US HVAC System Market to Reach $32.35 Billion by 2029, Driven by Energy Efficiency and Smart Technologies

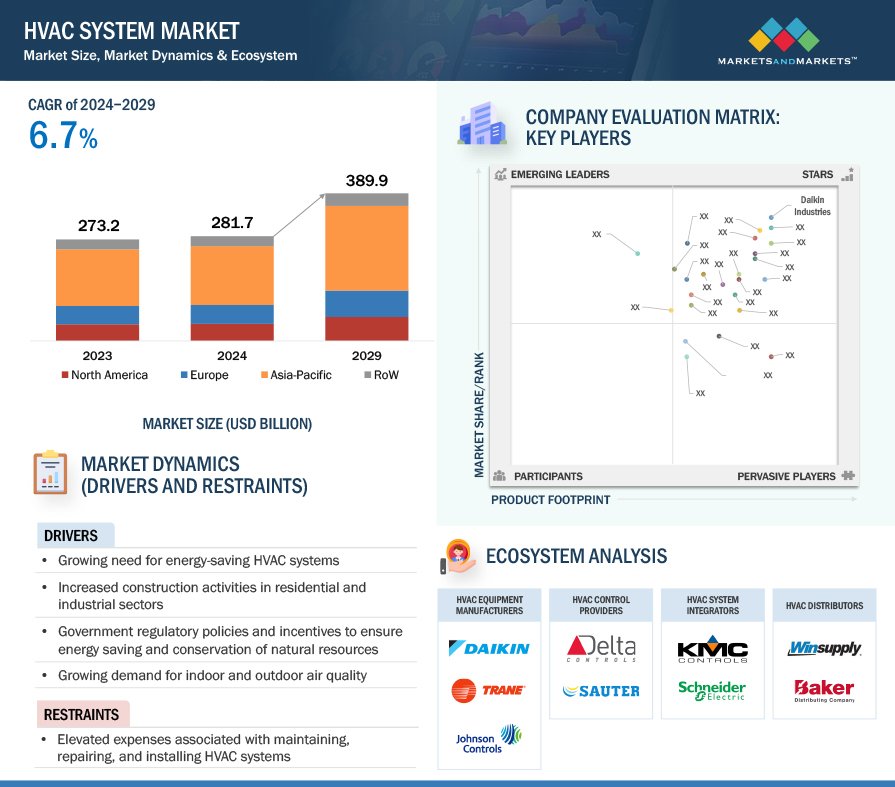

The HVAC system market in the United States is projected to grow from USD 22.35 billion in 2024 to USD 32.35 billion by 2029, according to a new report by MarketsandMarkets. This represents a compound annual growth rate (CAGR) of 7.7% over the forecast period.

Key factors contributing to market growth include stricter federal and state regulations aimed at reducing carbon emissions, increased demand for energy-efficient solutions, and incentives under the Inflation Reduction Act of 2022. Weather extremes such as heat waves and cold snaps also play a role in increasing demand for reliable heating and cooling systems.

The rise in residential and commercial construction - particularly in urban areas - is another driver. Upgrades in older buildings, adoption of IoT- and AI-enabled HVAC systems, and a shift toward electrified heating solutions are further shaping market dynamics.

Heating Equipment Segment Poised for Fastest Growth

The heating equipment segment is expected to be the fastest-growing category within the HVAC market. The push for electrification, especially heat pumps, is gaining momentum due to tax credits and rebates. Additionally, interest in intelligent heating systems and renewable energy solutions is rising. Severe weather and energy consumption concerns are prompting consumers and businesses to invest in high-efficiency furnaces, boilers, and smart thermostats.

Increased construction activity and the trend toward green building certifications such as LEED are also driving demand. Replacement of conventional gas-fired heating systems with electric alternatives supports national decarbonization goals.

Commercial Applications See Strong Uptake

The commercial segment is expected to register significant growth. Regulatory requirements from agencies like the US Department of Energy (DOE) and the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) are pushing commercial buildings to adopt energy-efficient technologies. These include Variable Refrigerant Flow (VRF) systems, rooftop units, and high-efficiency heat pumps.

New energy efficiency standards introduced in March 2023 for room air conditioners and portable air cleaners are further accelerating this shift. LEED-certified buildings increasingly incorporate advanced HVAC systems to meet sustainability targets.

Smart technologies are transforming commercial HVAC operations, especially in airports, hotels, and high-rise buildings. IoT-based systems and AI-powered predictive maintenance enhance energy efficiency and indoor air quality. The pharmaceutical and healthcare sectors also require advanced air filtration and precise climate control.

For example, in May 2022, Johnson Controls invested USD 7.5 million in automation technology at its Norman, Oklahoma facility to improve product quality and production efficiency.

US Market Outlook

The US HVAC market is benefitting from rapid urbanization, the development of smart cities, and the expansion of industries such as healthcare and data centers. The adoption of HVAC-as-a-Service models - where companies offer leasing and maintenance - provides cost-effective options for businesses.

There is also growing consumer interest in systems that incorporate next-generation air purification and humidity control. Supply chain disruptions and rising material costs have encouraged localized production and the use of alternative materials.

Leading Market Participants

Major players in the US HVAC market include Daikin Industries (Japan), Johnson Controls (Ireland), LG Electronics (Korea), Midea (China), Carrier (US), Trane Technologies (Ireland), Honeywell International (US), and Mitsubishi Electric (Japan). Startups such as Brainbox AI (Canada), Sensibo (Israel), and Smart Joules (India) are also contributing to innovation in the sector.

Read More