industry. For instance, in 2018, global capacity of refrigerated warehouses increased to 616 million cubic meters, with an increase of over 2.67% as compared with 2016.

Enhanced weight reduction to foster demand for centrifugal refrigerant compressors

Centrifugal compressors will witness significant gains of over 3.9% during 2020 to 2026. Centrifugal compressors offers higher efficiency and heat transfer under partial load conditions. Moreover, they provide 80-90% weight reduction owing to their compact structure and lighter weight per unit capacity. High reliability and lower maintenance cost further provide potential opportunities for their integration in large capacity applications.

In 2019, open type compressors accounted for a substantial share of over 25% in the refrigerant compressors market owing to their multiple benefits including higher efficiency, better compressor cooling, enhanced serviceability, and operational flexibility. Increasing investments targeted towards expansion of cold storage facilities and modernization of existing facilities are supporting the product demand.

Open type compressors are mostly used in medium to large capacity refrigeration systems due to their convenient adjustment of operating mode and higher reliability.

New energy efficient buildings will escalate the demand

The below 100 Kw cooling capacity segment will showcase potential growth prospects with 2.8% CAGR owing to their application in residential cooling appliances. Specific cooling demands from new building spaces including residential and service sector are majorly contributing towards the increased product demand.

Service sector buildings include offices, educational institutes, hotels, sport complexes, and others. New residential buildings incorporating high efficiency cooling appliances will offer positive growth prospects for the industry growth.

Proliferating food retail sales will foster the market demand

Surging food and beverage industry will significantly drive the industrial refrigerant compressors segment over the forecast timeframe. Manufacturers utilize refrigeration appliances during manufacturing processes as well as storage of products in refrigerated warehouses. Refrigerated warehouses facilitate the efficient storage of seasonally produced foods at production facilities and short term storage based in strategic locations to meet the retail distribution demand.

Domestic segment accounts for a major share around 45% in the refrigerant compressors market owing to the increased urban population along with growing demand for climate-friendly homes. Government organizations are promoting the energy efficient green building through supportive funding initiatives. Surging number of households, size of dwellings, and ownership of cooling appliances will prominently drive the market growth over the forecast timeframe.

Asia Pacific held over 50% refrigerant compressors market volume share in 2019. Emerging countries showcasing higher degree of economic growth are mostly located in tropical areas. Therefore, there is a continuous demand for air cooling for comforting the population in these regions. Expansion of middle class economy and better income thresholds are offering potential opportunities for utilizing refrigerators and AC’s.

North America will witness substantial growth with around 3% CAGR through 2026. Expansion of cold chain logistics for transporting meat and marine products, dairy products, confectionaries and ice cream will significantly escalate the segment size over the projected timeframe. Moreover, regional government bodies are offering funding opportunities for reducing the carbon footprint.

For instance, in April 2019, Environment and Climate Change Minister, Canada announced the funding of USD 12 million to Loblaw Companies Ltd. for installing lower emission refrigeration systems in 370 stores. This will significantly propel the regional demand for refrigerant compressors in the forecast timeframe.

Industry players are expanding their presence across the supply chain

Forward integrated manufacturers such as Gree Electric Appliances Inc., LG, Daikin and others are striving the penetrate the raw material production stage for establishing robust supply chain. For instance, in August 2018, Gree Electric Appliances Inc., announced their plans for establishing microchip manufacturing for inverter driven compressors.

This will enable the company to self-supply air conditioner chips, further enhancing their profit margins. Major industry participants in the refrigerant compressors market share include Guangdong Meizhi Compressor Co., Ltd. (GMCC), Bitzer, Danfoss, Emerson Daikin, LG, Rechi Precision and others.