Refrigerants Market - Global Forecast to 2028

Market Dynamics

Driver: Growing pharmaceutical industry

The pharmaceutical industry requires low temperatures conditions for the transport and storage of drugs. Factors such as the shift to biologics and as well as growing specialty pharmaceuticals and insulin products & vaccines are fueling the demand for refrigerants in this industry in developing Asian economies. The pharmaceutical industry is witnessing significant growth in major emerging economies of Asia Pacific, such as China and India. Therefore, the growth in the pharmaceutical industry is expected to drive the market for refrigerants. The rapid growth of the pharmaceutical industry in emerging economies such as Brazil, China, and India, is leading to a gradual migration of research activities from Europe to these. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), from 2015 to 2020, the Brazilian, Chinese, and Indian pharmaceuticals industries grew by 11.3%, 4.8%, and 10.0%, respectively, compared to the growth of global pharmaceutical industry (5.0%) for the top 5 European Union markets and 4.9% for the US market. In 2020, North America accounted for 49.0% of world pharmaceutical sales, followed by Europe (23.9%).

Restraints:Flammability and toxicity issues

Refrigerants such as ammonia, carbon dioxide, and HCs are flammable, corrosive, and toxic at higher concentrations. Ammonia can react with copper and corrode it. Hence, ammonia-based refrigeration systems are made of materials such as steel, though it increases the overall initial cost of systems. The safety precautions associated with ammonia and carbon dioxide are comparatively greater than those associated with fluorinated refrigerant gases. Carbon dioxide tends to solidify into dry ice upon contact with air. Hence, carbon dioxide cylinders and refrigeration systems require special valves to prevent this conversion.

Opportunities:Increasing demand for natural refrigerants

The most used natural refrigerants are ammonia, carbon dioxide, and HCs such as propane and isobutene. Technological advancements in cooling equipment are replacing traditional refrigerants such as HCFC and HFC with natural ones. This has increased the market share of natural refrigerants in applications such as air conditioning, refrigeration, and heating systems.

Challenges: Illegal trade of refrigerants

Major enforcement efforts in 2020 have made an impact on the illegal trading of these refrigerants across the countries. However, EIA is concerned that the lack of seizures in the first half of 2021 reflects a lull in enforcement efforts by member states and OLAF, which risks undermining progress made in 2020. Given the reduction in available quota starting in 2021, there is an urgent need to strengthen the current monitoring and enforcement system and upscale enforcement capacity in the member states to end the illegal trade in HFCs. Thus, considering these points, the illegal trade of refrigerants poses a challenge to the companies and manufacturers of refrigerants.

Refrigerants Market Ecosystem

The refrigerants ecosystem includes companies manufacturing refrigerants, such as Arkema SA, Dongyue Group Co. Ltd., Honeywell International Inc., Chemours Company, Linde Group, Air Liquide S.A., Sinochem Corporation, Daikin Industries Ltd., Orbia, and Asahi Glass Corporation.

Based on type, HFC & Blends was the largest segment for refrigerants market, in terms of value, in 2022.

HFCs are used as refrigerants, blowing agents, and aerosol propellants. Following the phase-out of chlorofluorocarbons (CFCs) and later HCFCs, which were also greenhouse gases, HFC & blends became popular. Although HFCs are greenhouse gases but not as potent as CFCs or HCFCs. Following the phase-out of CFCs and HCFCs, demand for HFCs has risen rapidly and further increased with the expansion of air conditioning in developing countries. However, due to its high GWP, on October 15, 2016, it was announced in Kigali, Rwanda, that 170 nations had agreed to phase down HFCs through an amendment to the Montreal Protocol.

Based on applications, refrigeration system was the largest segment for refrigerants market, in terms of value, in 2022.

This application is divided into three major categories, which are domestic refrigeration, industrial refrigeration, and commercial refrigeration. Domestic refrigeration is mainly used in households for preserving food, drinks, and medicine. This category mainly covers refrigerators, freezers, and combined systems. Initially, refrigerants such as CFCs (CFC11 and CFC12) and HCFC (R22) were used in cooling systems. Commercial refrigeration is mainly used to preserve or display food & beverages in retail stores. This segment includes supermarkets, hypermarkets, and office buildings, which require refrigeration systems. Currently, refrigerants such as HCFC (R22), HFCs (R134A and R404A), and HC (290 and 600A) are used in commercial refrigerators, with HCFCs being the predominant one in this application. The industrial refrigeration segment includes refrigerants used in manufacturing plants. Refrigerants such as HCFC and ammonia are most commonly used in industrial applications. However, due to new environmental legislation, the use of HCFC refrigerants is declining.

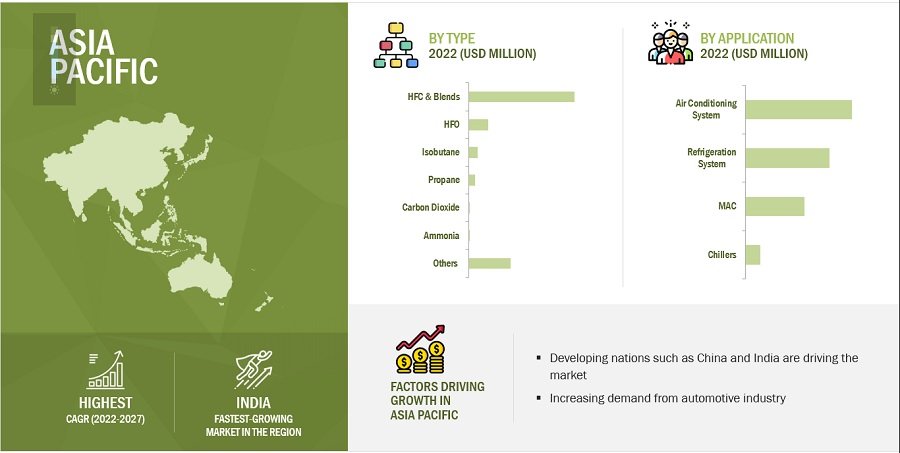

“Asia Pacific accounted for the largest market share for refrigerants market, in terms of value, in 2022”

Asia Pacfic is the largest refrigerants market, accounting for the largest share of the market in 2022. HFC and carbon dioxide are among the most widely consumed refrigerants due to the increasing consumption of refrigeration and AC equipment in commercial buildings and supermarkets. In Asia Pacific, the demand for inorganic refrigerants is expected to rise mainly due to the 100% phase-out of HCFCs by 2040 and the 85% phase-out of HFCs by 2047. Market growth in Asia Pacific is mainly attributed to China - the largest refrigerants market in the world in terms of volume. The presence of large consumer pockets and the low cost of production in India and China are driving the region’s refrigerants market. Moreover, rapid urbanization, demand for domestic consumer appliances, and the rapidly growing infrastructure industry in Thailand and Indonesia are also expected to support the growth of the refrigerants market in Southeast Asia during the forecast period.

Key Market Players

The key players profiled in the report include Arkema S.A. (France), Daikin Industries Ltd. (Japan), Honeywell International Inc. (US), The Chemours Company (US), The Linde Group (Dublin), and Air Liquide (France), among others, these are the key manufacturers that secured major market share in the last few years.